Pound Mixed After U.K. Retail Sales Data

March 26 2015 - 7:42AM

RTTF2

The pound traded mixed against its major rivals in European

deals on Thursday, after the release of U.K. retail sales data in

February.

While the pound rose against the greenback and the yen after

better-than-expected retail sales data, it was lower against the

franc and the euro due to escalating conflict in Yemen.

British retail sales growth accelerated more than expected in

February, data from the Office for National Statistics showed.

Retail sales volume increased at a faster pace of 0.7 percent in

February from January, when it gained 0.1 percent. The monthly

growth exceeded a 0.4 percent increase forecast by economists.

Sales excluding auto fuel also increased 0.7 percent and

reversed January's 0.3 percent fall. It was forecast to rise by 0.4

percent.

On a yearly basis, retail sales including automotive fuel rose

5.7 percent in February, slower than a 5.9 percent rise seen in

January.

European stocks are trading in a negative territory, as Saudi

Arabia and other Gulf states began air strikes against Houthi

fighters in Yemen's capital. The Iran-backed rebels are reportedly

besieging Aden, the country's second largest city, but forces loyal

to the President say that they recaptured the city airport on

Thursday after heavy fighting with Houthi fighters.

The pound added 0.8 percent to hit a weekly high of 1.4993

against the dollar, from its previous low of 1.4871. If the

pound-dollar pair extends rise, it is likely to find resistance

around the 1.50 zone.

The pound bounced off to 177.52 against the yen, up by 0.6

percent from a new 7-week low of 176.47 hit at 2:45 am ET.

Extension of the pound's uptrend may take it to a resistance

surrounding the 180.00 zone.

Although the pound edged up to 0.7356 against the euro

immediately after the data, it fell back in a short while. The pair

was trading at 0.7380, compared to Wednesday's closing value of

0.7369.

German consumer confidence is set to improve in April, survey

data from the market research group GfK showed.

The forward-looking consumer sentiment index rose to 10 in April

from 9.7 points in March. The index was expected to rise marginally

to 9.8.

The pound moved down to a 2-day low of 1.4205 against the Swiss

franc, compared to 1.4275 hit at Wednesday's close. The pound is

seen finding support around the 1.40 mark.

In the New York session, U.S. weekly jobless claims for the week

ended March 21 and Markit's U.S. PMI reports for March are slated

for release.

At 9:00 am ET, U.S. Federal Reserve Bank of Atlanta President

Dennis Lockhart will deliver a speech about the economic outlook

and monetary policy at the Engage International Investment

Education Symposium, in Detroit.

Subsequently, European Central Bank president Mario Draghi will

address the Italian parliament's finance and EU policy committees

in Rome at 9:15 am ET. After 15 minutes, Bank of Canada Governor

Stephen Poloz is expected to speak at the Canada-UK Chamber of

Commerce, in London.

Swiss National Bank member Fritz Zurbrugg will deliver a speech

about monetary policy after the cap at the Money Market Event, in

Zurich at 1:00 pm ET. Half-an-hour later, Bank of England Governor

Mark Carney will hold a press conference about his role as Chair of

the Financial Stability Board, in Frankfurt.

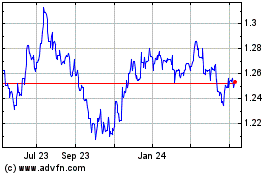

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024