(all figures in United States dollars unless otherwise noted) -

Eldorado Gold Corporation (TSX:ELD)(NYSE:EGO) ("Eldorado", the

"Company" or "We"), reported profit attributable to shareholders of

the Company of $75.8 million for the period, and generated $110.8

million in cash from operating activities before changes in

non-cash working capital.

Q3 2012 Summary Results

-- Gold production of 169,565 ounces at an average cash operating cost of

$493 per ounce, including 14,442 ounces of Efemcukuru pre-commercial

production (Q3 2011 gold production - 179,195 ounces at $397 per ounce).

-- Gold sales of 165,365 ounces at $1,670 per ounce, including 10,524

ounces of Efemcukuru sales related to pre-commercial production (Q3 2011

gold sales - 179,513 ounces at $1,700 per ounce).

-- Profit attributable to shareholders of the Company of $75.8 million or

$0.11 per share (Q3 2011 - $102.5 million or $0.19 per share).

-- $110.8 million generated in cash from operating activities before

changes in non-cash working capital (Q3 2011 - $159.7 million).

-- Company production guidance for 2012 maintained at 660,000 ounces of

gold at cash operating costs of approximately $465 per ounce.

Financial Results

Net income for the quarter was $75.8 million (or $0.11 per

share), compared with $102.5 million (or $0.19 per share) in the

third quarter of 2011. The decrease in net income year over year

was mainly due to lower gold sales volumes and prices. The Company

sold 154,841 ounces in the third quarter of 2012 (not including

10,524 ounces of precommercial sales from Efemcukuru) as compared

with 179,513 ounces in the third quarter of 2011.

----------------------------------------------------------------------------

Commercial sales volumes by 3 months ended 9 months ended

mine September 30, September 30,

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Gold ounces sold 154,841 179,513 438,421 490,207

----------------------------------------------------------------------------

- Kisladag 83,750 87,121 210,905 204,345

----------------------------------------------------------------------------

- Tanjianshan 28,944 26,935 84,932 87,405

----------------------------------------------------------------------------

- Jinfeng 25,805 44,187 86,663 139,086

----------------------------------------------------------------------------

- White Mountain 16,342 21,270 55,921 59,371

----------------------------------------------------------------------------

Average price per oz. $ 1,670 $ 1,700 $ 1,665 $ 1,546

----------------------------------------------------------------------------

Gold revenue (millions) $ 258.5 $ 305.2 $ 729.9 $ 757.6

----------------------------------------------------------------------------

Operating Performance

Kisladag

Kisladag placed 3.2 million tonnes of ore on the leach pad

during the quarter at a grade of 1.05 grams per tonne (Q3 2011 -

3.5 million tonnes of ore at 0.90 grams per tonne). Kisladag

produced 84,016 ounces of gold at a cash operating cost of $334 per

ounce in the quarter as compared to 86,788 ounces at a cash

operating cost of $377 per ounce during Q3 2011. Gold production at

Kisladag for the quarter was slightly lower year over year mainly

due to the stacking and leaching schedule. Daily production rates

increased during the quarter and we expect to see an increase in

production during the fourth quarter. Lower cash costs during the

quarter were largely a result of higher grade material being placed

on the leach pad during the year.

Tanjianshan("TJS")

TJS processed 283,654 tonnes of ore at a grade of 3.55 grams per

tonne in the quarter compared to 218,330 tonnes at a grade of 4.25

during Q3 2011. The mine produced 28,944 ounces of gold at a cash

operating cost of $396 per ounce in the quarter as compared to

26,935 ounces at a cash operating cost of $353 per ounce in Q3

2011. Gold production at TJS during the third quarter of 2012 was

higher than the same quarter of 2011 as a result of increased mill

throughput and slightly higher recovery rates, which offset the

lower mill head grades. The increase in cash costs during the

quarter was mainly due to the lower head grade.

Jinfeng

Jinfeng processed 356,575 tonnes of ore at a grade of 2.43 grams

per tonne during the quarter compared to 379,352 tonnes at a grade

of 4.26 grams per tonne during Q3 2011. The mine produced 25,821

ounces of gold at a cash operating cost of $946 per ounce during

the quarter compared to 44,202 ounces at a cash operating cost of

$424 during Q3 2011. Gold production at Jinfeng in Q3 2012 was

lower than the same quarter of 2011 due to lower head grades and

mill throughput. The open pit is currently in a waste stripping

phase and lower grade stockpile material is being treated to make

up for the lack of open pit ore. Cash costs were considerably

higher due to the lower grade and mill throughput.

White Mountain

White Mountain processed 210,114 tonnes of ore at a grade of

3.14 grams of gold per tonne in the quarter compared to 191,157

tonnes at a grade of 4.15 grams per tonne during Q3 2011. The mine

produced 16,342 ounces of gold at a cash operating cost of $766 per

ounce during the quarter compared to 21,270 ounces at $475 per

ounce during Q3 2011. Gold production at White Mountain in the

third quarter of 2012 was lower than in the same period of 2011.

This decrease was largely due to lower grades being mined and

processed during the quarter, which also negatively affected the

cash costs.

Efemcukuru

The Efemcukuru mine and mill operated at expected levels with

93,779 tonnes of ore processed at a grade of 9.31 grams of gold per

tonnes in the quarter and approximately 27,005 ounces of gold

recovered in concentrate. The paste fill system was commissioned

during the quarter and the underground crushing system was

completed and is now operational.

During the quarter 14,442 ounces were poured as pre-commercial

production during the commissioning and testing of the Kisladag

concentrate treatment plant. In September, the concentrate

treatment plant was not being operated pending modifications to the

circuit. We plan to sell the existing concentrate and future

concentrate production to a third party until the modifications are

completed. At the end of the quarter there were approximately

51,000 ounces of gold contained in concentrate.

Vila Nova

During the quarter Vila Nova processed 161,859 wet metric tonnes

and sold 123,180 dry metric tonnes of iron ore compared to 148,220

wet metric tonnes produced and 170,781 dry metric tonnes sold in Q3

2011. Iron ore production in Q3 2012 increased at Vila Nova

compared to the same quarter of 2011, mainly as a result of

improved efficiencies in both the mine and treatment plant. Three

shipments were completed in the quarter. These were 2 lump

shipments and one sinter shipment. Operating costs averaged $56 per

dry metric tonne (Q3 2011 - $64 per dry metric tonne).

Stratoni

During the third quarter, Stratoni mined 58,591 tonnes of

run-of-mine ore and produced 14,084 tonnes of lead and zinc

concentrate at an average cash cost of $717 per tonne of

concentrate produced. During the same period, Stratoni sold 15,891

tonnes of concentrate at an average price of $913 per tonne.

Development

Eastern Dragon

At Eastern Dragon work continued during the quarter on the

preparation of the Project Permit Approval (PPA) to be submitted to

the National Development and Reform Commission (NDRC). We

anticipate that the application will be submitted by the end of

2012. Construction activities have been suspended until the PPA is

approved.

Tocantinzinho

The Tocantinzinho project was granted the Preliminary

Environmental License (PEL) in September, an important milestone in

the permitting phase. The PEL confirms the environmental

feasibility of the project and allows the Company to apply for the

Construction License, the final permit needed for construction to

commence. Work on site was limited to environmental and hydrology

field work in the immediate area, along with geotechnical drilling

of the proposed road corridor. The feasibility study is well

advanced and will be completed in the fourth quarter 2012.

Perama Hill

Drilling activity at the Perama site continued throughout the

quarter. Geotechnical drill holes have been drilled in the plant

site to support geotechnical design analysis for civil structures

and foundations. In addition drilling in the open pit area has been

carried out to obtain drill core for geotechnical analysis for pit

slope stability design. Processing of the Perama Environmental

Impact Assessment (EIA) application through the Ministry of

Environment (MOE) continues, with a decision expected before the

end of the year. Public meetings have been held in the district as

prescribed by the MOE. All indications from the government agencies

remain positive towards the project.

Olympias

Rehabilitation of the Olympias underground mine and processing

plant continued during the quarter. In the mine, 406 meters of

underground access was rehabilitated or developed. Development of

the tunnel linking Stratoni and Olympias progressed well during the

quarter, with 108 meters of advance. Metallurgical testwork to

evaluate the proposed new processing facility at Stratoni continued

during the third quarter. Commissioning of the Olympias processing

plant was on-going during the quarter.

Skouries

Site work at Skouries during the quarter consisted mainly of

tree cutting at the plant site, construction of access roads, and

earthworks for various site infrastructures.

Certej

The Environmental Permit for Certej was approved by the

Timisoara Regional Department of Environment during the quarter.

Construction work advanced during the quarter on the temporary

power line to site and the water pumping station on the Mures

River.

Exploration Update

A total of 54,300 metres of exploration drilling were completed

during the quarter at our exploration projects and mine operations

in Greece, Romania, Turkey, Brazil, and China. With 132,800 meters

of drilling completed year-to-date, we are on track to complete our

2012 exploration programs according to plan.

Turkey

In Turkey, drilling during the quarter continued at the

Efemcukuru minesite, and commenced at Kisladag and at three

reconnaissance projects (Sebin, Dolek, and Gaybular).

Exploration drilling resumed at the Kisladag minesite late in

the quarter, testing conceptual targets defined by a combination of

three-dimensional induced polarization/resistivity surveys,

detailed ground magnetics, and soil geochemistry anomalies. This

program is directed towards identifying possible mineralized

satellite intrusions to the main porphyry system.

Six drillholes were completed at the Sebin porphyry/epithermal

prospect in the Pontide Belt. The project area covers a large

surface alteration zone with locally anomalous copper, molybdenum

and gold values, but no significant mineralization has been

intersected to date in drillholes. Drilling also began at the Dolek

prospect in the Pontide Belt, and at the Gaybular project in

Western Turkey.

At Efemcukuru 32 drillholes (8,440 metres) were completed on the

Kestane Beleni northwest extension (KBNW), South Ore Shoot (SOS),

and Kokarpinar vein targets. At KBNW, drilling defined a new

shallowly northwest-plunging lower zone of mineralization which has

been traced for nearly 400 metres along strike and remains open to

the northwest. At the SOS, drilling identified high gold grades at

50 to 75 metre stepouts from previous mineralized holes. At

Kokarpinar, limited drillsite availability meant that drilling was

focused on shallow targets on the central and southern part of the

vein. Selected drilling results are summarized in the table

below:

Selected Q3 drilling results, Efemcukuru:

----------------------------------------------------------------------------

From To Interval Au Ag Pb Zn

Hole ID (m) (m) (m) (g/t) (g/t) (%) (%)

----------------------------------------------------------------------------

Kestane Beleni Northwest Extension (lower zone)

----------------------------------------------------------------------------

KV-433 215.15 216.50 1.35 29.70 24.10 0.88 2.02

----------------------------------------------------------------------------

KV-444 170.86 172.58 1.72 27.46 19.61 1.61 2.23

----------------------------------------------------------------------------

KV-447 240.27 241.48 1.21 65.59 63.40 2.26 4.56

----------------------------------------------------------------------------

KV-448 183.83 186.20 2.37 7.39 37.90 2.88 1.20

----------------------------------------------------------------------------

South Ore Shoot (deep step-out drilling)

----------------------------------------------------------------------------

KV-496 223.00 224.50 1.50 4.95 3.70 0.01 0.03

----------------------------------------------------------------------------

KV-497 297.60 300.91 3.31 15.67 19.78 1.00 1.73

----------------------------------------------------------------------------

KV-501 282.50 287.20 4.70 11.80 8.00 0.02 0.03

---------------------------------------------------------------

including 286.10 287.20 1.10 44.80 26.70 0.01 0.02

----------------------------------------------------------------------------

Kokarpinar Vein

----------------------------------------------------------------------------

KV-459 222.55 227.50 4.95 6.84 Assays not yet completed

----------------------------------------------------------------------------

KV-423 225.20 226.00 0.80 283.00 110.00 0.03 0.11

----------------------------------------------------------------------------

Greece

Drilling continued at the Piavitsa prospect, with seven holes

completed and approximately 7,500 metres drilled during the

quarter. The primary target at Piavitsa is polymetallic,

gold-silver rich, carbonate replacement sulfide mineralization

along the Stratoni fault zone, similar to that typical of the

Olympias deposit. All 23 drillholes completed in this year's

program have intersected the fault zone near the projected depth,

and have cut intervals in the fault zone with some combination of

massive sulfide, disseminated sulphide, or oxide material. Selected

drilling results are summarized in the table below:

Selected Q3 drilling results, Piavitsa Project:

----------------------------------------------------------------------------

From To Interval Au Ag Pb Zn

Hole ID (m) (m) (m) (g/t) (g/t) (%) (%)

----------------------------------------------------------------------------

Stratoni Fault replacement-style zones

----------------------------------------------------------------------------

PHG065 436.00 440.00 4.00 2.05 19.20 0.35 0.46

----------------------------------------------------------------------------

PHG066 207.00 210.00 3.00 9.57 18.10 0.02 0.03

----------------------------------------------------------------------------

PHG067A 62.00 66.00 4.00 2.12 3.50 0.02 0.05

---------------------------------------------------------------

and 81.00 83.00 2.00 5.33 4.20 0.00 0.01

----------------------------------------------------------------------------

PHG070 209.00 232.00 23.00 4.35 85.30 2.92 1.68

---------------------------------------------------------------

including 215.00 223.00 8.00 11.89 228.40 8.27 4.65

----------------------------------------------------------------------------

PHG071 160.70 168.20 7.50 1.21 14.30 0.19 0.76

----------------------------------------------------------------------------

PHG072 182.00 188.00 6.00 1.38 7.70 0.06 0.11

----------------------------------------------------------------------------

PHG073 42.00 54.00 12.00 2.21 37.00 0.44 1.70

---------------------------------------------------------------

including 48.00 52.00 4.00 4.98 49.10 0.98 3.43

----------------------------------------------------------------------------

PHG074 80.00 87.00 7.00 1.20 7.40 0.02 0.23

----------------------------------------------------------------------------

PHG076 150.00 156.70 6.70 1.80 37.10 0.90 2.76

---------------------------------------------------------------

184.90 185.40 0.50 42.40 25.00 0.11 0.29

----------------------------------------------------------------------------

Hangingwall epithermal vein zones

----------------------------------------------------------------------------

PHG078 86.70 107.00 20.30 2.32 11.40 0.31 0.56

---------------------------------------------------------------

142.00 164.00 22.00 1.61 3.10 0.06 0.09

---------------------------------------------------------------

197.80 210.00 12.20 1.00 13.90 0.06 0.04

----------------------------------------------------------------------------

At Skouries, 17 drillholes (6,500 metres) were completed in the

quarter, representing roughly half of the planned infill and

confirmation programs. Infill drillholes have documented low but

consistent copper and gold grades within the in-pit inferred

resource halo of the deposit including 94.0 metres at 0.3 grams per

tonne gold and 0.27% copper in hole SOP-99; and 92.0 metres at 0.32

grams per tonne gold and 0.31% copper in hole SOP-100. Confirmation

drillholes have intersected the intensely stockwork veined

potassically-altered deposit core, with copper and gold grades

similar to that predicted by the resource model.

At the Fisoka copper-gold porphyry prospect, two holes were

completed during the quarter on the northern stock, and drilling

has now shifted to the untested central stock area. The northern

stock drilling further defined the shallow supergene zone outlined

in previous drilling programs.

At Perama Hill geotechnical, metallurgical and infill drilling

was conducted on the main deposit and infrastructure sites.

Exploration drilling of targets outside of the existing resource

model and at Perama South will commence in Q4 2012.

Romania

At the Certej deposit, drill programs were completed during the

quarter in the West Pit and Link Zone target areas. In the West Pit

area, drilling tested for extensions of the high-grade Hondol and

Kaiser vein systems, which were historically exploited in

underground openings. Although this drilling failed to identify

continuous high-grade veins, it outlined an approximately 50 metre

wide, tabular west by northwest-striking zone of lower grade

material which will be further tested in 2013. The Link Zone

program, targeting underdrilled areas of the deposit between the

West and Main zones, was completed during the quarter with 14 holes

(5,700 metres) drilled. Most of these holes intersected zones of

strong gold mineralization, which has positively impacted the

deposit resource model.

China

Exploration drilling in China during the quarter included

projects in the Guizhou, Jilin, and Qinghai regions. In Guizhou,

exploration drilling was conducted within the Jinfeng mining

license, at the nearby Shizhu prospect, and at the Weiruo prospect

(Jinluo exploration license). At the Jinfeng deposit, exploration

drilling continued to focus on the F3, F6, and F7 mineralized

structures from both surface and underground drill locations. A

total of 19 holes representing approximately 5,700 metres of

drilling were completed. The surface drilling program continues to

produce high grade intercepts associated with the F6 structure,

with notable intercepts during the quarter including 16.0 metres at

16.49 grams per tonne gold (HDDS0275); 6.0 metres at 15.59 grams

per tonne gold (also HDDS0275), and 22.0 metres at 5.14 grams per

tonne gold (HDDS0282).

In Qinghai (Tanjianshan), the Qinglongtan North and Xijingou

drilling programs were completed during the quarter, with 9

drillholes and 27 drillholes respectively. At Qinglongtan North,

drilling focused on previously untested areas down dip and along

strike from the northern end of the previously mined deposit.

Several of these holes intersected strong mineralization, including

intervals of 26.0 metres at 9.24 grams per tonne gold (QD279) and

9.1 metres at 2.68 grams per tonne gold (QD278). These new

intercepts may represent a new high grade gold zone lying beneath

the known deposit, and further drill testing is planned for the

fourth quarter of 2012. At Xinjingou, step-out drilling tested for

extensions to the known zones of high grade mineralization. Notable

results from this program include 11.8 metres at 11.51 grams per

tonne gold (XD073); 4.0 metres at 15.79 grams per tonne gold

(XD075), and 9.0 metres at 8.01 grams per tonne gold (also XD075).

Results are being compiled to determine if further drilling is

justified at Xijingou. Late in the quarter, a second phase of

drilling was initiated at the Jinlonggou deposit, testing a variety

of near-pit structurally-defined targets.

In the Jilin region (White Mountain), drilling was conducted at

the Dongdapo, Xiaoshiren, and Zhenzhumen prospect areas. No

significant results have been obtained to date.

Brazil

No drilling was conducted during the quarter at the

Tocantinzinho project. Exploration activities focused on

reconnaissance-level evaluation of the adjacent Rubens Zilio

license area through systematic soil sampling and prospecting.

At the Agua Branca project (35 kilometres south of

Tocantinzinho) the 2012 drilling program was concluded, with 15

drillholes during the quarter testing for along-strike extensions

of the Camarao zone. Although the mineralized zone demonstrates

continuity to the southwest, grades are erratic, and no significant

wide intercepts were obtained. Additional auger drilling, mapping,

and rock sampling programs are underway to generate new drill

targets at Agua Branca.

Fieldwork commenced during the quarter at the new Chapadinha

project, which we are exploring under an option agreement. The

Chapadinha project covers an area with extensive garimpo workings

exploiting narrow veins high gold grades. Our work program is

directed towards defining drill targets that will assess the

potential of the area for a bulk-tonnage style deposit.

About Eldorado

Eldorado is a gold producing, exploration and development

company actively growing businesses in Turkey, China, Greece,

Brazil and Romania. With our international expertise in mining,

finance and project development, together with highly skilled and

dedicated staff, we believe that our company is well positioned to

grow in value as we create and pursue new opportunities.

ON BEHALF OF ELDORADO GOLD CORPORATION

Paul N. Wright, Chief Executive Officer

Conference Call

Eldorado will host a conference call on Friday October 26, 2012

to discuss the 2012 Third Quarter Financial and Operating Results

at 11:30am EDT (8:30am PDT). You may participate in the conference

call by dialling 416-340-9432 in Toronto or 1-877-440-9795 toll

free in North America and asking for the Eldorado Conference Call

with Chairperson: Paul Wright, CEO of Eldorado Gold.

The call will be available on Eldorado's website.

www.eldoradogold.com. A replay of the call will be available until

November 2, 2012 by dialling 905-694-9451 in Toronto or

1-800-408-3053 toll free in North America and entering the Pass

code: 3971093.

Qualified Person(s)

Dr. Peter Lewis, P.Geo., VP Exploration for Eldorado Gold

Corporation, is the Qualified Person for the technical disclosure

of exploration results in this news release. Dr. Lewis is the

Qualified Person as defined in the National Instrument 43-101

(Standards of Disclosure for Mineral Projects) of the Canadian

Securities Regulators, responsible for preparing or supervising the

preparation of the scientific or technical information contained in

this document and verifying the technical data disclosed in the

document relating to exploration results. Dr. Lewis consents to the

inclusion in this news release of the matters based on his

information in the form and context in which it appears.

Assay results reported in this release district were diamond

drill core samples prepared at Eldorado's sample preparation

facilities in Turkey and China. The prepared samples were sent to

and assayed at various ACME and ALS analytical facilities

worldwide. For all projects, analyses were done on sawn half core

samples. Analysis for gold used fire assay (AA finish or

Gravimetric Finish) whereas AA and ICP methods were used for Ag,

Cu, Pb and Zn analyses. Assay quality was monitored and controlled

by the regular insertion of standard reference materials, blank

samples and duplicate samples prior to shipment from the respective

sample preparation site.

Certain of the statements made herein may contain

forward-looking statements or information within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities laws. Often, but not always,

forward-looking statements and forward-looking information can be

identified by the use of words such as "plans", "expects", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or the negatives thereof or

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved. Forward-looking statements

or information herein include, but are not limited, to the

Company's Q3, 2012 Financial and Operating Results.

Forward-looking statements and forward-looking information by

their nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. We have made certain assumptions about

the forward-looking statements and information and even though our

management believes that the assumptions made and the expectations

represented by such statements or information are reasonable, there

can be no assurance that the forward-looking statement or

information will prove to be accurate. Furthermore, should one or

more of the risks, uncertainties or other factors materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those described in forward-looking statements

or information. These risks, uncertainties and other factors

include, among others, the following: gold price volatility;

discrepancies between actual and estimated production, mineral

reserves and resources and metallurgical recoveries; mining

operational and development risk; litigation risks; regulatory

restrictions, including environmental regulatory restrictions and

liability; risks of sovereign investment; currency fluctuations;

speculative nature of gold exploration; global economic climate;

dilution; share price volatility; competition; loss of key

employees; additional funding requirements; and defective title to

mineral claims or property, as well as those factors discussed in

the sections entitled "Forward-Looking Statements" and "Risk

Factors" in the Company's Annual Information Form & Form 40-F

dated March 30, 2012.

There can be no assurance that forward-looking statements or

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, you should not place undue reliance on the

forward-looking statements or information contained herein. Except

as required by law, we do not expect to update forward-looking

statements and information continually as conditions change and you

are referred to the full discussion of the Company's business

contained in the Company's reports filed with the securities

regulatory authorities in Canada and the U.S.

Eldorado Gold Corporation's common shares trade on the Toronto

Stock Exchange (TSX:ELD) and the New York Stock Exchange

(NYSE:EGO).

Request for information packages: laurelw@eldoradogold.com

PRODUCTION HIGHLIGHTS

----------------------------------------------------------------------------

First First

First Second Third Third Nine Nine

Quarter Quarter Quarter Quarter Months Months

2012 2012 2012 2011 2012 2011

----------------------------------------------------------------------------

Gold Production

----------------

Ounces Sold 150,661 132,919 154,841 179,513 438,421 490,207

Ounces Produced 151,242 132,472 155,123 179,195 438,837 490,201

Cash Operating

Cost

($/oz)(1,3,4) 452 480 493 397 475 401

Total Cash Cost

($/oz)(2,3,4) 529 550 567 463 549 467

Realized Price

($/oz - sold) 1,707 1,612 1,670 1,700 1,665 1,546

----------------------------------------------------------------------------

Kisladag Mine,

Turkey

----------------

Ounces Sold 65,164 61,991 83,750 87,121 210,905 204,345

Ounces Produced 65,707 61,575 84,016 86,788 211,298 204,309

Tonnes to Pad 3,140,492 3,259,574 3,245,700 3,520,220 9,645,766 9,055,906

Grade (grams /

tonne) 1.13 1.30 1.05 0.90 1.16 0.94

Cash Operating

Cost

($/oz)(3,4) 339 333 334 377 335 383

Total Cash Cost

($/oz)(2,3,4) 374 357 363 401 365 406

----------------------------------------------------------------------------

Tanjianshan

Mine, China

----------------

Ounces Sold 28,816 27,172 28,944 26,935 84,932 87,405

Ounces Produced 28,816 27,172 28,944 26,935 84,932 87,405

Tonnes Milled 262,793 245,456 283,654 218,330 791,904 721,098

Grade (grams /

tonne) 4.00 3.73 3.55 4.25 3.75 4.12

Cash Operating

Cost

($/oz)(3,4) 408 432 396 353 411 365

Total Cash Cost

($/oz)(2,3,4) 605 621 593 541 606 552

----------------------------------------------------------------------------

Jinfeng Mine,

China

----------------

Ounces Sold 35,197 25,661 25,805 44,187 86,663 139,086

Ounces Produced 35,235 25,630 25,821 44,202 86,686 139,116

Tonnes Milled 368,756 337,560 356,575 379,352 1,062,891 1,161,739

Grade (grams /

tonne) 3.17 2.68 2.43 4.26 2.77 4.21

Cash Operating

Cost

($/oz)(3,4) 643 786 946 424 775 418

Total Cash Cost

($/oz)(2,3,4) 715 858 1,044 509 855 483

----------------------------------------------------------------------------

White Mountain

Mine, China

----------------

Ounces Sold 21,484 18,095 16,342 21,270 55,921 59,371

Ounces Produced 21,484 18,095 16,342 21,270 55,921 59,371

Tonnes Milled 158,114 188,038 210,114 191,157 556,266 523,926

Grade (grams /

tonne) 4.46 3.60 3.14 4.15 3.67 4.40

Cash Operating

Cost

($/oz)(3,4) 543 622 766 475 634 475

Total Cash Cost

($/oz)(2,3,4) 588 666 813 519 679 517

----------------------------------------------------------------------------

(1) Cost figures calculated in accordance with the Gold Institute Standard.

(2) Cash Operating Costs, plus royalties and the cost of off-site

administration.

(3) Cash operating costs and total cash costs are non-GAAP measures. See the

section "Non-GAAP Measures" of this Review.

(4) Cash operating costs and total cash costs have been recalculated for

prior quarters based on ounces sold.

Eldorado Gold Corporation

Unaudited Condensed Consolidated Balance Sheets

(Expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

September 30, December 31,

Note 2012 2011

$ $

ASSETS

Current assets

Cash and cash equivalents 271,401 393,763

Restricted cash 6 36,794 55,390

Marketable securities 3,052 2,640

Accounts receivable and other 55,402 42,309

Inventories 216,216 164,057

------------------------------

582,865 658,159

Non-current inventories 21,700 26,911

Investments in significantly influenced

companies 30,093 18,808

Deferred income tax assets 3,253 4,259

Restricted assets and other 42,387 38,430

Defined benefit pension plan 8 4,155 -

Property, plant and equipment 6,012,298 2,847,910

Goodwill 669,311 365,928

------------------------------

7,366,062 3,960,405

------------------------------

------------------------------

LIABILITIES & EQUITY

Current liabilities

Accounts payable and accrued

liabilities 214,596 168,367

Current debt 7 45,558 81,031

------------------------------

260,154 249,398

Debt 7 50,000 -

Asset retirement obligations 51,286 43,213

Defined benefit pension plan 8 - 19,969

Deferred income tax liabilities 871,056 336,579

------------------------------

1,232,496 649,159

------------------------------

Equity

Share capital 9 5,290,316 2,855,689

Treasury stock (7,317) (4,018)

Contributed surplus 69,278 30,441

Accumulated other comprehensive loss (17,162) (10,069)

Retained earnings 479,894 382,716

------------------------------

Total equity attributable to

shareholders of the Company 5,815,009 3,254,759

Attributable to non-controlling

interests 318,557 56,487

------------------------------

6,133,566 3,311,246

------------------------------

7,366,062 3,960,405

------------------------------

------------------------------

Approved on behalf of the Board of Directors

(Signed) Robert R. Gilmore, Director

(Signed) Paul N. Wright, Director

The accompanying notes are an integral part of these consolidated financial

statements.

Eldorado Gold Corporation

Unaudited Condensed Consolidated Income Statements

(Expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

-------------------- --------------------

2012 2011 2012 2011

$ $ $ $

Revenue

Metal sales 281,839 327,364 797,579 799,088

Cost of sales

Production costs 107,615 95,020 293,340 250,762

Depreciation and amortization 26,082 29,954 78,635 91,014

-------------------- --------------------

133,697 124,974 371,975 341,776

-------------------- --------------------

Gross profit 148,142 202,390 425,604 457,312

Exploration expenses 11,130 6,913 29,899 15,359

General and administrative expenses 17,518 11,207 53,345 45,815

Defined benefit pension plan

expense 638 418 1,899 1,274

Share based payments 4,396 3,599 17,210 15,403

Transaction costs 552 - 20,005 -

Foreign exchange (gain) loss (1,926) 3,530 (2,227) 5,558

-------------------- --------------------

Operating profit 115,834 176,723 305,473 373,903

(Gain) loss on disposal of assets (23) 420 423 (2,672)

Loss (gain) on marketable

securities and other investments - 1,528 (1,032) 239

Loss on investments in

significantly influenced companies 1,375 1,067 3,119 2,861

Other income (264) (2,792) (2,641) (4,808)

Asset retirement obligation

accretion 457 387 1,328 1,160

Interest and financing costs 1,481 2,293 3,615 5,407

-------------------- --------------------

Profit before income tax 112,808 173,820 300,661 371,716

Income tax expense 34,435 63,077 98,965 120,520

-------------------- --------------------

Profit for the period 78,373 110,743 201,696 251,196

-------------------- --------------------

Attributable to:

Shareholders of the Company 75,845 102,478 190,320 229,816

Non-controlling interests 2,528 8,265 11,376 21,380

-------------------- --------------------

78,373 110,743 201,696 251,196

-------------------- --------------------

-------------------- --------------------

Weighted average number of shares

outstanding

Basic 712,789 549,085 680,121 548,800

Diluted 713,340 551,309 681,222 550,737

Earnings per share attributable to

shareholders of the Company:

Basic earnings per share 0.11 0.19 0.28 0.42

Diluted earnings per share 0.11 0.19 0.28 0.42

The accompanying notes are an integral part of these consolidated financial

statements.

Eldorado Gold Corporation

Unaudited Condensed Consolidated Statements of Comprehensive Income

(Expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

-------------------- --------------------

2012 2011 2012 2011

$ $ $ $

Profit for the period 78,373 110,743 201,696 251,196

Other comprehensive income loss:

Change in fair value of available-

for-sale financial assets (net of

income taxes of nil and $12; and

nil and $12) (231) (399) (1,368) (1,383)

Realized gains on disposal of

available-for-sale financial

assets transferred to net income - - (24) (434)

Actuarial losses on defined benefit

pension plans - - (5,701) -

-------------------- --------------------

Total other comprehensive loss for

the period (231) (399) (7,093) (1,817)

-------------------- --------------------

Total comprehensive income for the

period 78,142 110,344 194,603 249,379

-------------------- --------------------

-------------------- --------------------

Attributable to:

Shareholders of the Company 75,614 102,079 183,227 227,999

Non-controlling interests 2,528 8,265 11,376 21,380

-------------------- --------------------

78,142 110,344 194,603 249,379

-------------------- --------------------

-------------------- --------------------

The accompanying notes are an integral part of these consolidated financial

statements.

Eldorado Gold Corporation

Unaudited Condensed Consolidated Statements of Cash Flows

(Expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

-------------------- --------------------

Note 2012 2011 2012 2011

$ $ $ $

Cash flows generated from

(used in):

Operating activities

Profit for the period 78,373 110,743 201,696 251,196

Items not affecting cash

Asset retirement obligation

accretion 457 387 1,328 1,160

Depreciation and amortization 26,082 29,954 78,635 91,014

Unrealized foreign exchange

(gain) loss (446) 1,500 (809) 6,261

Deferred income tax (recovery)

expense (42) 10,079 (6,730) 374

(Gain) loss on disposal of

assets (23) 420 423 (2,672)

Loss on investments in

significantly influenced

companies 1,375 1,067 3,119 2,861

Loss (gain) on marketable

securities and other

investments - 1,528 (1,032) 239

Share based payments 4,396 3,599 17,210 15,403

Defined benefit pension plan

expense 638 418 1,899 1,274

-------------------- --------------------

110,810 159,695 295,739 367,110

Changes in non-cash working

capital 11 20,743 13,933 (121,914) (2,389)

-------------------- --------------------

131,553 173,628 173,825 364,721

Investing activities

Net cash received on

acquisition of subsidiary 5 - - 18,789 -

Purchase of property, plant

and equipment (136,779) (76,028) (303,891) (201,630)

Proceeds from the sale of

property, plant and equipment 99 24 890 41

Net proceeds on pre-production

sales 17,412 - 37,434 -

Purchase of marketable

securities 2,152 (1,609) - (1,823)

Proceeds from the sale of

marketable securities - - 230 6,345

Funding of non-registered

supplemental retirement plan

investments, net - 43 14,486 (4,937)

Investments in significantly

influenced companies (11,947) (2,470) (15,359) (3,788)

Decrease in restricted cash 20,240 35 18,571 (2,963)

-------------------- --------------------

(108,823) (80,005) (228,850) (208,755)

Financing activities

Issuance of common shares for

cash 3,430 22,631 20,261 30,616

Dividend paid to non-

controlling interests (967) (4,473) (2,238) (8,095)

Dividend paid to shareholders (43,262) (33,426) (93,142) (61,167)

Purchase of treasury stock (691) (280) (6,702) (6,438)

Long-term and bank debt

proceeds - 2,579 50,000 5,782

Long-term and bank debt

repayments (24,429) (29,749) (35,516) (74,465)

(65,919) (42,718) (67,337) (113,767)

-------------------- --------------------

Net (decrease) increase in

cash and cash equivalents (43,189) 50,905 (122,362) 42,199

Cash and cash equivalents -

beginning of period 314,590 305,638 393,763 314,344

-------------------- --------------------

Cash and cash equivalents -

end of period 271,401 356,543 271,401 356,543

-------------------- --------------------

-------------------- --------------------

The accompanying notes are an integral part of these consolidated financial

statements.

Eldorado Gold Corporation

Unaudited Condensed Consolidated Statements of Changes in Equity

(Expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

-------------------- --------------------

2012 2011 2012 2011

$ $ $ $

Share capital

Balance beginning of period 5,282,368 2,825,024 2,855,689 2,814,679

Shares issued upon exercise

of share options, for cash 3,430 22,631 20,261 29,131

Transfer of contributed

surplus on exercise of

options 4,518 6,714 22,674 9,074

Shares issued on acquisition

of European Goldfields Ltd. 5 - - 2,380,140 -

Shares issued for deferred

phantom units - - 11,552 -

Shares issued upon exercise

of warrants, for cash - - - 1,485

-------------------- --------------------

Balance end of period 5,290,316 2,854,369 5,290,316 2,854,369

-------------------- --------------------

Treasury stock

Balance beginning of period (7,355) (4,432) (4,018) -

Purchase of treasury stock (691) (280) (6,702) (6,438)

Shares redeemed upon exercise

of restricted share units 729 499 3,403 2,225

-------------------- --------------------

Balance end of period (7,317) (4,213) (7,317) (4,213)

-------------------- --------------------

Contributed surplus

Balance beginning of period 70,444 30,828 30,441 22,967

Share based payments 4,081 3,742 16,231 15,689

Shares redeemed upon exercise

of restricted share units (729) (499) (3,403) (2,225)

Options issued on acquisition

of European Goldfields Ltd. 5 - - 31,130 -

Deferred phantom units

granted on acquisition of

European Goldfields Ltd. - - 29,105 -

Transfer to share capital on

exercise of options and

deferred phantom units (4,518) (6,714) (34,226) (9,074)

-------------------- --------------------

Balance end of period 69,278 27,357 69,278 27,357

-------------------- --------------------

Accumulated other

comprehensive loss

Balance beginning of period (16,931) (3,055) (10,069) (1,637)

Other comprehensive loss for

the period (231) (399) (7,093) (1,817)

-------------------- --------------------

Balance end of period (17,162) (3,454) (17,162) (3,454)

-------------------- --------------------

Retained earnings

Balance beginning of period 447,311 224,818 382,716 125,221

Dividends paid (43,262) (33,426) (93,142) (61,167)

Profit attributable to

shareholders of the Company 75,845 102,478 190,320 229,816

-------------------- --------------------

Balance end of period 479,894 293,870 479,894 293,870

-------------------- --------------------

Total equity attributable to

shareholders of the Company 5,815,009 3,167,929 5,815,009 3,167,929

-------------------- --------------------

Non-controlling interests

Balance beginning of period 316,029 41,041 56,487 36,021

Profit attributable to non-

controlling interests 2,528 8,265 11,376 21,380

Dividends declared to non-

controlling interests - - (9,399) (8,095)

Acquired non-controlling

interest 5 - - 260,093 -

-------------------- --------------------

Balance end of period 318,557 49,306 318,557 49,306

-------------------- --------------------

Total equity 6,133,566 3,217,235 6,133,566 3,217,235

-------------------- --------------------

-------------------- --------------------

The accompanying notes are an integral part of these consolidated financial

statements.

Click here for the Unaudited Consolidated Financial Statements

for the quarter ended Sept 30, 2012 in PDF:

http://media3.marketwire.com/docs/2012Q3Financials.pdf

Contacts: Eldorado Gold Corporation Nancy Woo VP Investor

Relations 604.601-6650 or 1.888.353.8166 604.687.4026

(FAX)nancyw@eldoradogold.com www.eldoradogold.com

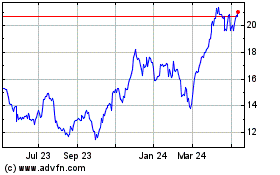

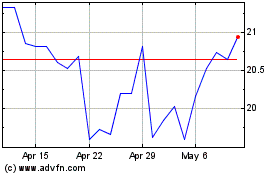

Eldorado Gold (TSX:ELD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eldorado Gold (TSX:ELD)

Historical Stock Chart

From Apr 2023 to Apr 2024