U.S. Dollar Extends Gain

August 05 2015 - 2:04AM

RTTF2

The U.S. dollar continued to be strong against the other major

currencies in the Asian session on Wednesday, in the wake of

comments from Atlanta Federal Reserve President Dennis Lockhart

that Fed policy makers are prepared to raise the Fed-funds rate in

September.

In an interview with The Wall Street Journal, Lockhart told that

it would take "a significant deterioration in the economic picture"

to persuade the Fed not to raise rates in September. He also said

that only a "significant deterioration" in economic momentum could

convince him to wait longer.

Lockhart's words raised strong belief that the Fed is moving

closer to raising interest rates at its September meeting.

The U.S. Commerce Department revealed Tuesday that factory

orders rose 1.8 percent in June compared to the previous month.

Economists were predicting an increase of 1.7 percent. In May,

factory orders were lower by 1.1 percent.

Tuesday, the U.S. dollar rose 0.63 percent against the euro,

0.15 percent against the pound, 0.89 percent against the Swiss

franc and 0.10 percent against the yen.

In the Asian trading today, the U.S. dollar rose to an 11-year

high of 1.3212 against the Canadian dollar and nearly a 4-month

high of 0.9789 against the Swiss franc, from yesterday's closing

quotes of 1.3190 and 0.9781, respectively. If the greenback extends

its uptrend, it is likely to find resistance around 1.34 against

the loonie and 0.98 against the franc.

Against the euro and the NZ dollar, the greenback advanced to

more than 2-week highs of 1.0847 and 0.6517 from yesterday's

closing quotes of 1.0879 and 0.6536, respectively. The greenback

may test resistance near 1.07 against the euro and 0.63 against the

kiwi.

The greenback climbed to a 9-day high of 1.5525 against the

pound and a 6-day high of 124.47 against the yen, from yesterday's

closing quotes of 1.5558 and 124.37, respectively. On the upside,

1.54 against the pound and 126.00 against the yen are seen as the

next resistance levels for the greenback.

Against the Australian dollar, the greenback edged up to 0.7352

from yesterday's closing value of 0.7377. The greenback is likley

to find resistance around the 0.72 area.

Meanwhile, the euro fell to more than a 2-week low of 0.6979

against the pound, from yesterday's closing quote of 0.6989. The

euro may test support near the 0.68 region.

Against the yen and the Australian dollar, the euro dropped to

2-week lows of 135.02 and 1.4735 from yesterday's closing quotes of

135.32 and 1.4742, respectively. If the euro extends its downtrend,

it is likely to find support around 134.00 against the yen and 1.44

against the aussie.

The euro slipped to a 5-day low of 1.4322 against the Canadian

dollar, from yesterday's closing value of 1.4349. On the downside,

1.41 is seen as the next support level for the euro.

Against the Swiss franc and the NZ dollar, the euro edged down

to 1.0621 and 1.6611 from yesterday's closing quotes of 1.0641 and

1.6625, respectively. The euro is likely to find support around

1.04 against the franc and 1.63 against the kiwi.

Looking ahead, service sector PMI reports from major European

economies for July and Eurozone retail sales for June are due to be

released in the European session.

In the New York session, U.S. private sector jobs data for July,

trade balance for June, U.S. services PMI for July and Canada trade

data for June are slated for release.

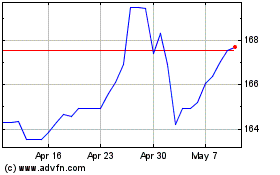

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

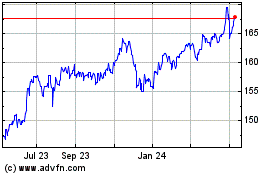

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024