By John Revill And Annie Gasparro

Several years ago, Kellogg Co. discovered it had a problem with

its Corn Flakes brand in South Africa: Customers were boiling the

cereal and turning it into a soggy mess.

Many South Africans, accustomed to hot porridge for breakfast,

didn't know how to prepare Corn Flakes. So Kellogg switched gears,

rolling out a Corn Flakes Instant Porridge in 2012. It since has

expanded with new flavors, including a strawberry version launched

this year.

Fine-tuning products to meet cultural expectations is critical

to efforts by Kellogg and other multinational cereal makers to ramp

up sales in developing countries in Africa, Asia and elsewhere. The

giants are making the overseas push to offset lackluster sales in

the U.S. and parts of Europe as consumers increasingly shun

sugar-laden breakfasts in favor of fresher, faster and more

portable foods.

Emerging markets are growing in importance to cereal makers as

more residents in those countries move to cities and have less time

and inclination to make traditional warm breakfasts. As middle

classes emerge, consumers have more disposable income and want more

variety in their food, said Dave Homer, chief executive of Cereal

Partners Worldwide SA, a joint venture between Swiss food maker

Nestlé SA and General Mills Inc., the U.S. producer of Cheerios and

Wheaties.

"Globally, cereal-category [sales] volumes are flattish, but

they don't need to be this way," Mr. Homer said. Cereal Partners,

which sells cereal in about 130 countries, isn't giving up on its

traditional markets, but developing markets "can help a lot," he

added.

Cereal sales in the U. S.--by far the biggest market, with

around one-third of the $32.5 billion global business--have been

sluggish for several years as more consumers favor protein-heavy

meals they can eat on the go. U.S. dollar sales of hot and cold

cereals are expected to inch up just 0.6% annually over the next

five years, according to market-research firm Euromonitor

International. In contrast, sales in China and India are expected

to rise an average of 9% and 22% each year, respectively, over the

next five years.

To appeal to consumers in developing markets, cereal makers must

overcome many hurdles, including little-to-no appetite for dairy

milk in some regions and a cultural affinity for traditional hot

foods such as rice. Chinese, for instance, often favor a breakfast

of hot rice porridge, breakfast soups or steamed buns.

"It is one thing to get people to try Western breakfast cereals,

but it is another thing entirely to get them to adopt it," said

Marcia Mogelonsky, an analyst with market-research firm Mintel in

Chicago.

In many countries, consumers eat fewer than 100 grams of

breakfast cereal annually per person, or about 3.5 ounces,

according to cereal manufacturers. So the companies can make a

significant impact on their growth simply by getting consumers in

emerging markets to eat one or two more servings a year, said Mr.

Homer of Cereal Partners, based in Lausanne, Switzerland.

Cereal Partners has been making inroads into markets such as

Indonesia and the Philippines. It seeks in developing countries to

promote cereal as a source of fiber, vitamins and minerals,

focusing especially on the benefits for children. To make products

more affordable and convenient, it has introduced three-serving

bags in Indonesia, while in Thailand it rolled out a single-serve

Koko Krunch chocolate cereal that comes with a paper bowl and

plastic spoon.

In Indonesia, Cereal Partners employees attend informal women's

networking groups and discuss the nutritional benefits compared

with the traditional local breakfast of fried rice.

"Eating cereal is very new to them," said Nadia Devisa, a Cereal

Partners marketing executive. "The moms had a lot of questions,

like, 'Can I eat it with any kind of milk, or hot milk?'"

Mira Santi, an Indonesian mother of two, found her children

liked Western cereal during a tasting. "I don't mind giving it to

them because it gives nutritional value," said Ms. Santi, who

usually makes nasi uduk, a rice dish, or bubur ayam, a type of

porridge, for breakfast.

Cereal Partners, formed in 1991, posted $1.89 billion in sales

in the 12 months through March 31, down from $2.11 billion a year

earlier. It doesn't break out sales in emerging markets.

Kellogg expects a higher percentage of its cereal sales to come

from more culturally relevant varieties, with Corn Flakes flavors

like unsweetened mango and local dishes like savory pongal--a

mixture of rice, milk, cane sugar and coconut--in India. The

company also has been selling sugary flavors such as Chocos Crunchy

Bites in India, but it said they haven't sold especially well.

In Colombia, Kellogg is selling cereals in packs attached to

yogurt, because consumers there to tend to eat more yogurt than

milk.

Kellogg logged about one-third of its $14.6 billion in sales

from outside the U.S. last year, with at least $2 billion coming

from sales of cereal and other products in emerging markets. Its

cereal sales by volume are rising by double-digit percentages in

Asian emerging markets and in the 4% to 6% range in developing

countries in Latin America, according to an investor presentation

earlier this month.

Kellogg has found it must be vigilant in some developing markets

about communicating how consumers should eat cold cereal. "In

markets where milk consumption is a lot lower, educating consumers

how to eat cold cereal, with ads illustrating that, is important,"

said Doug VanDeVelde, senior vice president of global breakfast for

the Battle Creek, Mich., company.

The company drew lessons from its stumbles with Corn Flakes in

Africa--where it discovered it had targeted some consumers in rural

areas who had grown up eating mielie-meal, a ground maize porridge.

Those consumers thought they should use hot water to prepare Corn

Flakes, too. Making a change to a porridge product became "a

no-brainer" at that point, said Kara Timperley, Kellogg's marketing

director for sub-Saharan Africa.

Access Investor Kit for Kellogg's

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US4878361082

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 25, 2015 05:35 ET (09:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

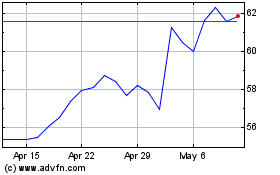

Kellanova (NYSE:K)

Historical Stock Chart

From Mar 2024 to Apr 2024

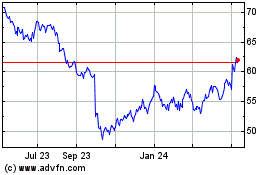

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2023 to Apr 2024