Euro Rises Ahead Of ECB Minutes

October 08 2015 - 1:37AM

RTTF2

The euro strengthened against most major currencies in the early

European session on Thursday, as traders await the release of the

European Central Bank's minutes of the monetary policy meeting in

September, due later in the day.

The minutes could provide more insights regarding Governing

Council's discussion of additional stimulus, given slowing global

growth and low inflation.

Moreover, U.S. jobless claims figures, the minutes from the

Fed's September meeting and speeches from Fed officials John

Williams, James Bullard and Narayana Kocherlakota are also largely

awaited for further clues on the outlook for Fed policy.

Although the currency trimmed some of its gains after after weak

German data, it climbed back in a short while.

Data from Destatis showed that Germany's exports declined at the

fastest pace in more than six years in August. Exports plunged by

seasonally adjusted 5.2 percent month-on-month in August, reversing

a 2.2 percent rise in July. This was the biggest decline since

January 2009, when it slid 6.9 percent. At the same time, imports

dropped 3.1 percent, in contrast to a 2.3 percent rise seen a month

ago.

The trade surplus decreased to around EUR 19.6 billion from EUR

22.4 billion in July.

In Greece, the nation's Prime Minister Alexis Tsipiras won the

confidence vote, targeting to pass his key reform laws to revive

the economy ahead of a crucial first review of its international

bailout.

In the Asian session today, the euro held steady against its

major rivals.

In the early European trading, the euro rose to a 6-day high of

1.1309 against the U.S. dollar, from an early low of 1.1234. If the

euro extends its uptrend, it is likely to find resistance around

the 1.15 area.

Against the pound, the yen and the NZ dollar, the euro advanced

to 0.7379, 135.36 and 1.7124 from early lows of 0.7334, 134.72 and

1.6953, respectively. The euro may test resistance near 0.74

against the pound, 136.00 against the yen and 1.75 against the

kiwi.

Against the Australian and the Canadian dollars, the euro

climbed to a 2-day high of 1.5761 and a 3-day high of 1.4761 from

early lows of 1.5575 and 1.4667, respectively. On the upside, 1.60

against the aussie and 1.50 against the loonie are seen as the next

resistance levels for the euro.

Meanwhile, the euro fell to 1.0915 against the Swiss franc, from

an early 9-day high of 1.0948. The euro is likely to find support

around the 1.08 region.

Data from the State Secretariat for Economic Affairs or SECO

showed that Switzerland's unemployment rate rose in September in

line with economists' expectations. The seasonally adjusted jobless

rate climbed to 3.4 percent from 3.3 percent in August.

Looking ahead, in the European session, the Bank of England will

announce its interest rate decision at 7:00 am ET. Economists

expect the bank to retain interest rates unchanged at 0.50 percent

and asset purchase target at GBP 375 billion.

Half-an-hour later, European Central Bank minutes of the

September monetary policy meeting is slated for release.

In the New York session, Canada housing starts for September and

house price index for August and U.S. weekly jobless claims for the

week ended October 3, are set to be released.

At 9:30 am ET, Federal Reserve Bank of St. Louis President James

Bullard gives welcome remarks before the Children's Saving Account

Symposium hosted by the Federal Reserve Bank of St. Louis.

At 2:00 pm ET, Federal Reserve releases minutes from September

16-17 FOMC meeting.

At the same time, Bank of England Governor Mark Carney will

participate in a panel discussion about the global economy at the

International Monetary Fund meeting, in Lima.

At 3:30 pm ET, Federal Reserve Bank of San Francisco President

John Williams is expected to speak about the economic outlook at

the Spokane Business and Community Leaders' Luncheon, in San

Francisco.

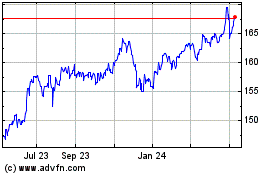

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

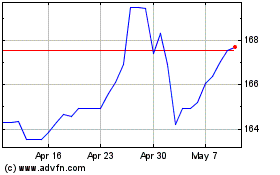

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024