Alhambra Resources Ltd. (TSX

VENTURE:ALH)(PINKSHEETS:AHBRF)(FRANKFURT:A4Y) ("Alhambra" or the

"Corporation"), an international gold producer and explorer,

announces assay results for eight of 18 diamond drill holes ("DDH")

completed at its 100% owned Shirotnaia Gold Project ("Shirotnaia").

Diamond drilling has intersected higher-grade gold mineralization

(+1.0 grams per tonne gold ("g/t Au")) over core intervals ranging

from 6.4 metres ("m') to 135.6 m (down-hole). These higher-grade

intervals define a core gold mineralization zone interpreted to be

at least 1,200 m long enveloped by an aureole of lower grade (less

than 1.0 g/t) gold mineralization with dimensions of 1,800 m by 750

m which remains open in three directions and at depth. This release

includes one of the best drill holes to date on the project which

entered strong mineralization from surface and retuned an interval

of 135.6 m averaging 1.12 g/t Au.

Shirotnaia is one of three advanced exploration project areas

Alhambra is exploring within its 9,800 square kilometre ("km2")

(2.4 million acre) Uzboy Gold Project located in north central

Kazakhstan (see location map, Figure 1). Shirotnaia is immediately

adjacent to the multi-million ounce Aksu and Quartzite Hills gold

deposits currently being mined by KazakhGold Group Limited

("KazakhGold").

HIGHLIGHTS

-- The best mineralization intersected included: 1.12 g/t Au over 135.6 m,

1.47 g/t Au over 27.4 m, 1.73 g/t over 17.5 m and 1.56 g/t Au over 18.2

m,

-- Gold mineralization in the area is now outlined by four higher grade

(+1.0 g/t Au) zones, one measuring about 1,200 m in length and 6.4 m to

135.6 m in width (down-hole).

-- Seven of the holes returned intercepts with gold grades greater than 1.0

g/t Au and in four of the holes these grade intervals have core lengths

greater than 6.0 m,

-- 38 mineralized intervals (of variable widths) with gold grades of

greater than 0.2 g/t Au were intersected in the eight holes assayed (see

Table 1).

Mr. John J. Komarnicki, Alhambra's Chairman and Chief Executive

Officer stated, "These latest Shirotnaia results are very

encouraging. The presence of 100 gram-meter intervals of gold from

surface is a strong indication of upside potential for Shirotnaia.

We are now delivering considerable thickness of potentially

economic grades in several areas, and the strike length for this

higher-grade zone is now over a kilometre. We expect to see the

Shirotnaia resource grow and the grade to improve as our technical

team continues with exploration drilling. The Shirotnaia deposit is

likely to be a significant gold system on a standalone basis, and

it is just one of a number of targets Alhambra will advance over

the next year."

DRILLING PROGRAM SUMMARY

The 2012 diamond drilling program consisted of 18 core holes

totaling 3,691 m. The average depth of the holes was 205 m. Of the

18 holes completed, assay results for eight holes totaling 1,408 m

have been received and are being reported (see Table 1 and Figures

2 and 3).

The assay results for the remaining 10 core holes will be

reported once the remaining assay results have been received and

are interpreted.

The objective of this core drilling program was to confirm and

extend the previously identified higher grade gold mineralization

zones along strike and to depth (see News Releases dated March 10,

2010 and April 28, 2011). This objective was achieved. The

geological model of the Shirotnaia gold mineralization includes an

interpreted higher grade (+1.0 g/t Au) zone that is about 1,200 m

long and ranges from 6.5 m to 25.0 m wide. Several parallel zones

of gold mineralization have been intersected next to the main zone

of higher-grade gold mineralization (see Figure 2). The

higher-grade core is interpreted to have more of an E-W strike than

the broader mineralized zone, which is orientated NE-SW. The higher

grades are probably controlled by shear zones and are generally

related to pervasively silicified rocks. The mineralized zone dips

generally to the NW at an angle of 60 degrees to 70 degrees,

steepening on the southwest limb. There are several NW trending

offsets in the lodes that exhibit much steeper plunges, which host

the richest and widest intervals of mineralization.

These significant new results reflect the benefits of the

structural geology and comprehensive geological modeling that have

been underway. This work continues in order to further improve

understanding of grade controls. It is expected that future drill

targeting will benefit from these results.

The fact that these intervals of +1.0 g/t Au mineralization

cluster into several parallel trends is a strong indicator of

mineralization continuity.

The most significant intervals that were received are summarized

in more detail below:

The best mineralized interval reported was in DDH 28-09 which

yielded 135.6 m @ 1.12 g/t Au from surface and 18.2 m @ 1.56 g/t Au

(including 11.2 m @ 2.26 g/t Au). This hole also bottomed in

mineralization at 210.0 m. The broad intersection at the top of

this hole identified a NW striking jog of the main higher-grade

zone, possibly drilling along the long axis of a newly discovered

lode. The second intercept extended the main zone itself by 50 m

down dip (see Figure 3).

DDH 32-03 targeted the southern parallel higher-grade zone and

successfully extended it with 40 m along strike to the NE. The best

mineralized interval from this hole returned 27.4 m @ 1.47 g/t

Au.

DDH 92-09 successfully extended the northern parallel

higher-grade zone by about 60 m in depth. The best mineralized

interval from DDH 92-09 returned 17.5 m @ 1.73 g/t Au (including

8.90 m @ 2.63 g/t Au).

DDH 24-04, situated 90 m south of the main zone, identified

another fragment of a higher grade zone parallel to the main zone

with an intercept of 6.4 m @ 1.26 g/t Au.

Table 1 - Summary Drilling Results

---------------------------------------------------------------------------

Inter- Grade Mineral-

Sec- Azi- From To val Au ization

tion DDH# Length muth Dip (m) (m) (m) (g/t) Type

---------------------------------------------------------------------------

92 DDH 92-09 260.2 145 -60 62.60 66.60 4.00 0.63 Sulphide

---------------------------------------------------------------------------

100.00 117.50 17.50 1.73 Sulphide

---------------------------------------------------------------------------

including 100.00 101.60 1.60 3.48 Sulphide

---------------------------------------------------------------------------

and including 108.60 117.50 8.90 2.63 Sulphide

---------------------------------------------------------------------------

including 109.60 112.60 3.00 6.69 Sulphide

---------------------------------------------------------------------------

175.50 181.50 6.00 0.20 Sulphide

---------------------------------------------------------------------------

208.70 211.70 3.00 1.01 Sulphide

---------------------------------------------------------------------------

221.80 226.80 5.00 0.25 Sulphide

---------------------------------------------------------------------------

100 DDH 100-04 150.0 145 -80 1.20 39.30 38.10 0.46Transition

---------------------------------------------------------------------------

including 10.20 12.70 2.50 1.19 Oxide

---------------------------------------------------------------------------

and including 14.70 17.70 3.00 1.12 Oxide

---------------------------------------------------------------------------

92.10 101.10 9.00 0.40 Sulphide

---------------------------------------------------------------------------

117.50 120.50 3.00 0.27 Sulphide

---------------------------------------------------------------------------

145.70 148.90 3.20 0.31 Sulphide

---------------------------------------------------------------------------

24 DDH 24-04 175.5 145 -60 1.20 6.00 4.80 0.23 Oxide

---------------------------------------------------------------------------

15.00 19.00 4.00 0.29 Sulphide

---------------------------------------------------------------------------

39.80 45.10 5.30 0.50 Sulphide

---------------------------------------------------------------------------

50.10 53.10 3.00 0.60 Sulphide

---------------------------------------------------------------------------

59.10 63.10 4.00 0.33 Sulphide

---------------------------------------------------------------------------

66.10 79.60 13.50 0.69 Sulphide

---------------------------------------------------------------------------

including 70.20 76.60 6.40 1.26 Sulphide

---------------------------------------------------------------------------

including 70.20 72.60 2.40 2.59 Sulphide

---------------------------------------------------------------------------

88.00 95.00 7.00 0.33 Sulphide

---------------------------------------------------------------------------

101.00 106.10 5.10 0.71 Sulphide

---------------------------------------------------------------------------

112.00 117.00 5.00 0.63 Sulphide

---------------------------------------------------------------------------

including 112.00 114.00 2.00 1.10 Sulphide

---------------------------------------------------------------------------

32 DDH 32-04 200.5 145 -60 102.30 106.50 4.20 0.34 Sulphide

---------------------------------------------------------------------------

DDH 32-03 132.0 145 -60 8.50 16.10 7.60 0.22 Oxide

---------------------------------------------------------------------------

25.10 54.10 29.00 0.18Transition

---------------------------------------------------------------------------

57.10 129.50 72.40 0.68 Sulphide

---------------------------------------------------------------------------

including 100.10 127.50 27.40 1.47 Sulphide

---------------------------------------------------------------------------

including 100.10 111.10 11.00 2.18 Sulphide

---------------------------------------------------------------------------

and including 116.10 127.50 11.40 1.30 Sulphide

---------------------------------------------------------------------------

28 DDH 28-09 210.0 145 -85 0.00 135.60 135.60 1.12 Sulphide

---------------------------------------------------------------------------

including 8.00 33.60 25.60 1.21Transition

---------------------------------------------------------------------------

and including 52.20 72.20 20.00 1.30 Sulphide

---------------------------------------------------------------------------

and including 81.20 84.20 3.00 2.46 Sulphide

---------------------------------------------------------------------------

and including 93.00 101.80 8.80 3.04 Sulphide

---------------------------------------------------------------------------

and including 107.80 132.60 24.80 1.57 Sulphide

---------------------------------------------------------------------------

141.60 159.80 18.20 1.56 Sulphide

---------------------------------------------------------------------------

including 145.60 156.80 11.20 2.26 Sulphide

---------------------------------------------------------------------------

164.80 168.60 3.80 1.03 Sulphide

---------------------------------------------------------------------------

180.40 210.00 29.60 0.42 Sulphide

---------------------------------------------------------------------------

24 DDH 24-21 149.6 145 -65 21.20 25.20 4.00 0.21Transition

---------------------------------------------------------------------------

28.20 33.20 5.00 0.19Transition

---------------------------------------------------------------------------

65.20 75.00 9.80 0.21 Sulphide

---------------------------------------------------------------------------

77.00 85.50 8.50 0.59 Sulphide

---------------------------------------------------------------------------

including 80.00 83.00 3.00 1.19 Sulphide

---------------------------------------------------------------------------

104.90 106.90 2.00 1.16 Sulphide

---------------------------------------------------------------------------

139.70 143.70 4.00 0.42 Sulphide

---------------------------------------------------------------------------

7 DDH 07-15 130.5 145 -65 22.40 29.00 6.60 0.35 Sulphide

---------------------------------------------------------------------------

32.00 37.40 5.40 0.28 Sulphide

---------------------------------------------------------------------------

41.40 58.40 17.00 0.33 Sulphide

---------------------------------------------------------------------------

including 51.40 55.40 4.00 0.81 Sulphide

---------------------------------------------------------------------------

63.10 81.10 18.00 0.21 Sulphide

---------------------------------------------------------------------------

91.10 104.10 13.00 0.32 Sulphide

---------------------------------------------------------------------------

including 95.10 96.10 1.00 1.79 Sulphide

---------------------------------------------------------------------------

116.10 128.10 12.00 0.23 Sulphide

---------------------------------------------------------------------------

The intervals set out in the above table are not true widths and

the assay results are uncut. Intercepts are calculated using a 0.15

g/t cut-off without upper cut, and with not more than 2 m of

internal waste.

SHIROTNAIA REGIONAL SETTING AND MINERALIZATION

Shirotnaia is just one target within Alhambra's 9,800 km2

mineral license which is located in the world-class Central

Asia-Chinese Altayshan Gold Belt that sweeps across northern

Kazakhstan. This mega-trend of important gold deposits hosts

orogenic type gold deposits, such as Vasilkovskoe, Aksu and

Quartzite Hills. On the eastern side of Alhambra's license, the

Corporation controls at least 50 kilometres ("kms") of an emerging

gold trend that extends from North Balusty south to Shirotnaia and

beyond; crossing the southern border of Alhambra's license. The

multi-million ounce Aksu and Quartzite Hills gold deposits, which

are currently being mined by KazakhGold Group Limited are located

approximately three kms southeast of Alhambra's Shirotnaia project

area. Along this trend, Alhambra controls the North Balusty,

Dombraly, Kerbay and Shirotnaia zones of gold mineralization.

Shirotnaia and Dombraly are the most advanced of these targets, but

much work remains to be done on this eastern trend.

At Shirotnaia, gold mineralization consists of several numerous

NE-SW to E-W orientated zones of intensive hydrothermal alterations

occurring within a structurally controlled low grade aureole which

is at least 1,800 m long, 750 m wide and remains open to the north,

northeast and southwest as well as at depth. Four zones of gold

mineralization are presently identified in the explored part of the

aureole.

The gold mineralization at Shirotnaia is hosted in a sequence of

mostly dacite-andesitic volcanic and volcaniclastic rocks with rare

sediment horizons. There is an oxidized zone to an average depth

from surface of about 20 m and a transition zone about 16 m thick

below that, underlain by primary gold mineralization.

DRILLING AND SAMPLING PROCEDURES

For the core drilling, an NQ diamond drilling core barrel was

utilized and average core recovery was 100%. The core was split by

the drilling contractor under the supervision of the Corporation's

geologists with one half sampled for assay and another half left

for references. Every meter of core was sampled and the exact

borders of the sampling interval were determined according to the

lithological contacts. The average sample weight was 2.6

kilograms.

Sample preparation was completed by Stewart Assay and

Environmental Laboratories located in Kyrgyzstan using the

following procedure: samples were crushed to minus 2 mm, mixed and

split into two 200 gram sub-samples. One sub-sample was pulverized

to - 200 mesh and the other sub-sample was retained for reference

purposes. A 30 gram sample of the -200 mesh material was used for

fire assay atomic absorption finish. Stewart Assay and

Environmental Laboratories is independent of Alhambra and is

accredited to International Standard Organization ("ISO") 17025 for

certain relevant assay methodologies.

QUALITY ASSSURANCE QUALITY CONTROL

The Kyrgyzstan Stewart Assay and Environmental Laboratories, as

a part of the worldwide ALS Group, have stringent quality assurance

and quality control ("QA/QC") procedures. Alhambra also follows a

rigorous QA/QC program consisting of inserting standards, blanks

and duplicates into the sample stream submitted to the laboratory

for analysis to ensure that the sampling and analysis of all

samples is conducted in accordance with the best possible

practices.

Elmer B. Stewart, MSc. P. Geol., a technical consultant, is the

Corporation's nominated Qualified Person. Mr. Stewart has reviewed

but not confirmed the technical information contained in this news

release.

ABOUT ALHAMBRA

Alhambra is a Canadian based international exploration and gold

production corporation with NI 43-101 gold resources as per ACA

Howe International UK and Micromine Consulting Services UK as noted

below:

----------------------------------------------------------------------------

Measured (M) Indicated (I)

----------------------------------------------------------------------------

Project Grade Grade

----------------------------------------------------------------------------

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Uzboy (1) 14,317,200 1.52 700,000 7,009,500 1.22 275,500

----------------------------------------------------------------------------

Dombraly (2) - - 559,000 1.22 22,000

----------------------------------------------------------------------------

Shirotnaia (3) - - 2,900,000 0.76 71,000

----------------------------------------------------------------------------

TOTAL 14,317,200 1.52 700,000 10,468,500 1.09 368,500

----------------------------------------------------------------------------

----------------------------------------------------------------------------

M + I Inferred

----------------------------------------------------------------------------

Project Grade Grade

----------------------------------------------------------------------------

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Uzboy (1) 21,326,700 1.42 975,500 11,258,200 1.17 421,700

----------------------------------------------------------------------------

Dombraly (2) 559,000 1.22 22,000 9,317,000 1.01 301,000

----------------------------------------------------------------------------

Shirotnaia (3) 2,900,000 0.76 71,000 34,577,000 0.58 645,000

----------------------------------------------------------------------------

TOTAL 24,785,700 1.34 1,068,500 55,152,200 0.77 1,367,700

----------------------------------------------------------------------------

(1) Effective as of Dec 31/07 as per ACA Howe per news release

dated Apr 8/08 at a 0.40 g/t cut-off.

(2) Effective as of Nov 27/11 as per ACA Howe per news release

dated Feb 7/12 using natural cut-off grades of 0.13 g/t, 0.1 g/t

and 0.2 g/t for the low grade stockpile, pit infill and in-situ

mineralized zones respectively.

(3) Effective as of Jan 9/12 as per ACA Howe per news release

dated Feb 28/12 using cut-off grades of 0.1 g/t for oxide gold

mineralization and 0.2 g/t for transitional and primary gold

mineralization respectively.

Alhambra holds exploration and exploitation rights to a 2.4

million acre (9,800 km2), 100% owned license called the Uzboy

Project, located in the Northern Kazakhstan Metallogenic Province,

which hosts numerous world-class gold deposits. Over 100 mineral

targets, including three advanced exploration areas, are contained

within the Uzboy Project.

Alhambra common shares trade in Canada on The TSX Venture

Exchange under the symbol ALH, in the United States on the

Over-The-Counter Pink Sheets Market under the symbol AHBRF and in

Germany on the Frankfurt Open Market under the symbol A4Y. The

Corporation's website can be accessed at

www.alhambraresources.com.

Forward-Looking Statements

Certain statements contained in this news release constitute

"forward-looking statements" as such term is used in applicable

Canadian and US securities laws. These statements relate to

analyses and other information that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management. In particular, there is no certainty

that additional drilling will be conducted nor that additional

resources or increased gold grade will be realized and other

factors and events described in this news release should be viewed

as forward-looking statements to the extent that they involve

estimates thereof. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or

performance (often, but not always, using words or phrases such as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans, "estimates" or "intends", or stating

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

"forward-looking statements". Such forward looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Corporation to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such risks and other factors include,

among others, conducting additional drill programs, identifying

additional resources or increasing gold grade, availability of

capital to fund exploration projects; political, social and other

risks inherent in carrying on business in a foreign jurisdiction

and such other business risks as discussed herein and other

publicly filed disclosure documents. Although the Corporation has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could vary or differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements contained in this news

release.

Forward looking statements are made based on management's

beliefs, estimates and opinions on the date the statements are made

and the Corporation undertakes no obligation to update

forward-looking statements and if these beliefs, estimates and

opinions or other circumstances should change, except as required

by applicable law.

This news release contains forward-looking statements based on

assumptions, uncertainties and management's best estimates of

future events. When used herein, words such as "intended" and

similar expressions are intended to identify forward-looking

statements. Forward-looking statements are based on assumptions by

and information available to the Corporation. Investors are

cautioned that such forward-looking statements involve risks and

uncertainties. Actual results may differ materially from those

currently anticipated. The forward-looking statements contained

herein are expressly qualified by this cautionary statement.

Note: To view Figures 1, 2 and 3 associated with this release,

please click the following link:

http://media3.marketwire.com/docs/alh1114.pdf.

Neither the TSX Venture Exchange Inc. nor its Regulation

Services Provider (as that term is defined in the Policies of the

TSX Venture Exchange Inc.) accepts responsibility for the adequacy

or accuracy of this release.

Contacts: Alhambra Resources Ltd. Ihor P. Wasylkiw VP &

Chief Information Officer +1 (403) 508-4953 Alhambra Resources Ltd.

John J. Komarnicki Chairman & CEO +1 (403) 228-2855

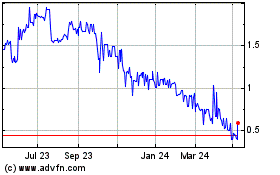

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Mar 2024 to Apr 2024

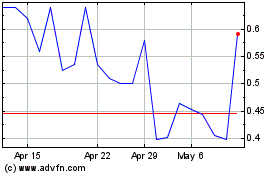

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Apr 2023 to Apr 2024