IMF Cuts Forecasts Saying Global Growth "Moderate And Uneven"

October 06 2015 - 6:57AM

RTTF2

Global growth remains 'moderate and uneven' amid the modest

pick-up in advanced economies and the slowdown in emerging markets,

and the more pronounced downside risks call for policy action to

boost economic expansion, the International Monetary Fund said, as

it cut its world growth forecasts for this year and next.

In its latest World Economic Outlook (WEO), the Washington-based

lender lowered the global growth forecast for this year to 3.1

percent from 3.3 percent. The outlook for next year was slashed to

3.6 percent from 3.8 percent. In 2014, the world economy grew 3.4

percent.

The WEO report was released on Tuesday in the Peruvian capital

Lima, where the IMF is holding its 2015 Annual Meetings between

October 9 and 11.

"Six years after the world economy emerged from its broadest and

deepest postwar recession, the holy grail of robust and

synchronized global expansion remains elusive," Maurice Obstfeld,

the IMF Economic Counsellor and Director of the Research

Department, said.

"Despite considerable differences in country-specific outlooks,

the new forecasts mark down expected near-term growth marginally

but nearly across the board. Moreover, downside risks to the world

economy appear more pronounced than they did just a few months

ago."

In this global environment, with the risk of low growth for a

long time, the report highlights the need for policymakers to raise

actual and potential growth, the IMF said.

Growth forecasts for advanced economies were cut to 2 percent

from 2.1 percent for this year and to 2.2 percent from 2.4 percent

for next year.

Projection for the U.S. economy for this year was raised to 2.6

percent from 2.7 percent, while that for next year was lowered to

2.8 percent from 3 percent.

Euro area growth forecast for this year was retained at 1.5

percent, while the outlook for next year was cut to 1.6 percent

from 1.5 percent.

Among the big four, Germany's projection for both years were

lowered, while those of France and Spain were retained, and Italy's

outlook was raised.

Growth forecasts for Japan and Canada for both years were

lowered, while the UK's projection for this year was boosted to 2.5

percent and the outlook for next year was retained at 2.2

percent.

Overall emerging market growth was forecast to ease to 4 percent

this year from 4.6 percent in 2014. However, it was seen rebounding

to 4.5 percent next year.

The projected rebound in growth in emerging market and

developing economies in 2016 reflects not a general recovery, but

mostly a less deep recession or a partial normalization of

conditions in countries in economic distress this year, spillovers

from the stronger pickup in activity in advanced economies, and the

easing of sanctions on Iran, the IMF said.

Further, the lender noted that external conditions are becoming

more difficult for most emerging economies, but many have increased

their resilience to external shocks and are now in a stronger

position to manage heightened volatility.

China's growth projections were retained at 6.8 percent and 6.3

percent, respectively. Meanwhile, India's growth forecast for this

year was cut to 7.3 percent from 7.5 percent, while the projection

for next year was retained at 7.5 percent.

Brazil's projections were severely slashed to 3 percent

contraction this year and 1 percent output decline next year.

Russia also had its outlook lowered to 3.8 percent contraction for

this year and 0.6 percent in 2016.

South Africa was forecast to log 1.4 percent growth this year

and 1.3 percent next year. Oil-exporter Saudi Arabia's growth

outlook for this year was boosted to 3.4 percent from 2.8 percent,

but the forecast for next year was cut to 2.2 percent from 2.4

percent.

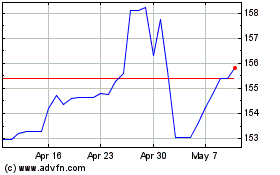

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

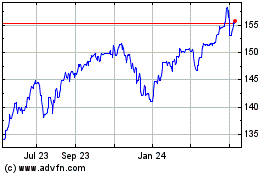

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024