Euro Mixed Following Eurozone PMI

April 01 2015 - 5:25AM

RTTF2

The euro showed mixed trading against the other major currencies

in the early European session on Wednesday, following the release

of Eurozone PMI for March.

Data from Markit Economics showed that Eurozone manufacturing

sector expanded more than initially estimated as growth accelerated

in Germany, Spain, Italy and the Netherlands. The Purchasing

Mangers' Index rose to a 10-month high of 52.2 in March from 51 in

February. The flash score was 51.9.

German manufacturing growth in March was faster than estimated

earlier, marking the strongest improvement in eleven months.

Markit/BME Germany Manufacturing Purchasing Managers' Index climbed

to 52.8 from 51.1 in February. The flash reading for the index was

52.4, released on March 24.

Italy's manufacturing sector expanded at the fastest pace in 11

months in March. The Markit/ADACI Purchasing Mangers' Index rose to

53.3 in March from 51.9 in February. This was the highest score

since April 2014. It was forecast to rise to 52.1.

In the Asian trading, the euro held steady against the other

major currencies.

In the early European trading, the euro rose to 0.7266 against

the pound, from an early low of 0.7229. If the euro extends its

uptrend, it is likely to find resistance around the 0.74 area.

Data from Markit Economics and the Chartered Institute of

Procurement & Supply showed that British manufacturing sector

expanded at the fastest pace in eight months during March on

stronger growth in production and new orders that led to increased

hiring. The Markit/CIPS Purchasing Managers' Index rose to 54.4

from 54 in February, which was revised down from 54.1. The latest

reading was in line with economists' expectations. Pulling away

from an early high of 1.0791 against the U.S. dollar, the euro

dropped to session's low of 1.0719. On the downside, 1.04 is seen

as the next support level for the euro.

The euro fell to 1.0429 against the Swiss franc, from an early

low of 1.0457. The euro may test support near the 1.01 region.

Data from the Credit Suisse showed that Switzerland's

manufacturing sector contracted for the third consecutive month in

March. Although the procure.ch Purchasing Managers' Index rose to

47.9 in March from 47.3 in February, the score was below 50

indicating contraction in the sector. The reading was expected to

rise to 47.5.

Against the yen, the euro slipped to 128.75 around 3:45 am ET,

from an early high of 129.44. Thereafter, the euro held steady

against the yen.

Data from Markit Economics showed that Japan's manufacturing

sector slowed in March but continued to expand, with a PMI score of

50.3. That's down from 51.6 in February, although it remains barely

above the boom-or-bust line of 50 that separates expansion from

contraction.

Looking ahead, U.S. ADP private sector employment data, U.S. ISM

manufacturing PMI and Canada RBC manufacturing PMI- all for March

are slated for release in the New York session.

At 9:00 am ET, U.S. Federal Reserve Bank of San Francisco

President John Williams will participate in a panel discussion

titled "Financial Stability: How Essential Financial Stability be

to Central Banks?" at the Federal Reserve Bank of Atlanta's

financial markets conference "Central Banking in the Shadows:

Monetary Policy and Financial Stability Post crisis," in Stone

Mountain.

About an hour and a half later, at the same conference in Stone

Mountain, U.S. Federal Reserve Bank of Atlanta President Dennis

Lockhart will participate in a panel discussion titled "Monetary

Policy: Will the Traditional Banking Channel Remain Central to

Monetary Policy?".

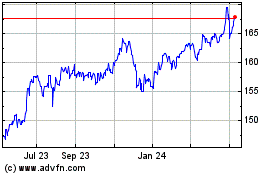

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

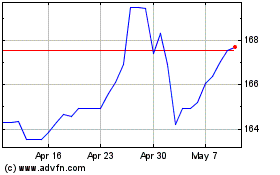

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024