Cineplex Inc. ("Cineplex") (TSX:CGX) today released its financial

results for the third quarter of 2012.

Third Quarter Results

----------------------------------------------------------------------------

Period over

Period

2012 2011 Change (i)

----------------------------------------------------------------------------

Total Revenues $281.4 million $276.7 million 1.7%

----------------------------------------------------------------------------

Attendance 18.3 million 18.5 million -1.0%

----------------------------------------------------------------------------

Other Revenues $ 33.3 million $ 32.1 million 3.9%

----------------------------------------------------------------------------

Net Income $ 51.7 million $ 25.7 million 100.9%

----------------------------------------------------------------------------

Adjusted EBITDA $ 54.6 million $ 57.4 million -5.0%

----------------------------------------------------------------------------

Adjusted EBITDA Margin 19.4% 20.8% -1.4%

----------------------------------------------------------------------------

Adjusted Free Cash Flow per

Share $ 0.5737 $ 0.7133 -19.6%

----------------------------------------------------------------------------

Basic Earnings per Share $ 0.84 $ 0.44 90.9%

----------------------------------------------------------------------------

Diluted Earnings per Share $ 0.83 $ 0.44 88.6%

----------------------------------------------------------------------------

i. Period over Period change calculated based on thousands of dollars

except percentage and per share values. Changes in percentage amounts

are calculated as 2012 value less 2011 value.

First Nine Months Results

----------------------------------------------------------------------------

Period over

Period

2012 2011 Change (i)

----------------------------------------------------------------------------

Total Revenues $793.2 million $756.5 million 4.8%

----------------------------------------------------------------------------

Attendance 52.6 million 51.0 million 3.2%

----------------------------------------------------------------------------

Other Revenues $ 82.5 million $ 89.4 million -7.8%

----------------------------------------------------------------------------

Net Income $ 87.8 million $ 38.3 million 129.0%

----------------------------------------------------------------------------

Adjusted EBITDA $143.0 million $133.1 million 7.4%

----------------------------------------------------------------------------

Adjusted EBITDA Margin 18.0% 17.6% 0.4%

----------------------------------------------------------------------------

Adjusted Free Cash Flow per

Share $ 1.5378 $ 1.6100 -4.5%

----------------------------------------------------------------------------

Basic Earnings per Share $ 1.45 $ 0.67 116.4%

----------------------------------------------------------------------------

Diluted Earnings per Share $ 1.45 $ 0.66 119.7%

----------------------------------------------------------------------------

i. Period over Period change calculated based on thousands of dollars

except percentage and per share values. Changes in percentage amounts

are calculated as 2012 value less 2011 value.

"Total revenues for the third quarter increased 1.7% compared to

a year ago and our merchandising and media businesses delivered

strong results," said Ellis Jacob, President and CEO, Cineplex

Entertainment. "New third quarter records were established for CPP

of $4.68, up 5.6%, BPP of $8.84, up 0.8% and concession revenues of

$85.9 million, an increase of 4.6% versus the same period last

year. On a year-to-date basis, total revenues were up 4.8% and

Adjusted EBITDA was up 7.4%."

"In other areas of our business, we completed the conversion of

our circuit to digital projection and approximately 36% of our

screens are 3D enabled. We completed the acquisition of four

theatres (86 screens) from AMC and are in the process of

implementing a number of our programs to improve the business

results. Our SCENE loyalty program reached a new milestone

surpassing 4 million members and continues to grow. The Cineplex

mobile app has now been downloaded more than 4.1 million times and

recorded approximately 85 million app sessions. We are pleased with

the progress in our key initiatives and are encouraged by the

industry box office results for October and the quality of the film

product for the balance of the quarter."

EBITDA and adjusted free cash flow are not measures recognized

by generally accepted accounting principles ("GAAP") and do not

have standardized meanings in accordance with such principles.

Therefore, EBITDA and adjusted free cash flow may not be comparable

to similar measures presented by other issuers. EBITDA is

calculated by adding back to net income, income tax expense,

amortization and interest expense net of interest income. Adjusted

EBITDA is calculated by adjusting EBITDA for gains and losses on

disposal of assets, gains on acquisition of businesses and the

share of income or loss of the Canadian Digital Cinema Partnership

("CDCP"). Adjusted free cash flow is a non-GAAP measure generally

used by Canadian corporations, as an indicator of financial

performance and it should not be seen as a measure of liquidity or

a substitute for comparable metrics prepared in accordance with

GAAP. Management uses adjusted EBITDA and adjusted free cash flow

to evaluate performance primarily because of the significant effect

certain unusual or non-recurring charges and other items have on

EBITDA from period to period. For a detailed reconciliation of net

income to EBITDA and adjusted EBITDA and from cash provided by

operating activities to adjusted free cash flow, please refer to

Cineplex's management's discussion and analysis filed on

www.sedar.com.

KEY DEVELOPMENTS IN THE THIRD QUARTER OF 2012

The following describes certain key business initiatives

undertaken during the third quarter of 2012 in each of Cineplex's

core business areas:

THEATRE EXHIBITION

-- Completed the acquisition of AMC Ventures Inc., which owns four theatres

located in Toronto, Mississauga and Oakville, Ontario and Montreal,

Quebec.

-- BPP increased 0.8% from $8.77 in the third quarter of 2011 to $8.84 in

the current year period, which is a third quarter BPP record for

Cineplex.

-- As of September 30, 2012, Cineplex has completed the planned conversion

of its theatre circuit to digital projection.

MERCHANDISING

-- Reported record quarterly concession revenues of $85.9 million, a 4.6%

increase in concession revenues compared to the prior year period.

-- Reported record quarterly CPP of $4.68, up $0.25 or 5.6% over the third

quarter of 2011, exceeding the previous quarterly record of $4.66

recorded in the second quarter of 2012.

-- Continued the roll-out of digital menu boards at concession stands

throughout the circuit, providing a flexible platform to communicate

pricing, promotions and merchandising programs.

-- Began implementing Cineplex's merchandising strategies at the four

theatres acquired from AMC during the period. Cineplex believes its

merchandising expertise will positively impact concession revenues at

these locations.

MEDIA

-- Media revenues increased 3.6% compared to the prior year period due

primarily to growth in the Cineplex digital media ("CDM") business.

-- Recruited a new Senior Vice President, Sales, responsible for overseeing

sales across all channels and platforms, starting October 1, 2012.

ALTERNATIVE PROGRAMMING

-- The Wimbledon tennis finals were screened live in 3D at select theatres

across Canada during the quarter.

-- Other alternative programming during the third quarter of 2012 included

ethnic films, live events such as World Wrestling Entertainment,

concerts, and performances from the National Theatre Live from London.

INTERACTIVE

-- Cineplex.com registered a 36% increase in page views and a 19% increase

in visits during the third quarter of 2012 compared to the prior year

period, registering 104 million page views and 17 million visits during

the quarter.

-- As of September 30, 2012, the Cineplex app had been downloaded 4.1

million times and recorded 84.8 million app sessions.

-- Launched Cineplex online store ("Cineplex Store") playback on Apple iOS

devices.

-- Added theatre ticketing and SCENE to Apple Passbook, and were Canadian

launch partners with the Google TV app.

-- Added e-gift cards to the Cineplex Store.

-- Launched the Cineplex Store app on LG set-top boxes.

LOYALTY

-- Membership in the SCENE loyalty program increased by 0.3 million members

during the third quarter of 2012 to 4.1 million.

-- SCENE became the first Canadian loyalty program to win prestigious

COLLOQUY Loyalty Awards, winning the award for "Innovation in Loyalty

Marketing" with its SCENEtourage initiative, as well as the award for

"Loyalty Innovation in Other Industries" for the mobile SCENE card.

OPERATING RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER

30, 2012

Total revenues

Total revenues for the three months ended September 30, 2012

increased $4.7 million, 1.7% to $281.4 million as compared to the

prior year period. Total revenues for the nine months ended

September 30, 2012 increased $36.7 million (4.8%) to $793.2 million

as compared to the prior year period. Exhibition revenues for the

current year periods were positively impacted by the acquisition of

the four theatres from AMC during the third quarter of 2012. A

discussion of the factors affecting the changes in box office,

concession and other revenues for the periods is provided on the

following pages.

Box office revenues

The following table highlights the movement in box office

revenues, attendance and BPP for the quarter and the year to date

(in thousands of Canadian dollars, except attendance reported in

thousands of patrons, and per patron amounts, unless otherwise

noted):

----------------------------------------------------------------------------

Box office revenues Third Quarter Year to Date

--------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Box office revenues $162,133 $162,522 -0.2% $467,772 $443,613 5.4%

Attendance 18,348 18,542 -1.0% 52,621 50,989 3.2%

Box office revenue

per patron $ 8.84 $ 8.77 0.8% $ 8.89 $ 8.70 2.2%

Canadian industry

revenues (i) -5.4% 2.8%

Same store box

office revenues $154,302 $161,362 -4.4% $457,036 $440,684 3.7%

Same store

attendance 17,556 17,113 2.6% 51,545 50,631 1.8%

% Total box from 3D,

UltraAVX, VIP &

IMAX 31.4% 35.7% -4.3% 31.6% 29.1% 2.5%

----------------------------------------------------------------------------

(i) The Motion Picture Theatre Associations of Canada ("MPTAC") reported

that the Canadian exhibition industry reported a box office revenue decrease

of 5.0% for the period from June 29, 2012 to September 27, 2012 as compared

to the period from July 1, 2011 to September 29, 2011. On a basis consistent

with Cineplex's calendar reporting period (July 1 to September 30), the

Canadian industry box office revenue decrease is estimated to be 5.4%. MPTAC

reported that the Canadian exhibition industry reported a box office revenue

increase of 2.4% for the period from December 30, 2011 to September 27, 2012

as compared to the period from December 31, 2010 to September 29, 2011. On a

basis consistent with Cineplex's calendar reporting period (January 1 to

September 30), the Canadian industry box office revenue is estimated to be

an increase of 2.8%.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Box office continuity Third Quarter Year to Date

Box Office Attendance Box Office Attendance

----------------------------------------------------------------------------

2011 as reported $ 162,522 18,542 $ 443,613 50,989

Same store attendance change (7,545) (861) 7,955 914

Impact of same store BPP

change 485 - -

New and acquired theatres 7,057 711 9,346 918

Disposed and closed theatres (386) (44) (1,539) (200)

----------------------------------------------------------------------------

2012 as reported $ 162,133 18,348 $ 467,772 52,621

----------------------------------------------------------------------------

Third Quarter

----------------------------------------------------------------------------

Third Quarter 2012 Top % Third Quarter 2011 Top %

Cineplex Films IMAX 3D Box Cineplex Films IMAX 3D Box

----------------------------------------------------------------------------

1 The Dark Knight 1 Harry Potter and the

Rises X 17.5% Deathly Hollows 2 X X 14.8%

2 The Amazing Spider- 2 Transformers: Dark

Man X X 10.7% of the Moon X X 9.6%

3 Ted 6.7% 3 The Smurfs X 6.0%

4 Ice Age: Continental 4 Captain America: The

Drift X X 6.0% First Avenger X 5.6%

5 The Bourne Legacy 4.9% 5 Rise of the Planet

of the Apes 5.6%

----------------------------------------------------------------------------

Box office revenues decreased $0.4 million, or 0.2%, to $162.1

million during the third quarter of 2012, compared to $162.5

million recorded in the same period in 2011. The decrease was due

to a 1.0% decrease in attendance. The top five films during the

quarter outperformed the top five films from the prior year period

($74.3 million compared to $67.6 million), but the remainder of the

film slate underperformed compared to the prior year period. The

decrease was also mitigated by the acquisition of the four theatres

from AMC during the quarter which are not included in the prior

period results.

The decrease in box office revenues due to the attendance

decline was partially offset by a 0.8% increase in BPP, from $8.77

in the third quarter of 2011 to $8.84 in the current year period.

This BPP increase was due to the films during the period catering

to more mature audiences than the product in the prior year period,

as well as the contribution from the four theatres acquired from

AMC which are located in major metropolitan areas and have higher

ticket prices than those in smaller markets. Premium-priced product

(3D, UltraAVX, IMAX and VIP) accounted for 31.4% of box office

revenues in the current quarter, down from 35.7% in the prior year

period as only two of the top five releases during the period were

screened in 3D, compared to all four of the top releases in the

prior year period shown in 3D.

Cineplex's investment in premium-priced formats over the last

four years has positioned it to take advantage of the price

premiums offered on these formats, which has contributed to

Cineplex's BPP growth in the current period compared to the prior

year period. This investment in premium-priced offerings

contributed to Cineplex outperforming the Canadian industry during

the third quarter.

Year to Date

----------------------------------------------------------------------------

Year to Date 2012 Top % Year to Date 2011 Top %

Cineplex Films IMAX 3D Box Cineplex Films IMAX 3D Box

----------------------------------------------------------------------------

1 Marvel's The 1 Harry Potter and the

Avengers X X 7.7% Deathly Hallows 2 X X 5.7%

2 The Dark Knight 2 Transformers: Dark

Rises X 6.1% of the Moon X X 4.3%

3 The Hunger Games X 5.2% 3 Pirates of the

Caribbean: On

Stranger Tides X X 3.1%

4 The Amazing Spider- 4 The Hangover 2 2.7%

Man X X 3.7%

5 Dr. Seuss' The Lorax X X 2.7% 5 Bridesmaids 2.6%

----------------------------------------------------------------------------

Box office revenues for the first nine months of 2012 were

$467.8 million or 5.4% higher than the prior year period. The

strong performance of the three major blockbusters released in 2012

(Marvel's The Avengers, The Dark Knight Rises and The Hunger Games)

were the main contributors to the $24.2 million increase in box

office revenue during the period. Attendance during the 2012 period

also benefited from the first week of January 2012 being a school

holiday week in most markets, whereas the same week in 2011 was

not. The acquisition of the four theatres from AMC during the third

quarter of 2012 also contributed to the box office revenue increase

in the current year period.

Cineplex's BPP for the first nine months of 2012 increased

$0.19, or 2.2%, from $8.70 in 2011 to $8.89 in the same period in

2012. This increase was primarily due to the increase in revenues

from premium-priced product. Premium-priced offerings accounted for

31.6% of Cineplex's box office revenues in the 2012 period,

compared to 29.1% in the prior year period. The top five films in

the 2012 period were screened in IMAX and three in 3D (2011 - three

in IMAX and three in 3D).

Concession revenues

The following table highlights the movement in concession

revenues, attendance and CPP for the quarter and the year to date

(in thousands of Canadian dollars, except attendance and same store

attendance reported in thousands of patrons, and per patron

amounts):

----------------------------------------------------------------------------

Concession revenues Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Concession revenues $ 85,924 $ 82,114 4.6% $242,923 $223,477 8.7%

Attendance 18,348 18,542 -1.0% 52,621 50,989 3.2%

Concession revenue per

patron $ 4.68 $ 4.43 5.6% $ 4.62 $ 4.38 5.5%

Same store concession

revenues $ 82,317 $ 81,607 0.9% $237,620 $222,312 6.9%

Same store attendance 17,556 18,417 -4.7% 51,545 50,631 1.8%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Concession revenue

continuity Third Quarter Year to Date

Concession Attendance Concession Attendance

----------------------------------------------------------------------------

2011 as reported $ 82,114 18,542 $ 223,477 50,989

Same store attendance change (3,815) (861) 4,013 914

Impact of same store CPP

change 4,526 - 11,295 -

New and acquired theatres 3,212 711 4,682 918

Disposed and closed theatres (113) (44) (544) (200)

----------------------------------------------------------------------------

2012 as reported $ 85,924 18,348 $ 242,923 52,621

----------------------------------------------------------------------------

Third Quarter

Concession revenues increased 4.6% as compared to the prior year

quarter despite the 1.0% decrease in attendance. CPP increased from

$4.43 in the third quarter of 2011 to $4.68 in the same period in

2012, a 5.6% increase and a quarterly record for Cineplex, $0.02

higher than the previous record set in the second quarter of 2012.

Cineplex believes a focus on revised concession offerings, its

retail branded outlet program and improved product promotion

through the expansion of a digital menu board program have all

contributed to the higher CPP in the current period compared to the

prior year period.

While the 10% SCENE discount and SCENE points issued on

concession combo purchases reduce individual transaction values

which impacts CPP, Cineplex believes that this program drives

incremental visits and concession purchases, resulting in higher

overall concession revenues.

Year to Date

Concession revenues increased 8.7% as compared to the prior year

period, due to the 3.2% increase in attendance and the 5.5%

increase in CPP. CPP increased from $4.38 in the first nine months

of 2011 to $4.62 in the same period in 2012. This represents the

highest CPP Cineplex has recorded through the first nine months of

a given year.

Other revenues

The following table highlights the movement in media, games and

other revenues for the quarter and the year to date (in thousands

of Canadian dollars):

----------------------------------------------------------------------------

Other revenues Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Media $ 22,996 $ 22,190 3.6% $ 53,890 $ 62,575 -13.9%

Games 1,644 2,492 -34.0% 5,018 5,456 -8.0%

Other 8,671 7,390 17.3% 23,573 21,386 10.2%

----------------------------------------------------------------------------

Total $ 33,311 $ 32,072 3.9% $ 82,481 $ 89,417 -7.8%

----------------------------------------------------------------------------

Third Quarter

Other revenues increased 3.9% to $33.3 million in the third

quarter of 2012. This increase was due to higher media revenues,

which during the third quarter of 2012 were $23.0 million, up $0.8

million, or 3.6%, when compared to the prior year period. This

increase was primarily due to higher revenues in Cineplex's Digital

Media business ($0.7 million). Showtime and pre-show advertising

returned to prior year levels in the third quarter of 2012.

The games revenue decrease is due to the formation of CSI on

January 31, 2012, with the acquisition by New Way Sales ("NWS") of

the gaming business of Starburst Coin Machines Inc. With the

creation of the CSI joint venture, revenues from CSI are included

in the 'Share of loss (income) of joint ventures' line in the

Statements of Operations. The Games revenues for the third quarter

of 2011 include the results of NWS ($1.2 million). The addition of

two new XSCAPE entertainment centres since the third quarter of

2011 partially offset the decrease in games revenue due to the

creation of CSI and related movement of CSI results to the joint

ventures line in the Statements of Operations. Other revenues also

increased due primarily to additional revenue arising from enhanced

guest service initiatives ($1.1 million).

Year to Date

Other revenues decreased 7.8% from $89.4 million in the first

nine months of 2011 to $82.5 million during the same period in

2012. Media revenues for the first nine months of 2012 decreased

$8.7 million, or 13.9%, from the prior year period. Declines in

Cineplex's media business were due in part to the challenging media

environment prevalent during the first half of 2012, partially

mitigated by the stronger CDM revenues in the third quarter.

Cineplex enjoys strong relationships with a number of national

advertisers and during the first half of the year the reduction in

campaigns from three major categories of these advertisers

contributed to the decrease in media revenues.

The decrease in games revenue was due to the impact of NWS and

the formation of CSI. The results of NWS are included in the

comparative period for May to September 2011 (following its

acquisition in May 2011) and for January 2012 (prior to the

formation of CSI described above - $0.4 million for the 2012 period

and $1.6 million for the 2011 period). This decrease was partially

offset by the impact of the new XSCAPE entertainment centres added

in the fourth quarter of 2011 as well as the higher attendance in

the current year period bringing more games traffic through the

theatres. The increase in the other category is primarily due to

higher auditorium rental and screening revenues as well as

additional revenue arising from enhanced guest service

initiatives.

Film cost

The following table highlights the movement in film cost and

Film Cost Percentage for the quarter and the year to date (in

thousands of Canadian dollars, except film cost percentage):

----------------------------------------------------------------------------

Film cost Third Quarter Year to Date

--------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Film cost $ 83,632 $ 85,320 -2.0% $243,804 $230,647 5.7%

Film cost percentage 51.6% 52.5% -0.9% 52.1% 52.0% 0.1%

----------------------------------------------------------------------------

Third Quarter

Film cost varies primarily with box office revenue, and can vary

from quarter to quarter based on the relative strength of the

titles exhibited during the period. The decrease in the third

quarter of 2012 compared to the prior year period was due to the

decrease in box office revenue and the 0.9% decrease in film cost

percentage. The decrease in film cost percentage is primarily due

to the settlement rate on certain strong performing titles during

the third quarter of 2012 being lower than the average film

settlement rate in the 2011 period.

Year to Date

The year to date increase in film cost was due to the 5.4%

increase in box office revenues and the 0.1% increase in film cost

percentage during the period. The increase in the film cost

percentage as compared to the prior year period is primarily due to

the settlement rate on certain strong performing titles during the

2012 period being higher than the average settlement rate in the

2011 period.

Cost of concessions

The following table highlights the movement in concession cost

and concession cost as a percentage of concession revenues

("concession cost percentage") for the quarter and the year to date

(in thousands of Canadian dollars, except concession cost

percentage and concession margin per patron):

----------------------------------------------------------------------------

Cost of concessions Third Quarter Year to Date

--------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Concession cost $ 17,831 $ 16,817 6.0% $ 50,321 $ 46,722 7.7%

Concession cost

percentage 20.8% 20.5% 0.3% 20.7% 20.9% -0.2%

Concession margin

per patron $ 3.71 $ 3.52 5.4% $ 3.66 $ 3.47 5.5%

----------------------------------------------------------------------------

Third Quarter

Cost of concessions varies primarily with theatre attendance as

well as the quantity and mix of concession offerings sold. The

increase in concession cost as compared to the prior year period

was due to the 4.6% increase in concession revenues, partially

offset by the 0.3% increase in the concession cost percentage

during the period. The concession margin per patron increased from

$3.52 in the third quarter of 2011 to $3.71 in the same period in

2012, reflecting the impact of the higher CPP during the

period.

Year to Date

The increase in concession cost during the period was due to the

8.7% increase in concession revenues partially offset by the 0.2%

decrease in the concession cost percentage. Despite the 10%

discount offered to SCENE members, which contributes to a higher

concession cost percentage, Cineplex believes the SCENE program

drives incremental attendance and purchase incidence which

increases concession revenues and CPP.

Depreciation and amortization

The following table highlights the movement in depreciation and

amortization expenses during the quarter and the year to date (in

thousands of Canadian dollars):

----------------------------------------------------------------------------

Amortization expenses Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Amortization of

property, equipment and

leaseholds $ 13,784 $ 14,372 -4.1% $ 42,727 $ 44,574 -4.1%

Amortization of

intangible assets and

other 230 2,241 -89.7% 2,397 6,729 -64.4%

----------------------------------------------------

Amortization expenses as

reported $ 14,014 $ 16,613 -15.6% $ 45,124 $ 51,303 -12.0%

----------------------------------------------------------------------------

The quarterly and annual decrease in amortization of property,

equipment and leaseholds of $0.6 million and $1.8 million

respectively is due in part to the transfer of digital projection

equipment to CDCP in June 2011 resulting in lower asset values to

depreciate, as well as certain assets becoming fully amortized in

the third quarter of 2012. The declining 35 millimeter projector

base due to the circuit's conversion to digital also contributed to

the decrease in amortization of property, equipment and leaseholds.

The decrease in amortization of intangible assets and other relates

to certain intangible assets that became fully amortized during the

first quarter of 2012.

Loss on disposal of assets

The following table shows the movement in the loss on disposal

of assets during the quarter and year to date (in thousands of

Canadian dollars):

----------------------------------------------------------------------------

Loss on disposal of

assets Third Quarter Year to Date

---------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Loss on disposal of

assets $ 114 $ 487 -76.6% $ 786 $ 4 NM

----------------------------------------------------------------------------

Third Quarter

For the third quarter of 2012, Cineplex recorded a loss of $0.1

million on the disposal of assets (2011 - $0.5 million).

Year to Date

For the nine months ended September 30, 2012, disposal of assets

resulted in a loss of $0.8 million on the disposal of assets. For

the nine months ended September 30, 2011, disposal of assets

resulted in a loss of $4.0 thousand, comprised of losses recorded

on assets that were sold or otherwise disposed of, offset by a gain

on the sale of the theatre during the second quarter of 2011 ($1.4

million) and a nominal gain recorded on the transfer of digital

projection assets to CDCP.

Gain on acquisition of business

----------------------------------------------------------------------------

Gain on acquisition of

business Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Gain on acquisition of

business $(23,822) $ - NM $(23,822) $ - NM

----------------------------------------------------------------------------

The gain on acquisition represents the gain recorded on the

acquisition of AMC Ventures Inc. during the third quarter of 2012

(see Section 1.3, Business acquisition).

Other costs

Other costs include three main sub-categories of expenses,

including theatre occupancy expenses, which capture the rent and

associated occupancy costs for Cineplex's various operations; other

operating expenses, which include the costs related to running

Cineplex's theatres and ancillary businesses; and general and

administrative expenses, which includes costs related to managing

Cineplex's operations, including the head office expenses. Please

see the discussions below for more details on these categories. The

following table highlights the movement in other costs for the

quarter and the year to date (in thousands of Canadian

dollars):

----------------------------------------------------------------------------

Other costs Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Theatre occupancy

expenses $ 45,871 $ 41,040 11.8% $128,761 $123,855 4.0%

Other operating expenses 65,631 65,620 - 184,917 182,193 1.5%

General and

administrative expenses 13,146 12,068 8.9% 41,937 43,459 -3.5%

----------------------------------------------------

Total other costs $124,648 $118,728 5.0% $355,615 $349,507 1.7%

----------------------------------------------------------------------------

Theatre occupancy expenses

The following table highlights the movement in theatre occupancy

expenses for the quarter and the year to date (in thousands of

Canadian dollars):

----------------------------------------------------------------------------

Theatre occupancy

expenses Third Quarter Year to Date

--------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Rent $ 30,379 $ 27,707 9.6% $ 85,650 $ 83,247 2.9%

Other occupancy 15,617 13,636 14.5% 44,285 42,091 5.2%

One-time items (i) (125) (303) -58.7% (1,174) (1,483) -20.8%

----------------------------------------------------------------------------

Total $ 45,871 $ 41,040 11.8% $128,761 $123,855 4.0%

----------------------------------------------------------------------------

i. One-time items include amounts related to both theatre rent and other

theatre occupancy costs. They are isolated here to illustrate Cineplex's

theatre rent and other theatre occupancy costs excluding these one-time,

non-recurring items.

----------------------------------------------------------------------------

Theatre occupancy continuity Third Quarter Year to Date

Occupancy Occupancy

----------------------------------------------------------------------------

2011 as reported $ 41,040 $ 123,855

Impact of new theatres 4,359 4,974

Impact of disposed theatres (620) (1,265)

Same store rent change 319 305

One-time items 178 309

Other 595 583

----------------------------------------------------------------------------

2012 as reported $ 45,871 $ 128,761

----------------------------------------------------------------------------

Third Quarter

Theatre occupancy expenses increased $4.8 million during the

third quarter of 2012 compared to the prior year period. This

increase was primarily due to the four theatres acquired from AMC

on July 12 ($4.3 million). The increase in the Other category

primarily relates to higher real estate taxes in the current

quarter compared to the prior year period.

Year to Date

The increase in theatre occupancy expenses of $4.9 million for

the first nine months of 2012 compared to the prior year period was

primarily due to the four theatres acquired from AMC on July 12

($4.3 million). The increase in the Other category primarily

relates to higher real estate taxes in the current year period

compared to the prior year.

Other operating expenses

The following table highlights the movement in other operating

expenses during the quarter and the year to date (in thousands of

Canadian dollars):

----------------------------------------------------------------------------

Other operating expenses Third Quarter Year to Date

---------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Other operating expenses $ 65,631 $ 65,620 - $184,917 $182,193 1.5%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Other operating continuity Third Quarter Year to Date

Other Other

In thousands Operating Operating

----------------------------------------------------------------------------

2011 as reported $ 65,620 $ 182,193

Impact of new theatres 2,362 3,257

Impact of disposed theatres (1,176) (1,603)

Same store payroll change 219 1,545

Marketing change 322 1,118

Media (34) (2,290)

New Way Sales (926) (1,013)

Theatre refurbishment payment (1,014) (1,014)

Other 258 2,724

----------------------------------------------------------------------------

2012 as reported $ 65,631 $ 184,917

----------------------------------------------------------------------------

Third Quarter

Other operating expenses during the third quarter of 2012 were

in line with the prior year period. The impact of new and acquired

net of disposed theatres was a $1.2 million increase to the

category primarily due to the four theatres acquired from AMC.

Other increases included higher marketing costs ($0.3 million) and

higher same-store payroll costs ($0.2 million). These increases

were partially offset by the impact of NWS ($0.9 million) as

expenses for NWS are included in other operating expenses in 2011

but not in 2012 due to the creation of CSI, and a $1.0 million

termination payment paid to a landlord in the prior year period to

refurbish theatre space for a disposed theatre.

The major movement in the Other category include the

following:

-- Higher credit card service fees due in part to an increase in pre-sales

for The Dark Knight Rises ($0.2 million).

-- Higher utility costs due to the higher temperatures across Canada during

the current year period ($0.5 million).

-- Higher digital projector rental costs due to the roll-out of digital

projectors by CDCP that commenced in June 2011 ($0.2 million).

-- Lower 3D royalty costs due to less 3D content in the current year period

($0.8 million).

Total theatre payroll costs accounted for 45.3% of total

operating expenses during the third quarter of 2012 as compared to

43.1% for the same period one year earlier due in part to minimum

wage increases.

Year to Date

For the nine months ended September 30, 2012, other operating

expenses increased $2.7 million, due in part to the higher business

volumes in the 2012 period compared to the prior year. The impact

of new and acquired net of disposed theatres was a $1.7 million

increase to the category primarily due to the four theatres

acquired from AMC. Cost increases included higher same-store

payroll expenses related to the increased business volumes ($1.5

million), higher marketing costs ($1.1 million) and the $2.7

million increase in the Other category. These cost increases were

partially offset by lower media expenses due to the lower media

sales during the period ($2.3 million) and the impact of NWS which

was contributed into CSI in January 2012 ($1.0 million) as well as

a $1.0 million termination payment paid to a landlord in the prior

year period to refurbish theatre space for a disposed theatre.

The major movement in the Other category include the

following:

-- Higher credit card service fees due in part to an increase in pre-sales

for highly anticipated releases ($1.0 million).

-- Higher utility costs due to the higher temperatures across Canada during

the current year period ($1.2 million).

-- Higher digital projector rental costs due to the roll-out of digital

projectors by CDCP that commenced in June 2011 ($0.7 million).

-- Higher theatre operating costs including cleaning relating to the higher

business volumes during the period.

-- Lower 3D royalty costs due to less 3D content in the current year period

($1.3 million).

Total theatre payroll accounted for 45.5% of total other

operating expenses in the first nine months of 2012, compared to

44.6% in the prior year period due in part to minimum wage

increases.

General and administrative expenses

The following table highlights the movement in general and

administrative ("G&A") expenses during the quarter and the year

to date, including share and unit based compensation costs, and

G&A net of these costs (in thousands of Canadian dollars):

----------------------------------------------------------------------------

G&A expenses Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

G&A excluding LTIP and

Option Plan expense $ 11,163 $ 9,589 16.4% $ 34,033 $ 30,053 13.2%

LTIP (i) 1,550 1,626 -4.7% 6,266 6,039 3.8%

Option plan 433 853 -49.2% 1,638 7,367 -77.8%

----------------------------------------------------

G&A expenses as reported $ 13,146 $ 12,068 8.9% $ 41,937 $ 43,459 -3.5%

----------------------------------------------------------------------------

(i) LTIP includes the expense for the LTIP program as well as

the expense for the executive and Board deferred share unit

plans.

Third Quarter

G&A expenses increased $1.1 million during the third quarter

of 2012 compared to the prior year period, due to a $0.6 million

increase in professional fees in part relating to the acquisition

of the theatres from AMC and a $1.0 million increase in payroll

related and general cost increases. These increases were partially

offset by lower expenses under the option plan ($0.4 million) and

lower LTIP expenses ($0.1 million).

Effective January 1, 2012, the Board of Directors of Cineplex

invoked Cineplex's right to substitute a cashless exercise for any

requested exercise of options for cash, in accordance with the

terms of the option plan. As a result of the change in

administrative policy, the options may only be equity-settled, and

are considered equity, not liabilities. The expense amount for

options is determined at the time of their issuance, recognized

over the vesting period of the options. Existing options at the

time of the change in administrative policy have their remaining

expense determined at the time of the change in administrative

policy, recognized over the remaining vesting periods.

Year to Date

G&A expenses for the first nine months of 2012 decreased

$1.5 million compared to the prior year period, due to the $5.7

million decrease in the option plan expense. This decrease was

partially offset by higher professional fees ($1.4 million)

relating to the creation of CSI, an internal corporate

reorganization effected on January 1, 2012 and the theatres

acquired from AMC, higher payroll related and general cost

increases ($2.6 million), and higher LTIP costs ($0.2 million).

Share of loss (income) of joint ventures

Cineplex's joint ventures in 2012 include its 50% share of one

theatre in Quebec and one IMAX screen in Ontario, its 50% interest

in SCENE LP, its 78.2% interest in CDCP (formed in June 2011) and

its 50% interest in CSI (formed January 31, 2012). For the 2011

period, Cineplex's joint ventures included one theatre in Quebec,

one IMAX screen in Ontario, its interest in SCENE LP and its 78.2%

interest in CDCP. The following table highlights the movement in

the share of loss (income) of joint ventures during the quarter and

the year to date (in thousands of Canadian dollars):

----------------------------------------------------------------------------

Share of loss

(income) of joint

ventures Third Quarter Year to Date

-------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Share of CDCP $ (462) $ 65 NM $ (1,388) $ 2,218 NM

Share of CSI (264) - NM (762) - NM

Share of SCENE 1,855 (1,494) NM 3,050 (3,342) NM

Share of other joint

ventures (105) (57) 84.2% (111) 32 NM

-------------------------------------------------------

Total loss (income)

of joint ventures $ 1,024 $ (1,486) -168.9% $ 789 $ (1,092) NM

----------------------------------------------------------------------------

Third Quarter

The movement from income of $1.5 million in the third quarter of

2011 to a loss of $1.0 million in the current period is primarily

due to the activities of SCENE, CDCP and CSI:

-- SCENE's results in the third quarter of 2011 include income relating to

an adjustment to SCENE's outstanding points balance due to certain

members having their points expired during the third quarter of 2011 due

to inactivity in the program. When compared to the current year period

the result is a negative variance of $3.3 million year over year.

-- CDCP generated income of $0.5 million in the third quarter of 2012,

which when compared to the modest loss in the prior year period, results

in a $0.5 million positive variance period over period.

-- The results of CSI, formed January 31, 2012 and therefore not included

in the prior year comparative, contributed a $0.3 million positive

variance year over year.

Year to Date

The movement from income of $1.1 million in the first nine

months of 2011 to a loss of $0.8 million in the current period is

primarily due to the activities of SCENE, CDCP and CSI:

-- SCENE's results in the 2011 period include income relating to a change

in accounting estimate for breakage resulting in a program-to-date

adjustment to its outstanding points liability as well as the adjustment

to SCENE's outstanding points balance due to certain members having

their points expired due to inactivity in the program. When compared to

the current year period the result is a negative variance of $6.4

million year over year.

-- CDCP in the 2011 period includes $2.2 million of start-up costs, which

when compared to the income of $1.4 million generated in the current

year period, results in a positive variance of $3.6 million year over

year.

-- The results of CSI, formed January 31, 2012 and therefore not included

in the prior year comparative, contributed a $0.8 million positive

variance year over year.

EBITDA and adjusted EBITDA

The following table represents EBITDA and adjusted EBITDA for

the three and nine months ended September 30, 2012 as compared to

the three and nine months ended September 30, 2011 (expressed in

thousands of Canadian dollars, except adjusted EBITDA margin):

----------------------------------------------------------------------------

EBITDA Third Quarter Year to Date

--------------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

EBITDA $ 77,941 $ 56,842 37.1% $165,683 $130,719 26.7%

Adjusted EBITDA $ 54,575 $ 57,441 -5.0% $142,977 $133,072 7.4%

Adjusted EBITDA

margin 19.4% 20.8% -1.4% 18.0% 17.6% 0.4%

----------------------------------------------------------------------------

Adjusted EBITDA for the third quarter of 2012 decreased $2.9

million, or 5.0%, as compared to the prior year period. The

decrease over the prior year period was primarily due to the lower

exhibition revenues recorded in the period, as well as the impact

of the four theatres acquired from AMC in the third quarter of

2012, which had a $0.8 million, or 1.5%, negative impact on

adjusted EBITDA in the quarter. Adjusted EBITDA margin, calculated

as adjusted EBITDA divided by total revenues, was 19.4%, down 1.4%

from 20.8% in the prior year period. Excluding the impact of the

theatres acquired from AMC, adjusted EBITDA margin was 20.3%.

Adjusted EBITDA for the nine months ended September 30, 2012

increased $9.9 million, or 7.4%, as compared to the prior year

period. The increase is primarily due to the higher exhibition and

concession revenues due to the higher theatre attendance. The

impact of the four theatres acquired from AMC in the third quarter

of 2012 had a $0.8 million, or 0.6%, negative impact on adjusted

EBITDA in the year-to-date period. Adjusted EBITDA margin,

calculated as adjusted EBITDA divided by total revenues, was 18.0%,

compared to 17.6% in the prior year period.

Cineplex believes its operating and programming expertise,

combined with its merchandising, media, marketing, interactive and

SCENE loyalty programs will positively and significantly improve

the operations of the four acquired theatres. Cineplex will invest

in each of the locations and may add UltraAVX auditoriums, VIP

auditoriums or XSCAPE entertainment centres to one or more of the

locations.

Adjusted Free Cash Flow

For the third quarter of 2012, adjusted free cash flow per

common share of Cineplex was $0.5737 as compared to $0.7133 in the

prior year period. The declared dividends per common share of

Cineplex were $0.3375 in the third quarter of 2012 and $0.3225 in

the prior year period. The payout ratios for these periods were 59%

and 45%, respectively.

For the first nine months of 2012, adjusted free cash flow per

common share of Cineplex was $1.5378 as compared to $1.6100 in the

prior year period. The declared dividends per commons share of

Cineplex were $0.9925 in the first nine months of 2012 and $0.9575

in the prior year period. The payout rations for these periods were

65% and 60%, respectively.

This news release contains "forward-looking statements" within

the meaning of applicable securities laws, such as statements

concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts. These

statements are not guarantees of future performance and are subject

to numerous risks and uncertainties, including those described in

our Annual Information Form and in this news release. Those risks

and uncertainties include adverse factors generally encountered in

the film exhibition industry such as poor film product and

unauthorized copying; the risks associated with national and world

events, including war, terrorism, international conflicts, natural

disasters, extreme weather conditions, infectious diseases, changes

in income tax legislation; and general economic conditions. Many of

these risks and uncertainties can affect our actual results and

could cause our actual results to differ materially from those

expressed or implied in any forward-looking statement made by us or

on our behalf. All forward-looking statements in this news release

are qualified by these cautionary statements. These statements are

made as of the date of this news release and, except as required by

applicable law, we undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Additionally, we undertake

no obligation to comment on analyses, expectations or statements

made by third parties in respect of Cineplex Inc. or Cineplex

Entertainment Limited Partnership, their financial or operating

results or their securities.

About Cineplex Inc.

Cineplex is one of Canada's leading entertainment companies and

operates one of the most modern and fully digitized motion picture

circuits in the world. A top-tier Canadian brand, Cineplex operates

numerous businesses including theatrical exhibition, food services,

gaming, alternative programming (Front Row Centre Events), Cineplex

Media, Cineplex Digital Solutions and the online sale of home

entertainment content through CineplexStore.com and on apps

embedded in various electronic devices. Cineplex is also a joint

venture partner in SCENE - Canada's largest entertainment loyalty

program.

Cineplex is headquartered in Toronto, Canada, and operates 133

theatres with 1,437 screens from British Columbia to Quebec,

serving approximately 70 million guests annually through the

following theatre brands: Cineplex Odeon, SilverCity, Galaxy

Cinemas, Colossus, Coliseum, Scotiabank Theatres, Cineplex VIP

Cinemas, Famous Players and Cinema City. Cineplex also owns and

operates the UltraAVX, Poptopia, and Outtakes brands. Cineplex

trades on the Toronto Stock Exchange under the symbol "CGX". More

information is available at www.cineplex.com.

Further information can be found in the disclosure documents

filed by Cineplex with the securities regulatory authorities,

available at www.sedar.com.

You are cordially invited to participate in a teleconference

call with the management of Cineplex (TSX:CGX) to review our

quarterly results. Ellis Jacob, President and Chief Executive

Officer and Gord Nelson, Chief Financial Officer, will host the

call. The teleconference call is scheduled for:

Thursday, November 8, 2012

10:00 a.m. Eastern Time

In order to participate in the conference call, please dial

416-644-3418 or outside of Toronto dial 1-800-814-4861 at least

five to ten minutes prior to 10:00 a.m. Eastern Time. Please quote

the conference ID 4570375 to access the call.

-- If you cannot participate in the live mode, a replay will be available.

Please dial 416-640-1917 or 1-877-289-8525 and enter code 4570375#. The

replay will begin at 12:00 p.m. Eastern Time on Thursday, November 8,

2012 and end at 11:59 p.m. Eastern Time on Thursday, November 15, 2012.

-- Note that media will be participating in the call in listen-only mode.

-- Thank you in advance for your interest and participation.

Cineplex Inc.

Interim Consolidated Balance Sheets

(Unaudited)

(expressed in thousands of Canadian dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

September 30, December 31,

2012 2011

Assets

Current assets

Cash and cash equivalents $ 1,076 $ 48,992

Trade and other receivables 36,042 67,185

Inventories 4,065 4,118

Prepaid expenses and other current assets 9,853 3,727

------------------------------

51,036 124,022

Non-current assets

Property, equipment and leaseholds 404,009 389,532

Deferred income taxes 53,961 12,052

Interests in joint ventures 40,793 26,163

Intangible assets 81,981 84,379

Goodwill 608,929 608,929

------------------------------

$ 1,240,709 $ 1,245,077

------------------------------

------------------------------

Liabilities

Current liabilities

Accounts payable and accrued expenses $ 76,970 $ 112,285

Dividends payable 6,982 6,285

Share-based compensation - 1,331

Income taxes payable 10,221 17,485

Deferred revenue 53,287 83,907

Finance lease obligations 2,182 2,411

Fair value of interest rate swap agreements 543 565

Convertible debentures 14,557 76,864

------------------------------

164,742 301,133

------------------------------

Non-current liabilities

Share-based compensation 10,316 9,466

Long-term debt 167,936 167,531

Fair value of interest rate swap agreements 555 1,199

Finance lease obligations 21,119 26,474

Post-employment benefit obligations 5,914 5,688

Other liabilities 140,348 103,727

Deficiency interest in joint venture 8,082 8,250

------------------------------

354,270 322,335

------------------------------

Total liabilities 519,012 623,468

------------------------------

Equity

Share capital 833,720 764,801

Deficit (114,075) (140,469)

Accumulated other comprehensive loss (1,088) (2,723)

Contributed surplus 3,140 -

------------------------------

721,697 621,609

------------------------------

$ 1,240,709 $ 1,245,077

------------------------------

------------------------------

Cineplex Inc.

Interim Consolidated Statements of Operations

(Unaudited)

(expressed in thousands of Canadian dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

--------------------------------------------

2012 2011 2012 2011

Revenues

Box office $ 162,133 $ 162,522 $ 467,772 $ 443,613

Concessions 85,924 82,114 242,923 223,477

Other 33,311 32,072 82,481 89,417

--------------------------------------------

281,368 276,708 793,176 756,507

--------------------------------------------

Expenses

Film cost 83,632 85,320 243,804 230,647

Cost of concessions 17,831 16,817 50,321 46,722

Depreciation and amortization 14,014 16,613 45,124 51,303

Loss on disposal of assets 114 487 786 4

Gain on acquisition of business (23,822) - (23,822) -

Other costs 124,648 118,728 355,615 349,507

Share of loss (income) of joint

ventures 1,024 (1,486) 789 (1,092)

Interest expense 2,499 6,275 10,495 17,886

Interest income (44) (381) (147) (804)

--------------------------------------------

219,896 242,373 682,965 694,173

--------------------------------------------

Income before income taxes 61,472 34,335 110,211 62,334

--------------------------------------------

Provision for (recovery of)

income taxes

Current 9,053 5,973 22,641 12,011

Deferred 707 2,625 (210) 11,994

--------------------------------------------

9,760 8,598 22,431 24,005

--------------------------------------------

Net income $ 51,712 $ 25,737 $ 87,780 $ 38,329

--------------------------------------------

--------------------------------------------

Basic net income per share $ 0.84 $ 0.44 $ 1.45 $ 0.67

Diluted net income per share $ 0.83 $ 0.44 $ 1.45 $ 0.66

Cineplex Inc.

Interim Consolidated Statements of Comprehensive Income

(Unaudited)

(expressed in thousands of Canadian dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

--------------------------------------------

2012 2011 2012 2011

Net income $ 51,712 $ 25,737 $ 87,780 $ 38,329

--------------------------------------------

Other comprehensive income

Income (loss) on hedging

instruments 196 (242) 2,457 1,281

Associated deferred income taxes

expense (107) (12) (822) (2,253)

--------------------------------------------

Other comprehensive income

(loss) 89 (254) 1,635 (972)

--------------------------------------------

Comprehensive income $ 51,801 $ 25,483 $ 89,415 $ 37,357

--------------------------------------------

--------------------------------------------

Cineplex Inc.

Interim Consolidated Statements of Changes in Equity

(Unaudited)

(expressed in thousands of Canadian dollars)

For the nine months ended September 30, 2012 and 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Unit Share Contributed

capital capital surplus

Balance - January 1, 2012 $ - $ 764,801 $ -

Share option liabilities

reclassified - - 6,850

Net income - - -

Other comprehensive income - - -

Dividends declared - - -

Long-term incentive plan

obligation - (5,071) -

Long-term incentive plan shares - 6,471 -

Share option expense - - 1,638

Issuance of shares on exercise

of options - 5,348 (5,348)

Issuance of shares on

conversion of debentures - 62,606 -

Issuance of shares for cash - 501 -

Shares repurchased and

cancelled - (936) -

---------------------------------------------

Balance - September 30, 2012 $ - $ 833,720 $ 3,140

---------------------------------------------

---------------------------------------------

Balance - January 1, 2011 $ 710,121 $ - $ 1,407

Effect of corporate conversion (710,121) 744,760 (1,407)

Net income - - -

Other comprehensive loss - - -

Long-term incentive plan

obligation - (2,504) -

Dividends declared - - -

Long-term incentive plan shares - 1,888 -

Issuance of shares on

conversion of debentures - 19,080 -

Shares repurchased and

cancelled - (375) -

---------------------------------------------

Balance - September 30, 2011 $ - $ 762,849 $ -

---------------------------------------------

---------------------------------------------

Accumulated

other

comprehensive

loss Deficit Total

Balance - January 1, 2012 $ (2,723) $ (140,469) $ 621,609

Share option liabilities

reclassified - - 6,850

Net income - 87,780 87,780

Other comprehensive income 1,635 - 1,635

Dividends declared - (60,536) (60,536)

Long-term incentive plan

obligation - - (5,071)

Long-term incentive plan shares - - 6,471

Share option expense - - 1,638

Issuance of shares on exercise

of options - - -

Issuance of shares on

conversion of debentures - - 62,606

Issuance of shares for cash - - 501

Shares repurchased and

cancelled - (850) (1,786)

---------------------------------------------

Balance - September 30, 2012 $ (1,088) $ (114,075) $ 721,697

---------------------------------------------

---------------------------------------------

Balance - January 1, 2011 $ (3,534) $ (113,120) $ 594,874

Effect of corporate conversion - - 33,232

Net income - 38,329 38,329

Other comprehensive loss (972) - (972)

Long-term incentive plan

obligation - - (2,504)

Dividends declared - (55,485) (55,485)

Long-term incentive plan shares - - 1,888

Issuance of shares on

conversion of debentures - - 19,080

Shares repurchased and

cancelled - - (375)

---------------------------------------------

Balance - September 30, 2011 $ (4,506) $ (130,276) $ 628,067

---------------------------------------------

---------------------------------------------

Cineplex Inc.

Interim Consolidated Statements of Cash Flows

(Unaudited)

(expressed in thousands of Canadian dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

--------------------------------------------

2012 2011 2012 2011

Cash provided by (used in)

Operating activities

Net income $ 51,712 $ 25,737 $ 87,780 $ 38,329

Adjustments to reconcile net

income to net cash provided by

operating activities

Depreciation and amortization 14,014 16,613 45,124 51,303

Amortization of tenant

inducements, rent averaging

liabilities and fair value

lease contract liabilities (1,436) (1,074) (3,601) (2,944)

Accretion of debt issuance

costs and other non-cash

interest 140 237 419 701

Loss on disposal of assets 114 487 786 4

Gain on acquisition of

business (23,822) - (23,822) -

Deferred income taxes 707 2,625 (210) 11,994

Interest rate swap agreements

- non-cash interest 16 1,279 1,780 1,143

Non-cash share-based

compensation 433 37 1,675 293

Accretion of convertible

debentures 43 251 299 1,078

Net change in interests in

joint ventures 1,187 578 4,827 (2,860)

Tenant inducements 727 1,535 5,972 5,585

Changes in operating assets and

liabilities (2,178) (181) (54,845) (21,101)

--------------------------------------------

Net cash provided by operating

activities 41,657 48,124 66,184 83,525

--------------------------------------------

Investing activities

Proceeds from sale of assets 4 82 1,133 1,822

Purchases of property, equipment

and leaseholds (15,878) (12,224) (49,477) (40,803)

Acquisition and formation of

businesses, net of cash

acquired 4,588 - (2,811) (3,280)

Additional equity funding of

CDCP (4) (210) (248) (378)

--------------------------------------------

Net cash used in investing

activities (11,290) (12,352) (51,403) (42,639)

--------------------------------------------

Financing activities

Dividends paid (20,908) (18,804) (59,839) (49,201)

Repayments under credit

facility, net (20,000) - - -

Payments under finance leases (520) (566) (1,573) (1,666)

Proceeds from issuance of shares - - 501 -

Acquisition of long-term

incentive plan shares - - - (9,793)

Deferred financing fees - (1,915) - (1,915)

Shares repurchased and cancelled - (375) (1,786) (375)

--------------------------------------------

Net cash used in financing

activities (41,428) (21,660) (62,697) (62,950)

--------------------------------------------

(Decrease) increase in cash and

cash equivalents during the

period (11,061) 14,112 (47,916) (22,064)

Cash and cash equivalents -

Beginning of period 12,137 49,167 48,992 85,343

--------------------------------------------

Cash and cash equivalents - End

of period $ 1,076 $ 63,279 $ 1,076 $ 63,279

--------------------------------------------

--------------------------------------------

Supplemental information

Cash paid for interest $ 1,955 $ 3,674 $ 7,427 $ 13,762

Cash paid for income taxes $ 5,385 $ - $ 29,987 $ 65

Cineplex Inc.

Interim Consolidated Supplemental Information

(Unaudited)

(expressed in thousands of Canadian dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliation to Adjusted EBITDA

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

2012 2011 2012 2011

--------------------------------------------

Net income $ 51,712 $ 25,737 $ 87,780 $ 38,329

Depreciation and amortization 14,014 16,613 45,124 51,303

Interest expense 2,499 6,275 10,495 17,886

Interest income (44) (381) (147) (804)

Current income tax expense 9,053 5,973 22,641 12,011

Deferred income tax expense

(recovery) 707 2,625 (210) 11,994

--------------------------------------------

EBITDA $ 77,941 $ 56,842 $ 165,683 $ 130,719

Loss on disposal of assets 114 487 786 4

Gain on acquisition of business (23,822) - (23,822) -

CDCP equity income (i) (462) 65 (1,388) 2,218

Depreciation and amortization -

joint ventures (ii) 539 47 1,453 131

Future income taxes - joint

ventures (ii) 236 - 236 -

Current income taxes - joint

ventures (ii) 29 - 29 -

--------------------------------------------

Adjusted EBITDA $ 54,575 $ 57,441 $ 142,977 $ 133,072

----------------------------------------------------------------------------

i. CDCP equity (income) loss not included in adjusted EBITDA as CDCP is a

limited-life financing vehicle that is funded by virtual print fees

collected from distributors.

ii. Includes the joint ventures with the exception of CDCP (see (i) above).

Components of Other Costs

----------------------------------------------------------------------------

Other costs Third Quarter Year to Date

----------------------------------------------------

2012 2011 Change 2012 2011 Change

----------------------------------------------------------------------------

Theatre occupancy

expenses $ 45,871 $ 41,040 11.8% $128,761 $123,855 4.0%

Other operating expenses 65,631 65,620 - 184,917 182,193 1.5%

General and

administrative expenses 13,146 12,068 8.9% 41,937 43,459 -3.5%

-------------------------------------------

Total other costs $124,648 $118,728 5.0% $355,615 $349,507 1.7%

----------------------------------------------------------------------------

Cineplex Inc.

Interim Consolidated Supplemental Information

(Unaudited)

(expressed in thousands of Canadian dollars, except number of shares and per

share data)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted Free Cash Flow

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

2012 2011 2012 2011

----------------------------------------------------

Cash provided by

operating activities $ 41,657 $ 48,124 $ 66,184 $ 83,525

Less: Total capital

expenditures net of

proceeds on sale of

assets (15,874) (12,142) (48,344) (39,981)

----------------------------------------------------

Standardized free cash

flow 25,783 35,982 17,840 44,544

Add/(Less):

Changes in operating

assets and liabilities

(i) 2,178 181 54,845 21,101

Changes in operating

assets and liabilities

of joint ventures (i) (163) (2,064) (4,038) 1,768

Tenant inducements (ii) (727) (1,535) (5,972) (5,585)

Principal component of

finance lease

obligations (520) (566) (1,573) (1,666)

Growth capital

expenditures and other

(iii) 9,733 8,166 32,986 29,931

Share of (loss) income

of joint ventures, net

of non-cash

depreciation (iv) (711) 1,598 (488) 3,441

Cash invested in CDCP

(iv) (4) (159) (248) (378)

----------------------------------------------------

Adjusted free cash flow $ 35,569 $ 41,603 $ 93,352 $ 93,156

----------------------------------------------------

----------------------------------------------------

Average number of Shares

outstanding 61,996,063 58,323,720 60,705,608 57,857,376

Adjusted free cash flow

per Share $ 0.5737 $ 0.7133 $ 1.5378 $ 1.6100

----------------------------------------------------------------------------

i. Changes in operating assets and liabilities are not considered a

source or use of adjusted free cash flow.

ii. Tenant inducements received are for the purpose of funding new theatre

capital expenditures and are not considered a source of adjusted free

cash flow.

iii. Growth capital expenditures and other represent expenditures on Board

approved projects as well as any expenditures for digital equipment

that was contributed to CDCP, exclude maintenance capital

expenditures, and are net of proceeds on asset sales. Cineplex's

revolving facility is available to fund Board approved projects.

iv. Excludes the share of income or loss of CDCP, as CDCP is a limited-

life financing vehicle funded by virtual print fees collected from

distributors. Cash invested into CDCP, as well as cash distributions

received from CDCP, are considered to be uses and sources of adjusted

free cash flow.

Contacts: Cineplex Inc. Gord Nelson Chief Financial Officer

(416) 323-6602 Cineplex Inc. Pat Marshall Vice President

Communications and Investor Relations (416) 323-6648

www.cineplex.com

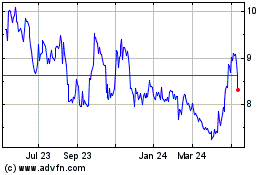

Cineplex (TSX:CGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

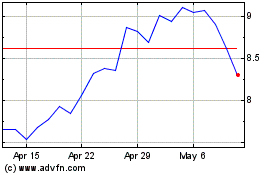

Cineplex (TSX:CGX)

Historical Stock Chart

From Apr 2023 to Apr 2024