U.S. Dollar Declines Ahead Of Fed Decision

January 28 2015 - 6:23AM

RTTF2

The U.S. dollar slipped against its major rivals in European

deals on Wednesday, as traders await the outcome of a 2-day

monetary policy meeting by the Federal Reserve later in the day,

amid hopes that it would be patient in raising rates.

Most economists expect the Fed to adhere to its December

meeting's stance of remaining patient as it considers when to raise

rates. At the December news conference, Fed Chair Janet Yellen told

reporters that the first increase won't happen for at least couple

of meetings or before April.

Although the U.S. economy has shown steady improvement,

inflation has been falling below the Fed's target rate, due to

plunging oil prices and a surging dollar. Since the December FOMC

meeting, the U.S. economic data has been inconsistent, raising

doubts among investors regarding whether the bank may further delay

its rate hike.

The currency was lower against most major currencies on Tuesday,

following an unexpected drop in durable goods orders in

December.

New orders for U.S. manufactured durable goods unexpectedly

showed a substantial decrease in the month of December, according

to a report released by the Commerce Department. The drop was

partly due to a sharp decline in orders for transportation

equipment.

Traders focus on U.S. GDP data due Friday, for further clues

about the economy's strength. Economists call for an increase of

3.0 percent on year in the fourth quarter, after the 5.0 percent

growth recorded in the third quarter.

Retreating from an early high of 0.9089 against the Swiss franc,

the greenback fell to 0.8987. The next possible support for the

greenback-franc pair is seen around the 0.85 zone.

Swiss consumption indicator increased in December as new car

registrations surged, a report from the global financial services

firm UBS showed.

The UBS consumption indicator climbed to 1.42 in December from

1.29 in November.

The greenback edged down to 117.54 against the Japanese yen,

after advancing to 118.25 around 8:30 pm ET. If the greenback-yen

pair extends slide, it may find support around the 116.00

level.

The greenback, which strengthened to 1.5153 against the Sterling

in early deals, dropped to 1.5213. On the downside, 1.55 is seen as

the greenback's next support level.

The greenback fell back against the euro, trading around the

1.138 level. Continuation of the greenback's downtrend may take it

to a support around the 1.25 mark.

Germany's import prices declined at a faster-than-expected pace

in December, figures from the statistical office Destatis

showed.

The import price index fell 3.7 percent year-on-year in

December, faster than November's 2.1 percent decline.

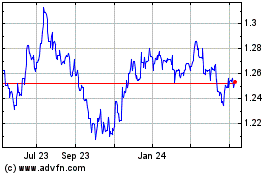

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024