Pound Climbs On Risk Appetite

December 19 2014 - 5:06AM

RTTF2

The pound firmed against its major rivals in European deals on

Friday, as European markets extended gains on Federal Reserve's

pledge that it would be patient in raising rates and after a strong

German consumer sentiment survey.

In its policy statement released on Wednesday, the Fed indicated

that it is prepared to hike interest rates as scheduled, while

replacing its "considerable time" language with a new language that

the bank "can be patient" about the timing of the first rate

hike.

Markets cheered the Fed chairwoman Janet Yellen's comments, who

sounded an upbeat assessment of the economy, while signaling that

the rates would rise after the "next couple of meetings."

According to the survey by the market research group GfK, German

consumer confidence is set to improve to an eight-year high at the

start of the year on strong gains in economic expectations and

willingness-to-buy as the current economic weakness is expected to

be temporary.

The forward-looking consumer confidence index climbed to 9 for

January, the highest since December 2006, from 8.7 in December. The

index was forecast to rise marginally to 8.8 points.

In economic news, majority of the households in the U.K.

perceived that the value of their houses increased in December,

results of a survey by Knight Frank and Markit Economics

showed.

The house price sentiment index, or HPSI, rose to 59.1 in

December from 58.4 in November. This marked the twenty first

consecutive month of the index remaining above 50.

Strong retail sales data for November, positive jobless claims

data and the Fed's assurance to start tightening by mid-2015

supported the currency on Thursday.

The pound, which closed yesterday's trading at 1.5347 against

the franc and 186.16 against the yen, approached a 5-week high of

1.5377 and a 1-week high of 187.23, respectively. The next possible

resistance for the pound is seen around 1.55 against the franc and

190.00 versus the yen.

The pound strengthened to 0.7829 against the euro, its highest

since November 12. This may be compared to an early low of 0.7850.

Continuation of the pound's bullish trend may lead it to a

resistance around the 0.775 mark.

The pound reversed from an early low of 1.5649 against the

greenback and rose to a 2-day high of 1.5681. If the

pound-greenback pair extends rise, 1.58 is seen as its next

resistance level.

Looking ahead, at 10:00 am ET, Fed's Charles Evans will give

opening remarks in Chicago.

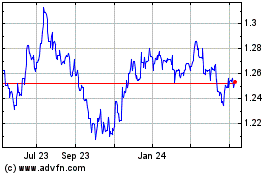

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024