Alhambra Resources Ltd. (TSX

VENTURE:ALH)(PINKSHEETS:AHBRF)(FRANKFURT:A4Y) ("Alhambra" or the

"Corporation"), an international gold producer and explorer,

announces that the first diamond drilling program completed in 2012

at its 100% owned Zhanatobe project area ("Zhanatobe") has

intersected significant gold mineralization at depth in both the

Northern and Central areas. Zhanatobe is one of Alhambra's 2012

early stage exploration targets within the Corporation's 100%

owned, 2.4 million acre, Uzboy Project located in north central

Kazakhstan (see Figure 1). Zhanatobe is located approximately 90

kilometres ("kms") southeast of Alhambra's Uzboy gold deposit and

40 kms northwest of the City of Stepnogorsk, Alhambra's Kazakhstan

operating base.

HIGHLIGHTS

-- Four of nine holes intersected mineralized intervals grading greater

than 0.5 grams per tonne gold ("g/t Au") located with broad intervals of

lower-grade gold mineralization,

-- In the Central area, gold mineralization was discovered at depth

returning 2.11 g/t Au over 5.0 metres ("m") and 1.98 g/t Au over 3.0 m,

and was hosted by silicified sandstone and andesite,

-- Gold mineralization was traced by diamond drill holes for about 600 m

along strike remaining open in both directions (NE and SW) and to depth,

-- In the Northern area, gold mineralization was also discovered at depth

returning 0.86 g/t Au over 11.0 m (including 1.37 g/t Au over 5.30 m),

-- The gold mineralization discovered is open in all directions, and

-- In both the Central and Northern areas, gold grades become significantly

higher at depth when compared to previous shallow rotary air-blast

("RAB") drilling results

John J. Komarnicki, Alhambra's Chairman and Chief Executive

Officer stated, "We are excited with the fact that the gold

mineralization discovered earlier by Alhambra at our early stage

exploration target at Zhanatobe continues at depth. Now we can

concentrate our Zhanatobe exploration efforts on outlining the

mineralization zones and searching for higher-grade areas of gold

mineralization."

DRILLING SUMMARY

The objective of the 2012 exploration program at Zhanatobe was

to check for the presence of gold at depth and to determine the

geometry and style of the gold mineralization located in both the

Central and Northern areas as a result of the shallow RAB drilling

conducted in 2010 and 2011.

Nine diamond drill holes totaling 1,449 m were completed in both

the Northern and Central areas of Zhanatobe (see Figures 2 and 3).

Assay results for the mineralized intervals in both the Central and

Northern areas are shown in Table 1.

Central Area:

In the Central area, RAB drilling up to and including 2011

resulted in the discovery of a new zone of gold mineralization.

This new zone, oriented in an ENE direction, was estimated to be

about 850 m along strike and up to 100 m in width with gold grades

ranging from 0.10 g/t Au to 1.72 g/t Au.

The 2012 drilling program consisted of six diamond drill holes

("DDH") drilled along three lines totaling 905 m (see Figure 2). Of

these new DDH tested, the most encouraging intercepts yielded 1.98

g/t Au over 3.0 m in DDH ZTD 06-01 and 2.11 g/t Au over 5.0 m in

DDH ZTD 04-01, including an individual sample that assayed 5.76 g/t

Au in a 1.0 m long core interval (see Table 1 and Figure 4). The

mineralized zone in the Central area has been tested by core holes

for about 600 m along strike. The mineralized zone is open to depth

and in both directions (NE and SW) along strike. When compared to

the shallow RAB drilling results, grades appear to increase at

depth. The gold mineralization is located close to the contact

between mainly to sporadically silicified sandstone and andesite as

well as to their contacts with siliclastic rocks. The geological

setting of the mineralization is similar to that of the Uzboy gold

deposit and it is possible that orogenic volcanosediment hosted

gold mineralization is developed at Zhanatobe.

Northern Area:

In the Northern area, RAB drilling up to and including 2011 led

to the discovery of a second zone of gold mineralization, oriented

in a NE direction, with a strike length of 400 m and a width of 150

m with gold grades ranging from 0.19 g/t Au to 0.51 g/t Au.

The 2012 diamond drilling program in the Northern area consisted

of three holes totaling 544 m. Of these drill holes, the most

interesting mineralized intercept was 0.86 g/t Au over 11.0 m

(including 1.37 g/t Au over 5.30 m) in DDH ZTD 15-02 (see Table

1).

Figure 4 shows the position of the gold mineralization in

section 15 of the Northern area. This section is orientated E-W and

is oblique to the mineralized zone. DDH ZTD 15-02 was unfortunately

stopped in the mineralized zone and the scissor hole ZTD 15-03

collapsed at the depth of 138.4 m and did not reach the mineralized

zone. DDH ZTD-15-02 intersected significant gold mineralization

over a core interval of 11.0 m and the mineralized zone remains

open to depth. The maximum individual gold assay in this drill hole

was 3.45 g/t Au in a 1.0 m long core interval. The gold

mineralization is related to the contact between silicified

sandstone and andesite located below a horizon of silicified

andesite.

Alhambra believes that the gold mineralization at Zhanatobe is

controlled by lithology. The gold grades appear to be increasing at

depth. The gold mineralization is related to a series of silicified

sandstone horizons and andesite flows. The surface and near surface

gold concentrations and alteration is interpreted to represent a

more extensive mineralized body at depth. To validate this concept,

Alhambra plans on re-logging all core and reviewing all sections

more precisely. Anticipated follow-up drill programs include a

reverse circulation ("RC") and follow-up core drilling program for

a better understanding of the geological model.

DRILLING AND SAMPLING PROCEDURES

For the core drilling, an NQ diamond drilling core barrel was

utilized and average core recovery was 100%. The core was split by

the drilling contractor under the supervision of the Corporation's

geologists with one half used for sampling and another half left

for references. Every meter of core was sampled and the exact

borders of the sampling interval were determined according to the

lithological contacts. The average sample weight was 2.2

kilograms.

Sample preparation was completed by Stewart Assay and

Environmental Laboratories located in Kyrgyzstan using the

following procedure: samples were crushed to minus 2 mm, mixed and

split into two 200 gram sub-samples. One sub-sample was pulverized

to - 200 mesh and the other sub-sample was retained for reference

purposes. A 30 gram sample of the -200 mesh material was used for

fire assay atomic absorption finish. Stewart Assay and

Environmental Laboratories is independent of Alhambra and is

accredited to International Standard Organization ("ISO") 17025 for

certain relevant assay methodologies.

Table 1 - Summary Drilling Results

----------------------------------------------------------------------

Area Section DDH# Length Azimuth Dip

----------------------------------------------------------------------

Northern 15 ZTD15-01 205.50 125 -60

----------------------------------------------------

ZTD15-03 138.40 305 -60

----------------------------------------------------

ZTD15-02 200.30 125 -60

----------------------------------------------------

----------------------------------------------------------------------

Central 6 ZTD06-01 156.90 125 -60

----------------------------------------------------

----------------------------------------------------

ZTD06-02 160.00 305 -60

----------------------------------------------------

----------------------------------------------------

ZTD06-03 107.80 305 -60

----------------------------------------------------

----------------------------------------------------

5 ZTD05-01 160.00 125 -60

----------------------------------------------------

ZTD05-02 160.30 305 -60

----------------------------------------------------

4 ZTD04-01 160.20 305 -60

----------------------------------------------------

---------------------------------------------------------------------------

Grade

Interval Au Mineralization

Area From (m) To (m) (m) (g/t) Type

---------------------------------------------------------------------------

Northern 14.30 17.30 3.00 0.23 Oxide

---------------------------------------------------------

108.00 113.00 5.00 0.14 Sulphide

---------------------------------------------------------

92.90 95.10 2.20 0.22 Sulphide

---------------------------------------------------------

125.10 127.10 2.00 0.14 Sulphide

---------------------------------------------------------

164.10 166.10 2.00 0.25 Sulphide

---------------------------------------------------------

176.30 180.30 4.00 0.15 Sulphide

---------------------------------------------------------

189.30 200.30 11.00 0.86 Sulphide

---------------------------------------------------------

including 195.00 200.30 5.30 1.37 Sulphide

---------------------------------------------------------------------------

Central 72.60 76.60 4.00 0.29 Sulphide

---------------------------------------------------------

80.60 100.40 19.80 0.63 Sulphide

---------------------------------------------------------

including 95.40 98.40 3.00 1.98 Sulphide

---------------------------------------------------------

3.40 9.70 6.30 0.18 Oxide

---------------------------------------------------------

22.50 28.60 6.10 0.19 Oxide

---------------------------------------------------------

34.60 60.70 26.10 0.41 Transition

---------------------------------------------------------

including 43.70 53.70 10.00 0.70 Transition

---------------------------------------------------------

including 43.70 47.70 4.00 1.02 Transition

---------------------------------------------------------

66.70 71.90 5.20 0.55 Sulphide

---------------------------------------------------------

88.90 95.60 6.70 0.21 Sulphide

---------------------------------------------------------

83.40 87.40 4.00 0.14 Sulphide

---------------------------------------------------------

99.00 102.40 3.40 0.40 Sulphide

---------------------------------------------------------

122.50 124.50 2.00 0.31 Sulphide

---------------------------------------------------------

116.3 119.20 2.90 0.41 Sulphide

---------------------------------------------------------

43.10 49.10 6.00 1.25 Transition

---------------------------------------------------------

53.90 65.90 12.00 0.97 Transition

---------------------------------------------------------

53.90 58.90 5.00 2.11 Transition

---------------------------------------------------------------------------

The intervals set out in the above table are not true widths and

the assay results are uncut. Intercepts are calculated using a 0.1

g/t Au cut-off without upper cut, and with not more than 2 m of

internal waste.

QUALITY ASSSURANCE QUALITY CONTROL

The Kyrgyzstan Stewart Assay and Environmental Laboratories, as

a part of the worldwide ALS Group, have stringent quality assurance

and quality control ("QA/QC") procedures. Alhambra also follows a

rigorous QA/QC program consisting of inserting standards, blanks

and duplicates into the sample stream submitted to the laboratory

for analysis to ensure that the sampling and analysis of all

samples is conducted in accordance with the best possible

practices.

Elmer B. Stewart, MSc. P. Geol., a technical consultant, is the

Corporation's nominated Qualified Person. Mr. Stewart has reviewed

but not confirmed the technical information contained in this news

release.

ABOUT ZHANATOBE

Zhanatobe is one of Alhambra's early stage exploration targets

within the Corporation's 100% owned Uzboy Project located in north

central Kazakhstan. Zhanatobe is located within the Mamay block

approximately 90 kms southeast of Alhambra's Uzboy gold deposit and

40 kms northwest of the city of Stepnogorsk, Alhambra's Kazakhstan

operating base.

ABOUT ALHAMBRA

Alhambra is a Canadian based international exploration and gold

production corporation with NI 43-101 gold resources as per ACA

Howe International UK and Micromine Consulting Services UK as noted

below:

---------------------------------------------------------------------------

Measured (M) Indicated (I)

---------------------------------------------------------------------------

Project Grade Grade

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Uzboy (1) 14,317,200 1.52 700,000 7,009,500 1.22 275,500

---------------------------------------------------------------------------

Dombraly (2) - - 559,000 1.22 22,000

---------------------------------------------------------------------------

Shirotnaia (3) - - 2,900,000 0.76 71,000

---------------------------------------------------------------------------

TOTAL 14,317,200 1.52 700,000 10,468,500 1.09 368,500

---------------------------------------------------------------------------

---------------------------------------------------------------------------

M + I Inferred

---------------------------------------------------------------------------

Project Grade Grade

Tonnes (g/t) Ounces Tonnes (g/t) Ounces

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Uzboy (1) 21,326,700 1.42 975,500 11,258,200 1.17 421,700

---------------------------------------------------------------------------

Dombraly (2) 559,000 1.22 22,000 9,317,000 1.01 301,000

---------------------------------------------------------------------------

Shirotnaia (3) 2,900,000 0.76 71,000 34,577,000 0.58 645,000

---------------------------------------------------------------------------

TOTAL 24,785,700 1.34 1,068,500 55,152,200 0.77 1,367,700

---------------------------------------------------------------------------

(1) Effective as of Dec 31/07 as per ACA Howe per news release dated Apr

8/08 at a 0.40 g/t cut-off.

(2) Effective as of Nov 27/11 as per ACA Howe per news release dated Feb

7/12 using natural cut-off grades of 0.13 g/t, 0.1 g/t and 0.2 g/t for the

low grade stockpile, pit infill and in-situ mineralized zones

respectively.

(3) Effective as of Jan 9/12 as per ACA Howe per news release dated Feb

28/12 using cut-off grades of 0.1 g/t for oxide gold mineralization and

0.2 g/t for transitional and primary gold mineralization respectively.

Alhambra holds exploration and exploitation rights to a 2.4

million acre (9,800 km2), 100% owned license called the Uzboy

Project, located in the Northern Kazakhstan Metallogenic Province

which hosts numerous world-class gold deposits. Over 100 mineral

targets, including three advanced exploration areas, are contained

within the Uzboy Project.

Alhambra common shares trade in Canada on The TSX Venture

Exchange under the symbol ALH, in the United States on the

Over-The-Counter Pink Sheets Market under the symbol AHBRF and in

Germany on the Frankfurt Open Market under the symbol A4Y. The

Corporation's website can be accessed at

www.alhambraresources.com.

Forward-Looking Statements

Certain statements contained in this news release constitute

"forward-looking statements" as such term is used in applicable

Canadian and US securities laws. These statements relate to

analyses and other information that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management. In particular, statements concerning

finding higher-grade gold at depth, re-logging all core, conducting

follow-up drill programs and other factors and events described in

this news release should be viewed as forward-looking statements to

the extent that they involve estimates thereof. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "expects" or "does not expect", "is expected",

"anticipates" or "does not anticipate", "plans, "estimates" or

"intends", or stating that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved) are not statements of historical fact and should be

viewed as "forward-looking statements". Such forward looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Corporation to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such risks and other factors

include, among others, finding higher-grade gold at depth,

re-logging all core, conducting follow-up drill programs, the

availability of capital to fund future exploration programs;

political, social and other risks inherent in carrying on business

in a foreign jurisdiction and such other business risks as

discussed herein and other publicly filed disclosure documents.

Although the Corporation has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that such statements will prove to be accurate

as actual results and future events could vary or differ materially

from those anticipated in such statements. Accordingly, readers

should not place undue reliance on forward-looking statements

contained in this news release.

Forward looking statements are made based on management's

beliefs, estimates and opinions on the date the statements are made

and the Corporation undertakes no obligation to update

forward-looking statements and if these beliefs, estimates and

opinions or other circumstances should change, except as required

by applicable law.

This news release contains forward-looking statements based on

assumptions, uncertainties and management's best estimates of

future events. When used herein, words such as "intended" and

similar expressions are intended to identify forward-looking

statements. Forward-looking statements are based on assumptions by

and information available to the Corporation. Investors are

cautioned that such forward-looking statements involve risks and

uncertainties. Actual results may differ materially from those

currently anticipated. The forward-looking statements contained

herein are expressly qualified by this cautionary statement.

To view the figures associated with this press release, please

visit the following link:

http://media3.marketwire.com/docs/ALH123.pdf.

Neither the TSX Venture Exchange Inc. nor its Regulation

Services Provider (as that term is defined in the Policies of the

TSX Venture Exchange Inc.) accepts responsibility for the adequacy

or accuracy of this release.

Contacts: Alhambra Resources Ltd. Ihor P. Wasylkiw VP &

Chief Information Officer +1 (403) 508-4953 Alhambra Resources Ltd.

John J. Komarnicki Chairman & CEO +1 (403) 228-2855

www.alhambraresources.com

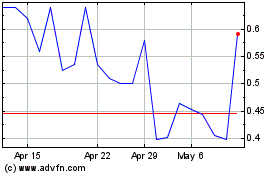

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Mar 2024 to Apr 2024

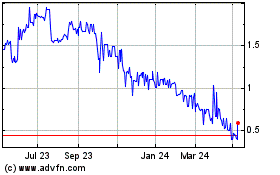

ACCENTRO Real Estate (TG:A4Y)

Historical Stock Chart

From Apr 2023 to Apr 2024