Platinum Group Metals Ltd. (TSX:PTM)(NYSE MKT:PLG) ("Platinum

Group" or the "Company") reports the Company's financial results

for the year ended August 31, 2012. For details of the consolidated

financial statements (the "Financial Statements") and Management's

Discussion and Analysis for the year ended August 31, 2012 please

see the Company's filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov). Shareholders are encouraged to visit the Company's

website at www.platinumgroupmetals.net. Shareholders may request a

copy of the complete Financial Statements from the Company free of

charge.

The Company's cash position at August 31, 2012 was $48.17

million, including $30.51 million in restricted cash. The Company

holds cash in both Canadian dollars and South African Rand and

changes in the exchange rate may create variance in the cash

holdings reported in Canadian dollars. All amounts herein are

reported in Canadian dollars unless otherwise specified.

Platinum Group has made the transition to mine construction at

the Western Bushveld Joint Venture Project 1 platinum mine

("Project 1") located near Rustenburg, South Africa and has made a

discovery of a second platinum deposit in South Africa at the

Waterberg project located near Mokopane, South Africa.

Phase 1 construction at Project 1 is estimated for completion in

late March or early April, 2013. The planned US $260 million

project senior loan facility for Phase 2 construction has advanced

through detailed technical, financial and legal due diligence. The

loan is in the formal credit approval process at this time.

Drilling to expand the newly discovered inferred mineral

resource at the Waterberg project is continuing.

Recent Highlights

-- A US $100 million Phase 1 development program is now approximately 80%

complete at Project 1. A central box cut excavation has been completed.

The sinking of twin declines at the central location is progressing

well. Both declines are now advanced to 770 metres linear from their

collar. Substantial surface infrastructure has now been constructed on

site.

-- Safety, in all our operations, is our number one priority, and the

Company is pleased to report that onsite safety performance at Project 1

has been excellent to date with approximately 950,000 man hours worked

and two minor lost time incidents.

-- A south box cut excavation for a planned second twin decline system is

substantially complete. Sinking of this second decline set is planned to

commence under Phase 2.

-- A temporary power supply of 1.5MVA has been installed on site and has

been energized. Construction of a 10 MVA supply line and substation is

almost complete, with switch gear currently being installed. This

service is to be energized in early 2013.

Milestones Completed

-- On November 5, 2012, the Company announced new drill intercepts

approximately doubling the strike length of the Waterberg discovery to a

total of 5.5 kilometers up to the northern boundary of the current joint

venture project. The results extended the known "F" mineralized layers

for 2.7 kilometers beyond the initial resource area declared in

September, 2012. Results included 24.00 meters grading 4.32 grams per

tonne ("g/t") 2E (platinum ("Pt") and palladium ("Pd") collectively) +

gold ("Au") with a larger intercept of 58.00 meters of 2.98 g/t 2E+Au

(Hole WB027). Results also included 11.5 meters grading 7.18 g/t 2E + Au

(Hole WB031) and 8.5 meters of 4.8 g/t 2E+Au (Hole WB-034). The deposit

remains open. See Technical Report titled "Updated Exploration Results

and Mineral Resource Estimate for the Waterberg Platinum Project, South

Africa located on the Northern Limb of the Bushveld Complex", with an

effective date of November 5, 2012 (the "Updated Waterberg Report")

available at www.sedar.com.

-- On September 11, 2012, the Company announced that Rustenburg Platinum

Mines Ltd., a wholly owned subsidiary of Anglo American Platinum

Limited, had exercised its first right of refusal to purchase the off-

take of concentrate from Project 1. Formal agreements are in process.

-- On September 4, 2012, the Company announced an initial 6.6 million ounce

inferred mineral resource estimate at the Waterberg project (initial

inferred mineral resource estimate of 68 million tonnes at 3.01 g/t

2E+Au, comprised of 0.94 g/t Pt, 1.71 g/t Pd, 0.37 g/t Au. See the

Updated Waterberg Report.

-- On July 9, 2012, the Company's board of directors approved the adoption

of a shareholder rights plan (the "Plan") subject to shareholder

approval. The Plan is now effective and will be set to a vote of the

shareholders at the Company's annual general and special meeting

scheduled for January 8, 2013.

-- On May 23, 2012, the Company announced the expansion of the Waterberg

discovery. Multiple layers of higher grade mineralization were

intersected at depths as shallow as 122 to 122 meters from surface.

-- On April 4, 2012, the Government of South Africa issued a formal Mining

Right to the Company for Project 1 in terms of section 23(1) of the

Mineral and Petroleum Resources Development Act, 28 of 2002, subject to

environmental authorizations, water use licenses and compliance with

applicable legislation on an ongoing basis.

Results For The Year Ended August 31, 2012

During the year ended August 31, 2012, the Company incurred a

net loss of $10.59 million (August 31, 2011 - net loss of $8.89

million). General and administrative expenses during the period

were reduced from the previous year to $5.37 million (August 31,

2011 - $6.79 million), losses on foreign exchange, due primarily to

a weaker Rand at period end, were $3.59 million (August 31, 2011

-$0.12 million), while stock based compensation expense, a non-cash

item, totalled $2.01 million (August 31, 2011 - $6.91 million).

Finance income consisting of interest earned and property rental

fees in the year amounted to $3.94 million (August 31, 2011- $3.79

million). Loss per share for the year amounted to $0.06 per share,

as compared to a loss of $0.05 per share for the comparative year

of fiscal 2011.

Accounts receivable at August 31, 2012 totalled $4.70 million

while accounts payable and accrued liabilities amounted to $7.78

million. Accounts receivable were comprised primarily of value

added taxes repayable to the Company in South Africa and amounts

receivable from partners. Accounts payable included accrued

professional fees, contract construction fees, drilling expenses,

engineering fees and regular trade payables for ongoing exploration

and development costs and administration.

Total expenditures by the Company for development and purchases

of property and equipment for Project 1 during the year totaled

approximately $37 million, before including the effects of foreign

currency exchange rate fluctuations. Expenditures by the Company

during the year for exploration on Waterberg were approximately

$6.68 million, of which $3.36 million was funded by joint venture

partner Japanese Oil, Gas and Metals National Corporation

("JOGMEC"). Mineral property acquisition and exploration

expenditures in Canada during the year totaled $1.89 million.

Outlook

The Company's objectives for the year ahead are to complete the

senior loan facility and other financing and move into a safe and

efficient Phase 2 construction of Project 1, to further the

geological understanding of the near surface Waterberg platinum,

palladium and gold deposit and to further explore the new northern

portion of the Bushveld Complex discovered by the Company.

Phase 1 construction at Project 1 is expected to be completed on

budget. Phase 2 development will commence once the project loan

facility and additional financing from the Company are available.

Phase 2 is to include a second twin decline access south of the

central twin decline development, underground lateral development,

a milling and concentrating facility and a tailings impoundment

area.

In conjunction with ongoing cost estimation work and banking

preparations, an updated project schedule for Phase 2 has been

completed by the Company. Plant and facility construction and

commissioning are estimated to take up to two years to complete.

Full commercial production is estimated to occur after a two year

ramp-up period subsequent to the commissioning of the plant. The

Merensky Reef is scheduled to be mined in the first approximately

13 years of the mine life. Steady state production is modelled at

an average annual rate of 275,000 4E ounces of (platinum,

palladium, rhodium and gold collectively) ounces in concentrate (on

average during the nine years of peak production). See the

technical report titled "Updated Technical Report (Updated

Feasibility Study Western Bushveld Joint Venture Project 1

(Elandsfontein and Frischgewaagd)" dated November 20, 2009 with an

effective date of October 8, 2009 (the "UFS") available at

www.sedar.com.

At the Waterberg project, in the newly discovered "north of the

North Limb" of the Bushveld Complex region, approximately 28 holes

have been drilled since the cut off for the initial inferred

mineral resource. Additional assay results for many holes are

pending at this time. PGE mineralization has now been intercepted

in drilling for approximately 5.5 km of strike length. The "T"

layers have been intercepted from 122 metres below surface to 1,375

metres deep.

A US $8.37 million 2012 drilling program at Waterberg funded by

JOGMEC and the Company is nearing completion. Planning for a 2013

program by the Waterberg joint venture is in progress, including

funding for an updated resource estimate and then a preliminary

economic assessment. Interpretation of current drilling combined

with geophysical survey data indicates that the currently granted

prospecting rights allow for up to six kilometres of northeasterly

strike length before the system strikes onto the adjacent permit

area, which is under registered application to the Company. The

up-dip extension of the deposit to the east will be drilled once

that licence area, now under registered application, is granted to

the Company on behalf of the Waterberg joint venture.

About Platinum Group Metals Ltd.

Platinum Group is based in Johannesburg, South Africa and

Vancouver, Canada. The Company's main asset is a 74% interest in

Project 1 near Rustenburg, South Africa, where a Phase 1

construction budget of US $100 million is in progress, including

underground development. Project 1 has an estimated steady state

production of 275,000 ounces per year of platinum group metals.

Platinum Group also has active exploration programs with drilling

at the Sable joint venture and Waterberg joint venture in South

Africa and active exploration in Canada for platinum and

palladium.

Qualified Person

R. Michael Jones, P.Eng., the Company's President, Chief

Executive Officer and a significant shareholder of the Company, is

a non-independent qualified person as defined in National

Instrument 43-101 Standards of Disclosure for Mineral Projects and

is responsible for preparing the technical information contained in

this news release.

On behalf of the Board of Platinum Group Metals Ltd.

Frank R. Hallam, CFO and Director

This press release contains forward-looking information within

the meaning of Canadian securities laws and forward-looking

statements within the meaning of U.S. securities laws (collectively

"forward-looking statements"). Forward-looking statements are

typically identified by words such as: believe, expect, anticipate,

intend, estimate, plans, postulate and similar expressions, or are

those, which, by their nature, refer to future events. All

statements that are not statements of historical fact are

forward-looking statements. Forward-looking statements in this

press release include, without limitation, statements regarding the

Company's plans to move into full scale development, the estimated

completion of Phase 1 on Project 1, the timing of any

debt/financing for Project 1, the commencement of Phase 2 on

Project 1, the completion of off-take negotiations, the timing of

first ore production and concentrate sales, and further exploration

on the Company's properties. In addition, the results of the UFS

and the Updated Waterberg Report may constitute forward-looking

statements to the extent that they reflect estimates of

mineralization, capital and operating expenses, metal prices and

other factors. Although the Company believes the forward-looking

statements in this press release are reasonable, it can give no

assurance that the expectations and assumptions in such statements

will prove to be correct. The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance, and that actual results may differ

materially from those in forward looking statements as a result of

various factors, including, but not limited to, variations in

market conditions; the nature, quality and quantity of any mineral

deposits that may be locate;, the Company's ability to obtain any

necessary permits, consents or authorizations required for its

activities; the Company's ability to successfully complete hedging

establishment and off-take negotiations; the Company's ability to

produce minerals from its properties successfully or profitably, to

continue its projected growth, or to be fully able to implement its

business strategies and other risk factors described in he

Company's Form 40-F annual report, annual information form and

other filings with the SEC and Canadian securities regulators,

which may be viewed at www.sec.gov and www.sedar.com,

respectively.

The Toronto Stock Exchange and the NYSE MKT LLC have not

reviewed and do not accept responsibility for the accuracy or

adequacy of this news release, which has been prepared by

management.

Contacts: Platinum Group Metals Ltd., Vancouver R. Michael Jones

President (604) 899-5450 / Toll Free: (866) 899-5450 Platinum Group

Metals Ltd., Vancouver Kris Begic VP, Corporate Development (604)

899-5450 / Toll Free: (866) 899-5450 (604) 484-4710 (FAX)

www.platinumgroupmetals.net

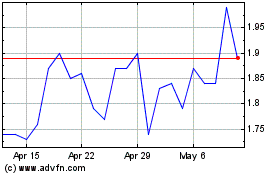

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

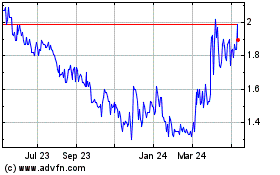

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Apr 2023 to Apr 2024