D-BOX Technologies Inc. (TSX:DBO), a leader in innovative motion

technology, today announced revenues of $3,707,717 for its second

quarter ended September 30, 2012 representing a 83% increase in

comparison to revenues of $2,029,899 realized in the second quarter

of the previous fiscal year. Also, for the second consecutive time,

D-BOX generates a positive adjusted EBITDA.

Quarterly highlights of the second quarter of the 2013 fiscal

year

-- Positive quarterly adjusted EBITDA for a second consecutive quarter:

-- + $130 k compared to ($813 k) for the corresponding quarter of the

previous fiscal year

-- For the first six months : + $247 k compared to ($1,983 k ) for the

same period of last year

-- Growth in total revenues for a third consecutive quarter:

-- + 83 % in comparison to last year

-- Commercial theatres: + 224% including 132% from utilization

rights, rental and maintenance fees

-- OEM: + 39%

-- 200 screens are now equipped or will soon be equipped of D-BOX MFX

systems, including:

-- 25 exhibitors currently owning more than one complex equipped with a

D-BOX screen, and

-- 14 exhibitors having as of today more than one screen within a same

complex.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

For the second quarter and six-month period ended September 30

(in thousands of CA$ except per share data)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Second quarter Six months

----------------------- -------------------------

F2013 F2012 F2013 F2012

----------------------------------------------------------------------------

Revenues 3,708 2,030 7,276 4,439

Adjusted EBITDA(i) 130 (813) 247 (1,983)

Net loss (1,204) (981) (1,794) (2,774)

Basic and diluted net loss

per share (0.0074) (0.0060) (0.0110) (0.0169)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Information from the Consolidated Balance Sheet

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sept. 30, March 31,

2012 2012

------------ ------------

Cash and cash equivalents 7,926 9,320

Working capital 12,904 14,870

Total assets 25,177 25,823

Property, plant and equipment 8,664 7,993

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) See the reconciliation table at the end of this press

release

Commenting on the quarterly realizations, Mr. Claude Mc Master,

President and Chief Executive Officer of D-BOX declared: "I am very

optimistic in regards to upcoming quarters given the current

revenue growth of our two business segments as a result of our

business development initiatives coupled with a tight control of

our operating expenses which clearly demonstrate we are on the

right track."

Additional informational in regards to three and six-month

periods ended September 30, 2012

The financial information in regards to the three and six-month

periods ended September 30, 2012 should be read in conjunction with

the Corporation's consolidated financial statements and

Management's Discussion and Analysis dated November 12, 2012. These

documents are available at the www.sedar.com website.

Outlook

Broadly speaking, D-BOX will focus on two major development

segments: commercial theatres and OEMs, who each target a specific

business market.

In light of the evolution of its sales and a relatively fixed

short-term cost structure, D-BOX aims at continuing to maintain a

positive adjusted EBITDA provided this figure may remain subject to

a certain level of volatility.

Reconciliation of the adjusted EBITDA to the net loss

The adjusted EBITDA designates net loss before items not

affecting cash, the foreign exchange gain or loss, financial

expenses, interest income, and income taxes. This measure supplies

useful and complementary information which allows amongst others to

evaluate profitability and cash flows provided by operations.

The following table explains the reconciliation of the adjusted

EBITDA to the net loss:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarter ended Six-month period ended

September 30 September 30

-------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net loss (1,204) (981) (1,794) (2,774)

Amortization of property,

plant and equipment 428 358 914 634

Amortization of

intangible assets 65 49 127 95

Amortization of other

assets 7 15 29 33

Share-based payment

expense 231 377 492 691

Foreign exchange loss

(gain)(ii) 609(ii) (600) 491(ii) (581)

Financial results

(financial expenses and

interest income) (6) (33) (16) (83)

Income taxes - 2 4 2

----------------------------------------------------------------------------

Adjusted EBITDA(i) 130 (813) 247 (1,983)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) See the "Non-IFRS financial measures in the management

discussion and analysis dated November 12, 2012".

(ii) The foreign exchange loss includes an unrealized foreign

exchange loss of $599 k for the quarter ended September 30, 2012

and $429 k for the six-month period ended September 30, 2012.

About D-BOX

D-BOX Technologies Inc. designs, manufactures and markets

cutting-edge motion systems intended mainly for the entertainment

and industrial simulation industries. This unique and patented

technology, D-BOX Motion Code, uses motion effects specifically

programmed for each visual content which are sent to a motion

system integrated into a platform, a seat or any other product. The

resulting motion is perfectly synchronized with the on-screen

action, thus creating an unparalleled realistic immersive

experience. As of today, many major studios offer D-BOX Motion Code

on their motion pictures in commercial theatres, on DVDs and

Blu-rays. By reaching agreements with various industry leaders,

D-BOX's award-winning motion technology is gradually proving itself

as a new global standard. D-BOX is a public company whose shares

are traded on the Toronto Stock Exchange under the symbol DBO.

D-BOX® and D-BOX Motion Code® are registered trademarks of D-BOX

Technologies Inc. Other names are for informational purposes only

and may be trademarks of their respective owners.

For more information, please visit D-BOX's website at

www.d-box.com

Disclaimer in regards to forward-looking statements

Certain statements included herein, including those that express

management's expectations or estimates of our future performance,

constitute "forward-looking statements" within the meaning of

applicable securities laws. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management at this time, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Investors are

cautioned not to put undue reliance on forward-looking statements.

The Corporation disclaims any intent or obligation to update

publicly these forward looking statements, whether as a result of

new information, future events or otherwise.

Contacts: Luc Audet Vice-President and Chief Financial Officer

D-BOX Technologies Inc. 450-442-3003 ext 296laudet@d-box.com

Investor Relations Marc Jasmin CMA, President Jasmin Financial

Communications 514-231-2360marc@comjasmin.com

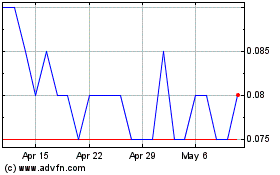

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

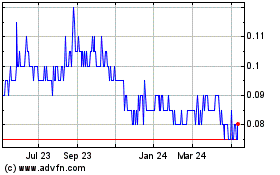

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Apr 2023 to Apr 2024