BMO Economics: Alberta to Lead Canada in Growth in 2012

October 09 2012 - 11:30AM

Marketwired

Alberta's economy continues to outperform amid rising oil

production and accelerating inward migration, according to the

Provincial Monitor report released today by BMO Economics. The

province will sit atop the Canadian leaderboard this year, with

growth hitting 3.5 per cent before falling back slightly to 2.9 per

cent in 2013.

"The energy sector remains the key driver of economic activity

in the province, with crude bitumen production up 16 per cent

year-over-year through the first half of the year, and the Energy

Resources Conservation Board expecting oil sands output to more

than double by 2021," said Robert Kavcic, Economist, BMO Capital

Markets.

"Businesses in the private sector continue to be driving

Alberta's economic growth by making important strategic investments

and by focusing on opening up new markets," said Bill Hogg,

District Vice President, Commercial, Alberta, BMO Bank of Montreal.

"Our recent BMO Small Business Confidence Report shows that

Albertan entrepreneurs have the most positive outlook in the

country, with 70 per cent saying 2013 will be a better year and 55

per cent believing their business will experience growth in the

year ahead."

Mr. Kavcic did note some potential risks to the oil sector.

"Cost pressures could again pick up, though oil sands operations

are generally viewed as economical at prices above $80. Also,

wrangling over new pipeline capacity continues. In the meantime,

more Bakken production-filling limited pipeline capacity-has

contributed to a wider discount received by Canadian producers

relative to WTI. Estimates suggest that production in Western

Canada could be negatively impacted by 2015/16 if there is not

enough new pipeline capacity put in place."

Strength in the energy sector has helped spur net in-migration,

which hit the highest since the 2006 boom in the first quarter of

2012. Labour market trends, while favourable, have ebbed from an

extremely robust performance last year. Private-sector job growth

has levelled off, up 2.7 per cent year-over-year in September; most

of the cooling has been in services, as growth in resources and

construction is still strong.

"The 4.4 per cent jobless rate remains the lowest in Canada,"

said Mr. Kavcic. "Housing market activity is improving thanks to

rising demand and a gradual drawdown of the excess supply put up

during the 2005-07 boom. In Calgary, prices were up 6.8 per cent

year-over-year in September, and have regained about half of the

declines seen during the recession."

The full Provincial Monitor can be downloaded at

www.bmocm.com/economics.

About BMO Financial Group

Established in 1817 as Bank of Montreal, BMO Financial Group is

a highly diversified North American financial services

organization. With total assets of $542 billion as at July 31,

2012, and more than 46,000 employees, BMO Financial Group provides

a broad range of retail banking, wealth management and investment

banking products and solutions.

Contacts: Media contacts: Laurie Grant, Vancouver (604)

665-7596laurie.grant@bmo.com Internet: www.bmo.com Twitter:

@BMOmedia

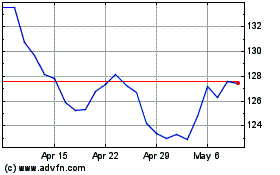

Bank of Montreal (TSX:BMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of Montreal (TSX:BMO)

Historical Stock Chart

From Apr 2023 to Apr 2024