To mark Financial Literacy Month and Financial Planning Week

(November 19th - 25th), BMO Financial Group is releasing a series

of financial tips. As part of BMO's commitment to 'Making Money

Make Sense', the tips are designed to help individuals and families

save and manage their day-to-day finances more effectively.

BMO's Tip of the Day: Say "I do" to keeping the costs of your

wedding under control.

"Your wedding day is a big day, but it's just one more day for

your finances," said Marlena Pospiech, Senior Manager, BMO Wealth

Planning Group, BMO Financial Group. "Savvy brides and grooms

should work together to establish a realistic budget and identify

ways they can minimize costs that will benefit them both in the

short and long term."

BMO encourages couples to find ways to have a big bash without

breaking the bank. Tips include:

-- Avoid the Saturday Premium: Choose to host your wedding on a day other

than Saturday. Having the ceremony on a Friday night or Sunday means

your guests can still partake in the weekend's festivities without

having to pay a premium for a Saturday ceremony.

-- Forgo a Sit-Down Dinner: Opt for a more casual brunch or lunchtime

affair, or a cocktail party with hors d'oeuvres. This can add up to big

savings as a sit-down dinner can cost upwards to $100 per person.

-- Be Your Own DJ: Instead of hiring an expensive DJ, be your own DJ and

create a unique and sentimental playlist that reflects the bride and

groom and their relationship.

-- Gown and Tuxedo Rentals: For a bride who is not planning on boxing

and/or saving her dress, renting a wedding dress is a common and

inexpensive option. The groom and groomsmen can also opt to rent their

tuxes, which can result in significant savings for the couple.

"CFEE commends BMO's ongoing efforts to support Financial

Literacy in Canada and promote ways in which Canadians can increase

their competence and confidence when managing their personal

finances on a day-to-day basis," said Gary Rabbior, President,

Canadian Foundation for Economic Education (CFEE).

To learn more about how financial planning can help you feel

confident about your future, or to contact a financial planner,

visit www.bmo.com/gettingmarried or call 1-888-389-8030.

BMO Financial Literacy Month Tips

November 1: Maximizing TFSA investments annually over 20 years

can save nearly $30,000 in taxes.

November 2: Utilize rewards to squeeze the most value out of

every dollar you spend this holiday season.

November 3: Choose an investment advisor who is right for you

and will help you meet your financial goals.

November 4: Use your RRSP to help make the down payment on your

first home.

November 5: Space out payments to avoid cash-flow problems.

November 6: Take advantage of the benefits of preferred

shares.

November 7: Consider investing in a Registered Retirement

Savings Plan (RRSP) and taking advantage of tax incentives when

saving for retirement.

November 8: Take advantage of Canada's numerous online personal

finance resources.

November 9: Before you head off on your winter vacation, be sure

you and your family are properly covered in the event of a medical

emergency.

November 10: Understand what you can hold in your RRSP.

November 11: Stick to the one-third rule when planning the

purchase of a home.

November 12: Secure your retirement by opening a Registered

Retirement Savings Plan (RRSP) as early as possible and contribute

to it on a regular basis.

November 13: As couples prepare for their wedding day, they

should have "The Financial Talk" to help the transition from "my

money" to "our money."

November 14: Using a combination of a credit card, debit card

and cash will give you convenience, security and flexibility when

you travel or shop in the United States.

November 15: Give the gift of securities and benefit from tax

savings.

November 16: To stay on track to reach your financial goals,

keep a well-diversified investment portfolio.

November 17: Take advantage of spousal RRSPs.

November 18: Take advantage of credit cards that offer

affordable emergency medical travel insurance.

November 19: Parents-to-be should consider their financial

situation before the Big Day.

November 20: Use the tax refund generated by your Registered

Retirement Savings Plan (RRSP) contribution to pay down your

mortgage.

November 21: Save for your child's education by investing

monthly Universal Child Care Benefit (UCCB) cheques in a Registered

Education Savings Plan (RESP).

November 22: Save for your child's education by encouraging

friends and family to contribute to a Registered Education Savings

Plan (RESP) this holiday season.

November 23: Bringing your lunch to work can help you save for

retirement.

November 24: Creating a financial plan, which includes an

emergency fund, can help you plan for tomorrow's unforeseen

expenses and avoid incurring high interest debt.

For more on financial literacy, Canadians can visit the

Government of Canada's Financial Literacy Month website, as well as

BMO's Financial Literacy online resource.

About BMO Financial Group

Established in 1817 as Bank of Montreal, BMO Financial Group is

a highly diversified North American financial services

organization. With total assets of $542 billion as at July 31,

2012, and more than 46,000 employees, BMO Financial Group provides

a broad range of retail banking, wealth management and investment

banking products and solutions.

Contacts: Media Contacts: Rachael McKay, Toronto (416)

867-3996rachael.mckay@bmo.com Valerie Doucet, Montreal (514)

877-8224valerie.doucet@bmo.com Laurie Grant, Vancouver (604)

665-7596laurie.grant@bmo.com Internet: www.bmo.com Twitter:

@BMOmedia

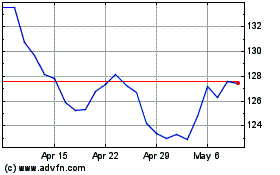

Bank of Montreal (TSX:BMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

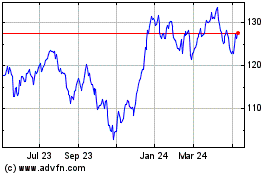

Bank of Montreal (TSX:BMO)

Historical Stock Chart

From Apr 2023 to Apr 2024