Pound Rebounds On Risk Appetite

December 16 2014 - 5:50AM

RTTF2

The pound trimmed its early losses against its major rivals in

early European deals on Tuesday, as European stocks recovered after

data showed that Eurozone business activity grew to 2-month high in

December.

Flash survey data from Markit Economics showed that Eurozone

composite output index advanced to 51.7 in December, the highest

reading in two months, from 51.1 in November. Economists had

forecast the PMI to come in at 51.5.

The flash services Purchasing Managers' Index rose to a 2-month

high of 51.9, while the manufacturing PMI climbed to a 5-month high

of 50.8.

The pound initially fell in response to a data showing slowdown

in U.K. inflation in November, but has recouped losses shortly

thereafter.

Data from the Office for National Statistics showed that U.K.

inflation slowed to 1 percent in November from 1.3 percent in

October. Economists had forecast prices to rise by 1.2 percent.

Another report from the same agency showed that factory gate

prices continued to decline in November. Factory gate prices were

down 0.1 percent, but slower than the 0.5 percent decrease in

October and a 0.6 percent drop forecast by economists.

House prices growth in the United Kingdom quickened less than

expected in October, separate data showed.

House prices grew 10.4 percent year-on-year in October following

the 12.1 percent rise in the previous month. Economists had

expected prices to advance 11.4 percent

After falling to a new 4-week low of 181.61 against the yen in

early deals, the pound snapped back to 183.07. The pair was worth

184.20 when it ended yesterday's deals. The next possible

resistance for the pound-yen pair is seen around the 186.00

zone.

The pound rebounded from an early near a 4-week low of 1.4997

against the franc with pair trading at 1.5086. Continuation of the

pound's uptrend may lead it to a resistance around the 1.515

mark.

The pound, having fallen to near a 4-week low of 0.8005 against

the euro earlier, bounced back to 0.7958. Next key resistance for

the pound may be eyed around the 0.79 region.

The pound edged up to 1.5723 against the greenback, reversing

from its recent decline of 1.5610. If the pound extends rise, 1.58

is seen as its next resistance level.

Looking ahead, U.S. building permits and housing starts, both

for November, and Markit's flash U.S. manufacturing PMI for

December are due to be released in the New York session.

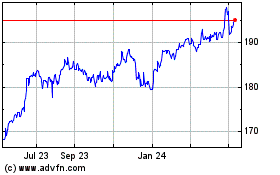

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

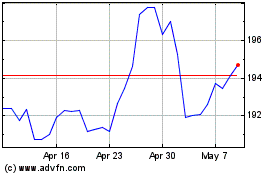

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024