(NYSE:CAE)(TSX:CAE) - CAE today reported financial results for the

second quarter ended September 30, 2012. Net income attributable to

equity holders was $36.5 million ($0.14 per share) this quarter,

compared to $38.4 million ($0.15 per share) last year. All

financial information is in Canadian dollars.

Excluding the $9.8 million pre-tax impact of restructuring,

integration and acquisition costs this quarter, net income

attributable to equity holders was $43.5 million ($0.17 per share).

In the second quarter last year, before acquisition and integration

charges of $8.4 million pre-tax, net income attributable to equity

holders was $41.1 million ($0.16 per share).

Also included in this quarter's financial results were other

non-recurring gains including $8.3 million pre-tax in foreign

exchange gains and a $5.0 million pre-tax gain on the expiry and

reversal of contingent liability related to a prior acquisition. Of

these amounts, $7.7 million is attributed to Military and $5.6

million to Civil.

Revenue for the quarter was $514.4 million, 19% higher than

$433.5 million last year.

"During the quarter, we recorded strong order bookings for

simulators in Civil and added more long-term recurring training

services in Military," said Marc Parent, CAE's President and Chief

Executive Officer. "However our results were impacted in Civil

training by a slower than usual summer and the ongoing integration

of Oxford. In Military, we have been restructuring our European

operations headquartered in Germany to adapt to lower demand, but

this has not kept pace with the drop in new orders in that country.

The resulting lower revenue and profit in that region during the

quarter negated otherwise good performance in the rest of the

business. In light of the clarity we now have about the magnitude

of the expected restructuring of the German armed forces, we are

undertaking additional restructuring estimated to cost $15 million

to right-size our operations for current and anticipated

contracts."

Looking forward, Parent added, "With very strong Military bid

activity by CAE currently underway, we remain confident in the

long-term growth and profitability of CAE's Military business. We

have signed several multi-year services contracts this year but

these translate to revenue over a longer period of time than

products sales. As a result of this, and our actions underway in

Europe, we now expect Military revenue to decline slightly this

year. We expect Military margins to begin recovering toward the

latter part of the year. In Civil, we are already experiencing a

stronger performance in training as we head into the second half of

the year and we expect this to continue. In civil products, with 19

simulator sales announced so far, we are tracking our expectation

for sales in the mid-30s."

Summary of consolidated results

(amounts in millions, except

for operating margins) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 514.4 480.1 506.7 453.1 433.5

Operating profit(1) $ 66.9 44.8 88.7 77.5 63.9

As a % of revenue % 13.0 9.3 17.5 17.1 14.7

Net income $ 36.8 21.7 53.7 46.1 38.7

Net income attributable to

equity holders of the

Company $ 36.5 21.3 53.2 45.6 38.4

Backlog(2) $ 3,909.1 3,894.5 3,724.2 3,514.9 3,648.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Civil segments

Revenue for our combined Civil segments increased 36% in the

second quarter to $288.0 million compared to $211.7 million last

year. Second quarter operating income was $46.2 million (16.0% of

revenue) compared to $42.3 million (20.0% of revenue) last year.

This quarter's results include the recently acquired Oxford

Aviation Academy (Oxford), which is being integrated with CAE's

existing operations to realize significant ongoing cost and revenue

synergies.

Civil training results were seasonally lower than usual during

the summer months and were further impacted by some disruption from

our ongoing integration of Oxford with our existing operations.

Demand for products continued to be robust with 12 full-flight

simulator orders booked in the second quarter for customers mainly

in Asia. During the quarter, we also obtained training services

contracts expected to generate $179.3 million in future revenue.

These include a long term agreement with easyjet in Europe, making

CAE its preferred training supplier, and an exclusive multi-year

contract with an airline in South America.

We received $302.7 million in combined civil segment orders this

quarter representing a book-to-sales ratio of 1.05x. The ratio for

the trailing 12 months was 1.10x.

Training & Services/Civil (TS/C)

(amounts in millions except

operating margins, RSEU and

FFSs deployed) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 189.1 170.9 132.3 123.0 119.1

Segment operating income $ 27.3 33.3 30.3 28.8 27.6

Operating margins % 14.4 19.5 22.9 23.4 23.2

Backlog $ 1,360.9 1,400.0 1,183.4 1,102.8 1,125.4

RSEU 187 164 142 140 139

FFS deployed 218 216 171 170 165

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Simulation Products/Civil (SP/C)

(amounts in millions except

operating margins) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 98.9 80.3 83.1 80.7 92.6

Segment operating income $ 18.9 14.4 14.0 13.2 14.7

Operating margins % 19.1 17.9 16.8 16.4 15.9

Backlog $ 385.2 361.9 351.6 366.5 340.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Military segments

Revenue for our combined Military segments decreased 2% in the

second quarter to $198.1 million compared to $201.5 million last

year. Operating income was $28.3 million (14.3% of revenue) for the

quarter, compared to $30.2 million (15.0% of revenue) last

year.

We booked orders in our products segment during the quarter for

Middle-Eastern forces involving new simulators for the C295 and

C-130J transport aircrafts. We also received a range of upgrade

orders involving already installed simulators in the U.K. on C-130J

and Lynx helicopter platforms, and in the U.S. on the KC-135 tanker

aircraft simulators. In services, we received an order in Asia for

long-term training on helicopter and fixed-wing aircraft and in the

U.S., the Air Force exercised its option for a third year of

aircrew training under the KC-135 Aircrew Training Systems

program.

We received $258.9 million in combined military segment orders

this quarter, representing a book-to-sales ratio of 1.31x. The

ratio for the trailing 12 months was 1.07x.

Simulation Products/Military (SP/M)

(amounts in millions except

operating margins) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 130.8 135.4 195.6 152.4 136.0

Segment operating income $ 20.9 19.5 34.6 26.9 20.9

Operating margins % 16.0 14.4 17.7 17.7 15.4

Backlog $ 723.1 755.6 786.0 812.7 907.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Training & Services /Military (TS/M)

(amounts in millions except

operating margins) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 67.3 67.4 71.5 69.9 65.5

Segment operating income $ 7.4 8.9 11.0 10.0 9.3

Operating margins % 11.0 13.2 15.4 14.3 14.2

Backlog $ 1,439.9 1,377.0 1,403.2 1,232.9 1,274.8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

New Core Markets

Revenue in New Core Markets was $28.3 million for the quarter,

up 39% from $20.3 million last year. Operating income was $2.2

million for the quarter, compared to negative $8.6 million last

year.

We had continued success with the introduction of new products

and sales of existing lines.

In CAE Mining, we announced a strategic partnership with Devex,

a mining operations management technology company, which gives

additional breadth to our solutions portfolio and exclusive

distribution rights in a number of key markets globally. The market

continued to be receptive to our software solutions, with sales

during the quarter to major mining customers in South America,

South Africa and Australia.

In CAE Healthcare, we launched the new Caesar trauma patient

simulator and we prelaunched our new VIMEDIX Women's Health

ultrasound simulator. During the quarter, we sold our centre

management system to the U.S. Veterans Health Administration for

use in 159 centres throughout the U.S. and to the U.S. Air Force in

25 medical simulation centres around the world. Additionally, we

sold solutions within our range of simulator products and centre

management systems to universities and teaching hospitals in the

U.S., Canada, Australia and Russia.

New Core Markets (NCM)

(amounts in millions) Q2-2013 Q1-2013 Q4-2012 Q3-2012 Q2-2012

----------------------------------------------------------------------------

Revenue $ 28.3 26.1 24.2 27.1 20.3

Segment operating income

(loss) $ 2.2 0.7 (1.2) (1.4) (8.6)

Operating margins % 7.8 2.7 - - -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Additional financial highlights

Income taxes this quarter were $12.5 million representing an

effective tax rate of 25%, compared to 21% last year. The tax rate

was lower in the second quarter last year due to the recognition of

certain tax assets.

Free cash flow(3) was positive $17.7 million this quarter. The

increase from last quarter was mainly attributable to favourable

changes in non-cash working capital and more cash provided by

operating activities. The decrease from the second quarter of

fiscal 2012 was mainly attributable to unfavourable changes in

non-cash working capital, partially offset by more cash provided by

operating activities.

Capital expenditures totalled $44.0 million this quarter,

including $33.4 million in growth capital expenditures and $10.6

million for maintenance.

Net debt(4) was $994.8 million compared with $988.9 million as

at June 30, 2012.

CAE will pay a dividend of $0.05 per share effective December

31, 2012 to shareholders of record at the close of business on

December 14, 2012.

Additional information

You will find a more detailed discussion of our results by

segment in the Management's Discussion and Analysis (MD&A) as

well as in our consolidated interim financial statements which are

posted on our website at www.cae.com/Q2FY13. .

CAE's unaudited consolidated interim financial statements and

management's discussion and analysis for the quarter ended

September 30, 2012 have been filed with the Canadian securities

commissions and are available on our website (www.cae.com) and on

SEDAR (www.sedar.com). They have also been filed with the U.S.

Securities and Exchange Commission and are available on their

website (www.sec.gov).

Conference call Q2 FY2013

CAE will host a conference call focusing on fiscal year 2013

second quarter financial results today at 1:00 p.m. ET. The call is

intended for analysts, institutional investors and the media.

Participants can listen to the conference by dialling + 1 877 586

3392 or +1 416 981 9024. The conference call will also be audio

webcast live for the public at www.cae.com.

CAE is a global leader in modeling, simulation and training for

civil aviation and defence. The company employs approximately 8,000

people at more than 100 sites and training locations in

approximately 30 countries. CAE offers civil aviation, military,

and helicopter training services in more than 45 locations

worldwide and trains approximately 100,000 crewmembers yearly. In

addition, the CAE Oxford Aviation Academy offers training to

aspiring pilot cadets in 11 CAE-operated flight schools. CAE's

business is diversified, ranging from the sale of simulation

products to providing comprehensive services such as training and

aviation services, integrated enterprise solutions, in-service

support and crew sourcing. The company applies simulation expertise

and operational experience to help customers enhance safety,

improve efficiency, maintain readiness and solve challenging

problems. CAE is leveraging its simulation capabilities in new

markets such as healthcare and mining. www.cae.com

You will find more information about the risks and uncertainties

associated with our business in the MD&A section of our annual

report and annual information form for the year ended March 31,

2012. These documents have been filed with the Canadian securities

commissions and are available on our website (www.cae.com), on

SEDAR (www.sedar.com) and a free copy is available upon request to

CAE. They have also been filed with the U.S. Securities and

Exchange Commission under Form 40-F and are available on EDGAR

(www.sec.gov). The forward-looking statements contained in this

news release represent our expectations as of November 8, 2012 and,

accordingly, are subject to change after this date. We do not

update or revise forward-looking information even if new

information becomes available unless legislation requires us to do

so. You should not place undue reliance on forward-looking

statements.

Notes

1. Operating profit is non-GAAP measure that shows us how we have performed

before the effects of certain financing decisions and tax structures. We

track operating profit because we believe it makes it easier to compare

our performance with previous periods, and with companies and industries

that do not have the same capital structure or tax laws.

2. Backlog is a non-GAAP measure that represents the expected value of

orders we have received but have not yet executed.

3. Free cash flow is a non-GAAP measure that shows us how much cash we have

available to build the business, repay debt and meet ongoing financial

obligations. We use it as an indicator of our financial strength and

liquidity. We calculate it by taking the net cash generated by our

continuing operating activities, subtracting maintenance capital

expenditures, other assets not related to growth and dividends paid and

adding proceeds from disposal of property, plant and equipment.

4. Net debt is a non-GAAP measure we use to monitor how much debt we have

after taking into account liquid assets such as cash and cash

equivalents. We use it as an indicator of our overall financial

position, and calculate it by taking our total long-term debt, including

the current portion of long-term debt, and subtracting cash and cash

equivalents.

Consolidated Statement of Financial Position

(Unaudited) September 30 March 31

(amounts in millions of Canadian dollars) 2012 2012

----------------------------------------------------------------------------

Assets

Cash and cash equivalents $ 229.4 $ 287.3

Accounts receivable 363.1 308.4

Contracts in progress: assets 270.6 245.8

Inventories 162.8 153.1

Prepayments 53.5 47.7

Income taxes recoverable 115.6 95.5

Derivative financial assets 19.5 10.3

----------------------------------------------------------------------------

Total current assets $ 1,214.5 $ 1,148.1

Property, plant and equipment 1,465.2 1,293.7

Intangible assets 739.2 533.2

Deferred tax assets 36.8 24.1

Derivative financial assets 7.2 7.2

Other assets 182.0 177.4

----------------------------------------------------------------------------

Total assets $ 3,644.9 $ 3,183.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities and equity

Accounts payable and accrued liabilities $ 590.2 $ 597.6

Provisions 40.9 21.6

Income taxes payable 9.4 10.9

Contracts in progress: liabilities 105.8 104.6

Current portion of long-term debt 220.8 136.0

Derivative financial liabilities 10.2 12.7

----------------------------------------------------------------------------

Total current liabilities $ 977.3 $ 883.4

Provisions 8.2 6.0

Long-term debt 1,003.4 685.6

Royalty obligations 154.7 161.6

Employee benefits obligations 150.2 114.2

Deferred gains and other non-current

liabilities 183.3 186.0

Deferred tax liabilities 128.5 91.8

Derivative financial liabilities 12.0 12.9

----------------------------------------------------------------------------

Total liabilities $ 2,617.6 $ 2,141.5

----------------------------------------------------------------------------

Equity

Share capital $ 462.5 $ 454.5

Contributed surplus 20.9 19.2

Accumulated other comprehensive loss (41.4) (9.8)

Retained earnings 563.5 558.0

----------------------------------------------------------------------------

Equity attributable to equity holders of the

Company $ 1,005.5 $ 1,021.9

Non-controlling interests 21.8 20.3

----------------------------------------------------------------------------

Total equity $ 1,027.3 $ 1,042.2

----------------------------------------------------------------------------

Total liabilities and equity $ 3,644.9 $ 3,183.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Income Statement

(Unaudited)

(amounts in millions of

Canadian dollars,

except per share Three months ended Six months ended

amounts) September 30 September 30

2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue $ 514.4 $ 433.5 $ 994.5 $ 861.4

Cost of sales 370.4 296.0 691.4 584.3

----------------------------------------------------------------------------

Gross profit $ 144.0 $ 137.5 $ 303.1 $ 277.1

Research and development

expenses 14.5 15.9 28.5 31.1

Selling, general and

administrative expenses 67.3 59.8 135.7 122.1

Other (gains) losses -

net (14.5) (2.1) (14.6) (12.0)

Restructuring,

integration and

acquisition costs 9.8 - 41.8 -

----------------------------------------------------------------------------

Operating profit $ 66.9 $ 63.9 $ 111.7 $ 135.9

----------------------------------------------------------------------------

Finance income (1.6) (2.3) (3.1) (3.5)

Finance expense 19.2 17.2 37.6 33.3

----------------------------------------------------------------------------

Finance expense - net $ 17.6 $ 14.9 $ 34.5 $ 29.8

----------------------------------------------------------------------------

Earnings before income

taxes $ 49.3 $ 49.0 $ 77.2 $ 106.1

Income tax expense 12.5 10.3 18.7 23.9

----------------------------------------------------------------------------

Net income $ 36.8 $ 38.7 $ 58.5 $ 82.2

----------------------------------------------------------------------------

Attributable to:

Equity holders of the

Company $ 36.5 $ 38.4 $ 57.8 $ 81.5

Non-controlling

interests 0.3 0.3 0.7 0.7

----------------------------------------------------------------------------

$ 36.8 $ 38.7 $ 58.5 $ 82.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share from

continuing operations

attributable to equity

holders of the Company

Basic and diluted $ 0.14 $ 0.15 $ 0.22 $ 0.32

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Statement of Comprehensive (Loss) Income

(Unaudited) Six months

(amounts in millions of Three months ended ended

Canadian dollars) September 30 September 30

2012 2011 2012 2011

----------------------------------------------------------------------------

Net income $ 36.8 $ 38.7 $ 58.5 $ 82.2

----------------------------------------------------------------------------

Foreign currency translation

Net currency translation

difference on the

translation of financial

statements of foreign

operations $ (41.3) $ 59.4 $ (38.4) $ 58.5

Net gains (losses) on

certain long-term debt

denominated in foreign

currency and designated as

hedges of net investments

in foreign operations 9.7 (12.3) 7.2 (11.5)

Income taxes (1.3) 1.9 (1.3) 1.9

----------------------------------------------------------------------------

$ (32.9) $ 49.0 $ (32.5) $ 48.9

----------------------------------------------------------------------------

Net changes in cash flow

hedges

Effective portion of changes

in fair value of cash flow

hedges $ 14.0 $ (25.9) $ 9.2 $ (27.9)

Net change in fair value of

cash flow hedges

transferred to net income

or to related non-financial

assets or liabilities (6.3) (2.1) (7.7) (6.6)

Income taxes (2.0) 7.6 (0.6) 8.9

----------------------------------------------------------------------------

$ 5.7 $ (20.4) $ 0.9 $ (25.6)

----------------------------------------------------------------------------

Defined benefit plan

actuarial losses

Defined benefit plan

actuarial losses $ (33.6) $ (42.1) $ (39.6) $ (44.8)

Income taxes 9.0 11.7 10.6 12.4

----------------------------------------------------------------------------

$ (24.6) $ (30.4) $ (29.0) $ (32.4)

----------------------------------------------------------------------------

Other comprehensive loss $ (51.8) $ (1.8) $ (60.6) $ (9.1)

----------------------------------------------------------------------------

Total comprehensive (loss)

income $ (15.0) $ 36.9 $ (2.1) $ 73.1

----------------------------------------------------------------------------

Attributable to:

Equity holders of the

Company $ (15.2) $ 36.4 $ (2.8) $ 72.2

Non-controlling interests 0.2 0.5 0.7 0.9

----------------------------------------------------------------------------

$ (15.0) $ 36.9 $ (2.1) $ 73.1

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated Statement of Changes in Equity

(Unaudited) Attributable to equity holders of the Company

--------------------------------------------------------

six months ended

September 30, 2012

(amounts in

millions of Accumulated

Canadian dollars, Common other

except number of Number of shares Contributed comprehensive

shares) shares Stated value surplus (loss) income

----------------------------------------------------------------------------

Balances, beginning

of period 258,266,295 $ 454.5 $ 19.2 $ (9.8)

Net income - - - -

Other comprehensive

(loss) income:

Foreign currency

translation - - - (32.5)

Net changes in cash

flow hedges - - - 0.9

Defined benefit

plan actuarial

losses - - - -

----------------------------------------------------------------------------

Total comprehensive

loss - $ - $ - $ (31.6)

Stock options

exercised 233,425 2.0 - -

Optional cash

purchase 612 - - -

Stock dividends 543,516 5.4 - -

Transfer upon

exercise of stock

options - 0.6 (0.6) -

Share-based payments - - 2.3 -

Additions to non-

controlling

interests - - - -

Dividends - - - -

----------------------------------------------------------------------------

Balances, end of

period 259,043,848 $ 462.5 $ 20.9 $ (41.4)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Attributable to equity

(Unaudited) holders of the Company

----------------------------

six months ended

September 30, 2012

(amounts in

millions of

Canadian dollars, Non-

except number of Retained controlling Total

shares) earnings Total interests equity

---------------------------------------------------------------------------

Balances, beginning

of period $ 558.0 $ 1,021.9 $ 20.3 $ 1,042.2

Net income 57.8 57.8 0.7 58.5

Other comprehensive

(loss) income:

Foreign currency

translation - (32.5) - (32.5)

Net changes in cash

flow hedges - 0.9 - 0.9

Defined benefit

plan actuarial

losses (29.0) (29.0) - (29.0)

---------------------------------------------------------------------------

Total comprehensive

loss $ 28.8 $ (2.8) $ 0.7 $ (2.1)

Stock options

exercised - 2.0 - 2.0

Optional cash

purchase - - - -

Stock dividends (5.4) - - -

Transfer upon

exercise of stock

options - - - -

Share-based payments - 2.3 - 2.3

Additions to non-

controlling

interests - - 0.8 0.8

Dividends (17.9) (17.9) - (17.9)

---------------------------------------------------------------------------

Balances, end of

period $ 563.5 $ 1,005.5 $ 21.8 $ 1,027.3

---------------------------------------------------------------------------

---------------------------------------------------------------------------

(Unaudited) Attributable to equity holders of the Company

---------------------------------------------------------

six months ended

September 30, 2011

(amounts in

millions of Accumulated

Canadian dollars, Common other

except number of Number of shares Contributed comprehensive

shares) shares Stated value surplus (loss) income

----------------------------------------------------------------------------

Balances, beginning

of period 256,964,756 $ 440.7 $ 17.1 $ (9.8)

Net income - - - -

Other comprehensive

income (loss):

Foreign currency

translation - - - 48.7

Net changes in

cash flow hedges - - - (25.6)

Defined benefit

plan actuarial

losses - - - -

----------------------------------------------------------------------------

Total comprehensive

income - $ - $ - $ 23.1

Stock options

exercised 270,750 2.0 - -

Optional cash

purchase 495 - - -

Stock dividends 322,776 3.6 - -

Transfer upon

exercise of stock

options - 0.7 (0.7) -

Share-based

payments - - 2.2 -

Dividends - - - -

----------------------------------------------------------------------------

Balances, end of

period 257,558,777 $ 447.0 $ 18.6 $ 13.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Attributable to equity

(Unaudited) holders of the Company

----------------------------

six months ended

September 30, 2011

(amounts in

millions of

Canadian dollars, Non-

except number of Retained controlling Total

shares) earnings Total interests equity

--------------------------------------------------------------------------

Balances, beginning

of period $ 466.4 $ 914.4 $ 18.5 $ 932.9

Net income 81.5 81.5 0.7 82.2

Other comprehensive

income (loss):

Foreign currency

translation - 48.7 0.2 48.9

Net changes in

cash flow hedges - (25.6) - (25.6)

Defined benefit

plan actuarial

losses (32.4) (32.4) - (32.4)

--------------------------------------------------------------------------

Total comprehensive

income $ 49.1 $ 72.2 $ 0.9 $ 73.1

Stock options

exercised - 2.0 - 2.0

Optional cash

purchase - - - -

Stock dividends (3.6) - - -

Transfer upon

exercise of stock

options - - - -

Share-based

payments - 2.2 - 2.2

Dividends (17.0) (17.0) - (17.0)

--------------------------------------------------------------------------

Balances, end of

period $ 494.9 $ 973.8 $ 19.4 $ 993.2

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The total of retained earnings and accumulated other comprehensive (loss)

income for the six months ended September 30, 2012 was $522.1 million (2011

- $508.2 million).

Consolidated Statement of Cash Flows

(Unaudited)

six months ended September 30

(amounts in millions of Canadian dollars) 2012 2011

----------------------------------------------------------------------------

Operating activities

Net income $ 58.5 $ 82.2

Adjustments to reconcile net income to cash flows

from operating activities:

Depreciation of property, plant and equipment 52.7 44.6

Amortization of intangible and other assets 20.9 14.5

Financing cost amortization 0.9 0.8

Deferred income taxes 15.1 13.6

Investment tax credits (11.2) (8.4)

Share-based payments (0.3) 0.5

Defined benefit pension plans (3.1) (4.5)

Amortization of other non-current liabilities (7.0) (4.9)

Other (0.2) (4.3)

Changes in non-cash working capital (154.9) (92.7)

----------------------------------------------------------------------------

Net cash (used in) provided by operating activities $ (28.6) $ 41.4

----------------------------------------------------------------------------

Investing activities

Business combinations, net of cash and cash

equivalents acquired $ (264.4) $ (126.1)

Joint ventures, net of cash and cash equivalents

acquired - (26.8)

Capital expenditures for property, plant and

equipment (90.5) (77.2)

Proceeds from disposal of property, plant and

equipment - 27.2

Capitalized development costs (24.0) (18.7)

Enterprise resource planning (ERP) and other

software (10.1) (8.5)

Other (1.0) (0.5)

----------------------------------------------------------------------------

Net cash used in investing activities $ (390.0) $ (230.6)

----------------------------------------------------------------------------

Financing activities

Net borrowing under revolving unsecured credit

facilities $ 229.9 $ 14.2

Net effect of current financial assets program (21.9) (7.7)

Proceeds from long-term debt, net of transaction

costs 336.6 170.5

Repayment of long-term debt (154.7) (16.7)

Repayment of finance lease (7.6) (11.1)

Dividends paid (17.9) (17.0)

Common stock issuance 2.0 2.0

Other (1.5) (0.6)

----------------------------------------------------------------------------

Net cash provided by financing activities $ 364.9 $ 133.6

----------------------------------------------------------------------------

Net decrease in cash and cash equivalents $ (53.7) $ (55.6)

Cash and cash equivalents, beginning of period 287.3 276.4

Effect of foreign exchange rate changes on cash and

cash equivalents (4.2) 6.3

----------------------------------------------------------------------------

Cash and cash equivalents, end of period $ 229.4 $ 227.1

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Supplemental information:

Dividends received $ 2.0 $ 2.8

Interest paid 28.0 21.8

Interest received 2.4 2.2

Income taxes paid 15.5 21.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Investor relations: Andrew Arnovitz, Vice President

Investor Relations and Strategy (514)

734-5760andrew.arnovitz@cae.com Media: Nathalie Bourque, Vice

President, Public Affairs and Global Communications (514)

734-5788nathalie.bourque@cae.com

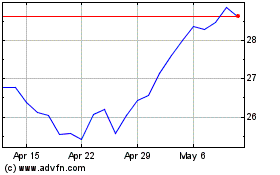

CAE (TSX:CAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

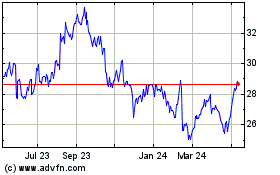

CAE (TSX:CAE)

Historical Stock Chart

From Apr 2023 to Apr 2024