Copper Market Rebounds -- Lundin Mining and Freeport McMoRan Poised to Benefit

January 19 2012 - 8:20AM

Marketwired

Copper stocks have been on the upswing this week as the price of

the red metal recently hit a new 3 month high. Copper prices have

rallied as upbeat Chinese economic data fed hopes that officials in

the world's top copper consumer will try to stimulate growth. China

said its economy grew by 8.9 percent in the fourth quarter, which

was slower than the previous quarter. Analysts, however, consider

these levels "robust," the Associated Press reports. The Paragon

Report examines investing opportunities in the Copper Industry and

provides equity research on Freeport McMoRan Copper & Gold Inc.

(NYSE: FCX) and Lundin Mining Corporation (TSX: LUN). Access to the

full company reports can be found at:

www.paragonreport.com/FCX

www.paragonreport.com/LUN

Copper inventories in London Metal Exchange (LME) warehouses

dropped to a 13-month low this week, and more declines are seen

likely due to a pick-up in U.S. demand. Reuters reported that a 25

percent drop in LME copper prices in the fourth quarter, which

touched a low of $6,635 per tonne in October, triggered restocking

in China, which accounts for about 40 percent of global copper

consumption.

Citigroup analyst David Wilson says that "it's fairly obvious

that China has been restocking since September, attracted by lower

prices, but now the question is: are we going to see more

restocking or are consumers already sitting on reasonable

volumes?"

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the Copper industry register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Lundin Mining Corporation operates as a diversified base metals

mining company with operations in Portugal, Sweden, Spain, and

Ireland. The company produced 27,488 tonnes of copper in the fourth

quarter, up from the 24,908 tonnes a year ago. Zinc production rose

15 percent to 27,053 tonnes. Full-year copper production fell five

percent to 75,877 tonnes, mainly due to production issues at

Neves-Corvo earlier in 2011.

Freeport-McMoRan Copper & Gold Inc. engages in the

exploration, mining, and production of mineral resources. The

company primarily explores for copper, gold, molybdenum, silver,

and cobalt.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

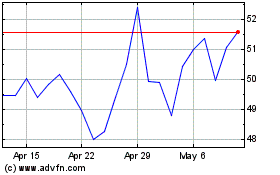

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

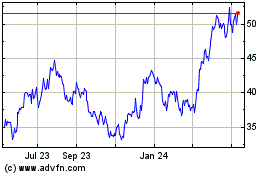

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024