Pound Advances As U.K. House Prices Rise To 5-month High

April 16 2015 - 8:16AM

RTTF2

The pound firmed against its major rivals in European deals on

Thursday, as a survey showed that U.K. house prices rose at the

fastest rate in five months for March.

The latest survey from the Royal Institution of Chartered

Surveyors revealed early in the day that U.K. house price balance

rose to 21 percent on a monthly basis in March, mainly due to the

shortage of available properties.

The figure beat expectations for a score of 15 percent after

coming in at 14 percent in February.

U.K. labour market data is due tomorrow, with economists

expecting the jobless rate to tick down to 5.6 percent for the

three months through February, from 5.7 percent in three months

ending November. Claimant count is expected to have dropped to

29,500 in March from 31,000 last month.

Meanwhile, European markets are trading in a negative territory,

amid worries about Greece. Standard & Poor's Ratings Services

cut its credit ratings on Greece deeper into junk territory, saying

it expects the country's debt and other financial commitments to be

"unsustainable" without deep economic reform.

The pound exhibited mixed trading in the previous session. While

the pound rose against the euro and the yen, it dropped against the

greenback and the franc.

The pound hit a 1-week high of 177.81 against the yen and an

8-day high of 1.4939 against the dollar, compared to yesterday's

closing values of 176.77 and 1.4837, respectively. The next

possible resistance for the pound may be located around 178.00

against the yen and 1.50 against the greenback.

The pound rebounded to 1.4401 against the Swiss franc, from an

early 2-day low of 1.4283, and held steady thereafter. The pair was

valued at 1.4309 at yesterday's close.

The pound hit a 4-week high of 0.7163 against the euro at 3:45

am ET before stabilising in subsequent deals. This may be compared

to an early 2-day low of 0.7230. At Wednesday's close, the pair was

worth 0.7196.

Looking ahead, U.S. building permits and housing starts - both

for March, U.S. weekly jobless claims for the week ended April 11

and Reserve Bank of Philadelphia's manufacturing index for April

are slated for release in the New York session.

At 1:00 am ET, Federal Reserve Bank of Atlanta President Dennis

Lockhart will deliver a speech about the US economic outlook and

monetary policy at the Palm Beach County Convention Center.

After 10 minutes, Federal Reserve Bank of Cleveland President

Loretta Mester will speak on the economy before the Forecasters

Club of New York.

Subsequently, Federal Reserve Bank of Boston President Eric

Rosengren participates in "The U.S. Economic Outlook and

Implications for Monetary Policy" event hosted by Chatham House in

London at 1:30 pm ET.

At 3:00 pm ET, Federal Reserve Governor Stanley Fischer will

participate in a panel discussion titled "The Elusive Pursuit of

Inflation" at the International Monetary Fund Spring Meetings in

Washington DC at 3:00 pm ET.

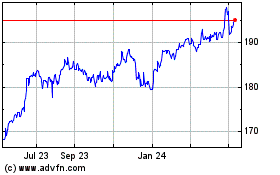

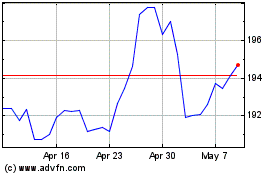

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024