Euro Recovers On Reports Of Greek PM Tsipras Reconsidering Junker's Proposal

June 30 2015 - 7:10AM

RTTF2

The euro came off from its early lows against the other major

currencies in European deals on Tuesday, as a media report

indicated that Greek Prime Minister Alexis Tsipras is examining the

latest aid proposal made by European Commission President

Jean-Claude Juncker.

According to Greek daily Kathimerini, Greek PM's office

intimated Brussels that they are working on new proposal of Junker

which included debt relief in October and changes in the EKAS

supplement (for low-income Greeks)

The offer, which was published on Sunday, requires the Greek PM

to pledge "Yes" campaign for the planned July 5 referendum, while

conveying a written acceptance of the proposed plan to the lenders

today.

Meanwhile, the European stocks are trading in a negative

territory, amid uncertainty about the future of Greece in euro

area, after Greece said that it won't make the 1.6 billion euro

debt payment to the International Monetary Fund due today.

In economic front, the flash data from Eurostat showed that

Eurozone inflation slowed slightly in June after accelerating in

May.

Inflation eased to 0.2 percent in June, in line with forecast,

from 0.3 percent in the prior month.

Another report from Eurostat showed that the unemployment rate

remained unchanged at 11.1 percent in May. This was the lowest rate

recorded in the euro area since March 2012. It came in line with

expectations.

The currency drifted lower in the Asian session, due to Greece

debt default fears.

The euro bounced off to 1.1205 against the greenback, 137.24

against the yen and 0.7126 against the pound, from its early lows

of 1.1133, 135.87 and 0.7081, respectively. The euro ended Monday's

trading at 1.1234 against the greenback, 137.65 against the yen and

0.7139 against the pound.

The euro was trading at 1.0414 against the franc, moving away

from its previous low of 1.0371. The pair was valued at 1.0391 at

yesterday's close.

Looking ahead, Canada GDP for April, U.S. S&P/Case-Shiller

home price index for April, U.S. Chicago PMI and U.S. consumer

confidence, both for June, are set to be published in the New York

session.

At 7:00 am ET, Bank of England Chief Economist Andy Haldane is

expected to speak at the Open University in London.

An hour later, European Central Bank Governing Council member

Ewald Nowotny will give a keynote speech at "Raiffeisen Bank

International-Summer Talk" in Vienna.

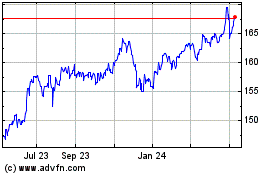

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

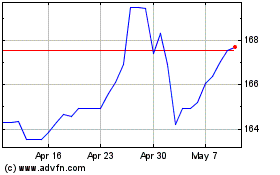

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024