Avalon Rare Metals Inc. (TSX:AVL)(NYSE MKT:AVL)(NYSE Amex:AVL)

("Avalon" or the "Company") is pleased to announce an updated

resource estimate for the Nechalacho Rare Earth Elements Deposit,

Thor Lake, NWT (the "Nechalacho Deposit") which is effective as of

November 21, 2012. The estimate, prepared by Avalon geologists and

independently audited by Roscoe Postle Associates Inc. ("RPA"), is

based on the assays from all drilling completed up to August 27,

2012. The updated resource estimate further increases mineral

resources in the Nechalacho Deposit at the key Measured level of

confidence.

The updated NI 43-101 technical report prepared by RPA, dated

August 25, 2011(the "RPA Technical Report"), recommended

preparation of a mine plan for the Basal Zone part of the

Nechalacho Deposit. This resource estimate for the Basal Zone

(Table 1) will serve as the basis for the mine plan and reserves

estimate in the Feasibility Study ("FS") currently in preparation

and scheduled for completion in Q2 2013. An updated resource

estimate is also provided for the Upper Zone of the Nechalacho

Deposit in Table 2, although it does not form part of the mine plan

in the RPA Technical Report.

The updated estimate is highlighted by an increase in Measured

Mineral Resources in the Basal Zone to 10.88 million tonnes grading

1.67% TREO(1), 0.38% HREO and 22.91% HREO/TREO(2) at the revised

base case cut-off of US$320 NMR(3) per tonne, compared to C$260 NMR

per tonne used in the previous resource estimate. The revised base

case cut-off reflects anticipated higher overall operating costs

based on preliminary estimates of including separation and refining

costs in the development model to be incorporated in the FS. The

increase in measured resources ensures that a high proportion of

the resources applicable to the mineral reserves to be used in the

FS mine plan will be at the highest level of confidence.

The breakdown of the resource estimate grades for the individual

rare earth element oxides is provided in Table 3.

The presence of a high grade sub-zone within the Basal Zone

resource is apparent when higher NMR cut-offs are applied, as was

highlighted previously in the Company's news release dated July 10,

2012. For example, at the higher NMR cut-off of $800 estimated

combined Measured and Indicated Mineral Resources total 18.57

million tonnes of 2.19% TREO, 0.57% HREO and 25.78% HREO/TREO

(Table 1). The mine plan in the FS will be designed to maximize the

exploitation of higher grade resources in the early years of

mining.

Despite the use of a higher NMR cut-off in the base case, the

base case updated resource estimate for the Basal Zone shows only a

slight decrease in the total Measured and Indicated Mineral

Resources to 65.83 million tonnes of 1.57% TREO and 21.86%

HREO/TREO compared to 72.66 million tonnes of 1.53% TREO and 21.5%

HREO/TREO reported previously for the Basal Zone in the news

release dated July 10, 2012.

The mineral resource estimate was prepared Benjamin Webb, Senior

Resource Geologist, Avalon Rare Metals Inc., under the supervision

of the Company's Vice-President, Exploration, William Mercer,

Ph.D., P.Geo. (Ont), P. Geo. (NWT) who is the QP for Avalon for

this news release. An independent audit of the estimate was

completed by Tudorel Ciuculescu, P. Geo., Senior Geologist, RPA.

Drilling operations are being performed by a third party drilling

company under the supervision of a consulting Professional

Geologist. William Mercer is also providing overall direction on

the project and monitoring of the QA/QC on the laboratory analyses.

(see the RPA Technical Report, dated August 25, 2011, for QA/QC

procedures).

About Avalon Rare Metals Inc.

Avalon Rare Metals Inc. is a mineral development company focused

on rare metals deposits in Canada. Its flagship project, the

100%-owned Nechalacho Deposit, Thor Lake, NWT, is emerging as one

of the largest undeveloped rare earth elements resources in the

world. Its exceptional enrichment in the more valuable 'heavy' rare

earth elements, which are key to enabling advances in green energy

technology and other growing high-tech applications, is one of the

few potential sources of these critical elements outside of China,

currently the source of 95% of world supply. Avalon is well funded,

has no debt and its work programs are progressing steadily. Social

responsibility and environmental stewardship are corporate

cornerstones.

Shares Outstanding: 103,621,986. Cash resources: approximately

$27 million. To find out more about Avalon Rare Metals Inc., please

visit our website at www.avalonraremetals.com.

----------------------------------------------------------------------------

(1) HREO (Heavy Rare Earth Oxides) is the total concentration of: Y2O3,

Eu2O3, Gd2O3, Tb2O3, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3 and Lu2O3. TREO

(Total Rare Earth Oxides) is HREO plus: La2O3, Ce2O3, Pr2O3, Nd2O3 and

Sm2O3.

(2) HREO/TREO is the percentage proportion of rare earths that are HREO.

(3) NMR is defined as "Net Metal Return" or the in situ value of all payable

metals, net of estimated metallurgical recoveries and off-site

processing costs.

This news release contains "forward-looking statements" within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and applicable Canadian securities legislation.

Generally, these forward-looking statements can be identified by

the use of forward-looking terminology such as "scheduled",

"anticipates", "expects" or "does not expect", "is expected",

"scheduled", "targeted", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking statements contained herein include,

without limitation the expected timing for the completion of the

Nechalacho feasibility study; anticipated higher operating costs

based on preliminary estimates; and the expectation that the mine

plan design will maximize the exploitation of higher grade

resources in the early years of mining. Forward-looking statements

are subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, level of activity,

performance or achievements of Avalon to be materially different

from those expressed or implied by such forward-looking statements.

Forward-looking statements are based on assumptions management

believes to be reasonable at the time such statements are made.

Although Avalon has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

Factors that may cause actual results to differ materially from

expected results described in forward-looking statements include,

but are not limited to: Avalon's ability to secure sufficient

capital to implement its business plans, Avalon's ability to

complete its FS within the timeframe anticipated; the final results

on which the FS will be based on; uncertainties associated with

Avalon's resource and reserve estimates; uncertainties regarding

global supply and demand for rare earth materials; the results and

estimates set out in the separation plant prefeasibility study

proving to be inaccurate; and uncertainties associated with

unanticipated geological conditions related to mining. There can be

no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Such forward-looking statements

have been provided for the purpose of assisting investors in

understanding the Company's plans may not be appropriate for other

purposes. Accordingly, readers should not place undue reliance on

forward-looking statements. Avalon does not undertake to update any

forward-looking statements that are contained herein, except in

accordance with applicable securities laws.

---------------------------------------------------------------------------

Table 1: Nechalacho Deposit Measured, Indicated and Inferred Mineral

Resources for Basal Zone by NMR Cut-Off Value with the Base Case

$320/tonne NMR Cut-Off.

---------------------------------------------------------------------------

Category

and Zone NMR Cut-Off Tonnes TREO HREO HREO/TREO ZrO2 Nb2O5 Ta2O5

-----------------------------------------------------------------

($USD) (millions) (%) (%) (%) (%) (%) (%)

---------------------------------------------------------------------------

Measured

---------------------------------------------------------------------------

Basal greater than

or equal

to 320 10.88 1.67 0.38 22.91 3.13 0.41 0.04

---------------------------------------------------------------------------

Basal greater than

or equal

to 600 6.75 1.98 0.49 24.76 3.79 0.48 0.05

---------------------------------------------------------------------------

Basal greater than

or equal

to 800 4.00 2.23 0.59 26.51 4.31 0.54 0.06

---------------------------------------------------------------------------

Basal greater than

or equal

to 1000 1.99 2.52 0.70 27.67 4.90 0.61 0.06

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Indicated

---------------------------------------------------------------------------

Basal greater than

or equal

to 320 54.95 1.54 0.33 21.63 3.01 0.40 0.04

---------------------------------------------------------------------------

Basal greater than

or equal

to 600 30.03 1.88 0.45 23.88 3.66 0.47 0.05

---------------------------------------------------------------------------

Basal greater than

or equal

to 800 14.57 2.18 0.56 25.57 4.21 0.53 0.06

---------------------------------------------------------------------------

Basal greater than

or equal

to 1000 5.72 2.52 0.67 26.58 4.79 0.60 0.06

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Measured + Indicated

---------------------------------------------------------------------------

Basal greater than

or equal

to 320 65.83 1.57 0.34 21.86 3.03 0.40 0.04

---------------------------------------------------------------------------

Basal greater than

or equal

to 600 36.78 1.90 0.46 24.05 3.68 0.47 0.05

---------------------------------------------------------------------------

Basal greater than

or equal

to 800 18.57 2.19 0.57 25.78 4.23 0.53 0.06

---------------------------------------------------------------------------

Basal greater than

or equal

to 1000 7.71 2.52 0.68 26.86 4.82 0.60 0.06

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Inferred

---------------------------------------------------------------------------

Basal greater than

or equal

to 320 59.89 1.28 0.25 19.59 2.70 0.36 0.03

---------------------------------------------------------------------------

Basal greater than

or equal

to 600 18.68 1.69 0.37 22.14 3.33 0.45 0.04

---------------------------------------------------------------------------

Basal greater than

or equal

to 800 4.75 2.03 0.51 25.28 3.88 0.51 0.05

---------------------------------------------------------------------------

Basal greater than

or equal

to 1000 1.10 2.47 0.63 25.44 4.24 0.56 0.06

---------------------------------------------------------------------------

Notes:

1. CIM definitions were followed for Mineral Resources.

2. The Qualified Person for this Mineral Resource estimate is William

Mercer, PhD, P.Geo. (Ontario), P. Geo.(NWT) VP, Exploration, Avalon Rare

Metals Inc.

3. HREO (Heavy Rare Earth Oxides) is the total concentration of: Y2O3,

Eu2O3, Gd2O3, Tb2O3, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3 and Lu2O3.

4. TREO (Total Rare Earth Oxides) is HREO plus: La2O3, Ce2O3, Pr2O3, Nd2O3

and Sm2O3.

5. Rare earths were valued at an average net price of US$38/kg, ZrO2 at

US$3.77/kg, Nb2O5 at US$56/kg, and Ta2O5 at US$256/kg. Average REO price

is net of metallurgical recovery and payable assumptions for contained

rare earths, and will vary according to the proportions of individual

rare earth elements present. This average price is based on the

individual price set used in the RPA Technical Report, except for four

changes applicable to individual oxides reflecting present and projected

2016 markets:

a. La2O3, Ce2O3 and Sm2O3 reduced 50% to $8.75, $6.23 and $6.75 per kg

respectively.

b. Y2O3 increased 140% to $67.25/kg.

c. Remaining rare earth prices are unchanged at Pr2O3 at $75.20, Nd2O3

at $76.78, Eu2O3 at $1392.57, Gd2O3 at $54.99, Tb2O3 at $1055.70,

Dy2O3 at $688.08, Ho2(CO3)3 at $66.35, Er2O3 at $48.92, Lu2O3 at

$522.83.

6. An exchange rate of US$1.00 = C$1.05 was used.

7. A cut-off NMR value of US$320 per tonne was used. NMR is defined as "Net

Metal Return" or the in situ value of all payable metals, net of

estimated metallurgical recoveries and off-site processing costs.

8. ZrO2 refers to Zirconium Oxide, Nb2O5 refers to Niobium Oxide, Ta2O5

refers to Tantalum Oxide.

9. See Table 2 for summary of resources in Basal and Upper zones at NMR

$320 cut-off.

10. See Table 3 for individual rare earth oxide details.

----------------------------------------------------------------------------

Table 2: Nechalacho Deposit Mineral Resources at the Base Case $320/tonne

NMR Cut-Off

----------------------------------------------------------------------------

Category Zone Tonnes TREO HREO HREO/TREO ZrO2 Nb2O5 Ta2O5

-------------------------------------------------

(millions) (%) (%) (%) (%) (%) (%)

----------------------------------------------------------------------------

Measured Basal 10.88 1.67 0.38 22.91 3.13 0.41 0.04

--------------------------------------------------------

Upper Nil Nil Nil Nil Nil Nil Nil

============================================================================

Total Measured 10.88 1.67 0.38 22.91 3.13 0.41 0.04

============================================================================

Indicated Basal 54.95 1.54 0.33 21.63 3.01 0.40 0.04

--------------------------------------------------------

Upper 55.61 1.42 0.14 10.10 1.92 0.28 0.02

============================================================================

Total Indicated 110.56 1.48 0.24 16.08 2.46 0.34 0.03

============================================================================

Measured and Basal

Indicated 65.83 1.57 0.34 21.86 3.03 0.40 0.04

--------------------------------------------------------

Upper 55.61 1.42 0.14 10.10 1.92 0.28 0.02

============================================================================

Total Measured and

Indicated 121.44 1.50 0.25 16.77 2.52 0.34 0.03

============================================================================

Inferred Basal 59.89 1.28 0.25 19.59 2.70 0.36 0.03

--------------------------------------------------------

Upper 122.12 1.28 0.13 9.77 2.21 0.32 0.02

============================================================================

Total Inferred 182.01 1.28 0.17 13.01 2.37 0.33 0.02

============================================================================

----------------------------------------------------------------------------

Table 3: Nechalacho Deposit Measured, Indicated and Inferred Rare Earth

Oxide Grades at the Base Case $320/tonne NMR Cut-Off

----------------------------------------------------------------------------

Tonnes

Category Zone (millions) La2O3(%) Ce2O3(%) Pr2O3(%) Nd2O3(%)

----------------------------------------------------------------------------

Measured Basal 10.88 0.263 0.589 0.074 0.293

-----------------------------------------------------------

Upper Nil Nil Nil Nil Nil

----------------------------------------------------------------------------

Total Measured 10.88 0.263 0.589 0.074 0.293

----------------------------------------------------------------------------

Indicated Basal 54.95 0.251 0.557 0.070 0.274

-----------------------------------------------------------

Upper 55.61 0.268 0.594 0.073 0.284

----------------------------------------------------------------------------

Total Indicated 110.56 0.259 0.576 0.071 0.279

----------------------------------------------------------------------------

Measured and Basal 65.83

Indicated 0.253 0.562 0.070 0.277

-----------------------------------------------------------

Upper 55.61 0.268 0.594 0.073 0.284

----------------------------------------------------------------------------

Total Measured and 121.44

Indicated 0.260 0.577 0.072 0.281

----------------------------------------------------------------------------

Inferred Basal 59.89 0.210 0.474 0.061 0.239

-----------------------------------------------------------

Upper 122.12 0.231 0.553 0.066 0.258

----------------------------------------------------------------------------

Total Inferred 182.01 0.225 0.527 0.064 0.252

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Table 3: Nechalacho Deposit Measured, Indicated and Inferred Rare Earth

Oxide Grades at the Base Case $320/tonne NMR Cut-Off

----------------------------------------------------------------------------

Tonnes

Category Zone (millions) Sm2O3(%) Eu2O3(%) Gd2O3(%) Tb2O3(%)

----------------------------------------------------------------------------

Measured Basal 10.88 0.065 0.0081 0.059 0.0091

-----------------------------------------------------------

Upper Nil Nil Nil Nil Nil

----------------------------------------------------------------------------

Total Measured 10.88 0.065 0.0081 0.059 0.0091

----------------------------------------------------------------------------

Indicated Basal 54.95 0.059 0.0073 0.053 0.0080

-----------------------------------------------------------

Upper 55.61 0.054 0.0058 0.039 0.0042

----------------------------------------------------------------------------

Total Indicated 110.56 0.057 0.0065 0.046 0.0061

----------------------------------------------------------------------------

Measured and Basal 65.83

Indicated 0.060 0.0074 0.054 0.0082

-----------------------------------------------------------

Upper 55.61 0.054 0.0058 0.039 0.0042

----------------------------------------------------------------------------

Total Measured and 121.44

Indicated 0.057 0.0067 0.047 0.0063

----------------------------------------------------------------------------

Inferred Basal 59.89 0.049 0.0060 0.044 0.0063

-----------------------------------------------------------

Upper 122.12 0.047 0.0051 0.034 0.0035

----------------------------------------------------------------------------

Total Inferred 182.01 0.047 0.0054 0.037 0.0044

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Table 3: Nechalacho Deposit Measured, Indicated and Inferred Rare Earth

Oxide Grades at the Base Case $320/tonne NMR Cut-Off

----------------------------------------------------------------------------

Tonnes

Category Zone (millions) Dy2O3(%) Ho2O3(%) Er2O3(%) Tm2O3(%)

----------------------------------------------------------------------------

Measured Basal 10.88 0.047 0.008 0.022 0.003

-----------------------------------------------------------

Upper Nil Nil Nil Nil Nil

----------------------------------------------------------------------------

Total Measured 10.88 0.047 0.008 0.022 0.003

----------------------------------------------------------------------------

Indicated Basal 54.95 0.041 0.007 0.018 0.002

-----------------------------------------------------------

Upper 55.61 0.016 0.002 0.005 0.001

----------------------------------------------------------------------------

Total Indicated 110.56 0.029 0.005 0.012 0.002

----------------------------------------------------------------------------

Measured and Basal 65.83

Indicated 0.042 0.007 0.019 0.002

-----------------------------------------------------------

Upper 55.61 0.016 0.002 0.005 0.001

----------------------------------------------------------------------------

Total Measured and 121.44

Indicated 0.030 0.005 0.013 0.002

----------------------------------------------------------------------------

Inferred Basal 59.89 0.031 0.006 0.013 0.002

-----------------------------------------------------------

Upper 122.12 0.014 0.002 0.005 0.001

----------------------------------------------------------------------------

Total Inferred 182.01 0.020 0.003 0.007 0.001

----------------------------------------------------------------------------

------------------------------------------------------------------

Table 3: Nechalacho Deposit Measured, Indicated and Inferred Rare

Earth Oxide Grades at the Base Case $320/tonne NMR Cut-Off

------------------------------------------------------------------

Tonnes

Category Zone (millions) Yb2O3(%) Lu2O3(%) Y2O3(%)

------------------------------------------------------------------

Measured Basal 10.88 0.017 0.002 0.206

-------------------------------------------------

Upper Nil Nil Nil Nil

------------------------------------------------------------------

Total Measured 10.88 0.017 0.002 0.206

------------------------------------------------------------------

Indicated Basal 54.95 0.014 0.002 0.181

-------------------------------------------------

Upper 55.61 0.004 0.001 0.065

------------------------------------------------------------------

Total Indicated 110.56 0.009 0.001 0.123

------------------------------------------------------------------

Measured and Basal 65.83

Indicated 0.015 0.002 0.185

-------------------------------------------------

Upper 55.61 0.004 0.001 0.065

------------------------------------------------------------------

Total Measured and 121.44

Indicated 0.010 0.001 0.130

------------------------------------------------------------------

Inferred Basal 59.89 0.011 0.002 0.132

-------------------------------------------------

Upper 122.12 0.004 0.001 0.057

------------------------------------------------------------------

Total Inferred 182.01 0.006 0.001 0.081

------------------------------------------------------------------

Contacts: Avalon Rare Metals Inc. Don Bubar President

416-364-4938ir@avalonraremetals.com www.avalonraremetals.com

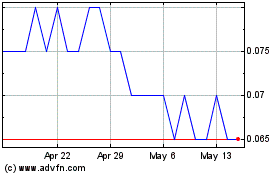

Avalon Advanced Materials (TSX:AVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

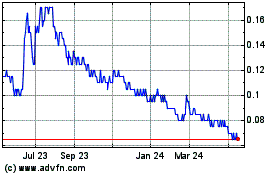

Avalon Advanced Materials (TSX:AVL)

Historical Stock Chart

From Apr 2023 to Apr 2024