Pound Mixed Following BoE Minutes, U.K. Jobless Rate

December 17 2014 - 5:15AM

RTTF2

The British pound showed mixed trading against the other major

currencies in the early European session on Wednesday following the

release of the Bank of England's minutes of its monetary policy

meeting and the nation's unemployment report for the three months

to October.

Bank of England policymakers decided to leave its key rate at a

historic low of 0.50 percent in a split vote for the fifth straight

time at the meeting held on December 3 and 4. The Monetary Policy

Committee voted 7-2 to retain its key rate at 0.50 percent. Ian

McCafferty and Martin Weale sought a 25 basis-point hike for the

fifth straight meeting.

Regarding the asset purchase programme, the Monetary Policy

Committee unanimously decided to maintain it at GBP 375

billion.

Data from the Office for National Statistics showed that U.K.

unemployment rate fell less than expected in the August to October

period. Compared with a year earlier, the number of unemployed

people fell by 455,000.

The claimant count rate fell to 2.7 percent in November as

expected, from 2.8 percent in October. The number of people

claiming jobseeker's allowance decreased by 26,900 from October,

while economists expected a decline of 20,000.

Traders focus on the Federal Reserve's final interest rate

announcement of 2014, due later in the day.

In the Asian trading, the pound held steady against most major

rivals.

In the European trading, the pound retreated to 1.5106 the Swiss

franc, from an early 2-day high of 1.5155 and held steady

thereafter.

Against the euro, the pound rose to a 2-day high of 0.7922 from

an early low of 0.7953. If the pound extends its uptrend, it is

likely to find resistance around the 0.78 area.

Pulling away from early highs of 1.5752 against the U.S. dollar

and 184.68 against the yen, the pound edged down to 1.5676 and

183.63, respectively, and held steady thereafter.

Looking ahead, U.S. CPI for November and current account balance

for third quarter are due to be released in the New York

session.

At 9:00 am ET, Swiss National Bank is set to release its latest

quarterly monetary policy report on business cycle trends.

At 2:00 pm ET, the Federal Reserve will announce its decision on

monetary policy. The Fed is expected to hold rates at 0.25 percent.

Subsequently, Fed Chair Janet Yellen holds a press conference

following FOMC meeting on interest rate policy.

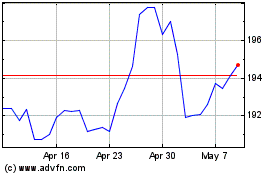

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

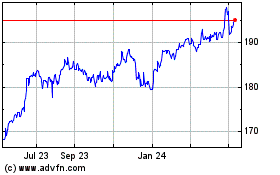

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024