Pound Lower As BoE Governor Carney Confirms Low Interest Rate Stance

November 24 2015 - 2:23AM

RTTF2

The pound continued to be lower in European deals on Tuesday,

after the Bank of England chief Mark Carney signaled that the

prolonged low interest rate environment would likely remain for

some time.

Speaking to the Treasury Select Committee, Carney indicated that

the U.K. will have low interest rates "for some time," and "even

with limited and gradual rate increases it still will be a

relatively low interest rate environment."

Chief Economist Andy Haldane, who appeared alongside Carney in

Parliament, warned that the world economy faces "headwinds" from

the slowdown in emerging markets.

Haldane also cautioned that monetary policy may need to be

lowered, instead of tightening, in the short term.

The European markets fell, as a slump in commodity prices

continued, after Turkey gunned down a Russian jet near the border

with Syria.

According to Turkey, pilots of the Russian jet ignored repeated

warnings about Turkish airspace violation. Meanwhile, Russia's

Defense Ministry denied that the aircraft had left Syrian airspace,

but said one of the planes crashed in the country.

In Asian deals, the pound showed mixed performance against its

major rivals. While the pound held steady against the euro and the

yen, it rose against the greenback and the franc.

In European deals, the pound depreciated to a 2-week low of

1.5101 against the dollar, down from a high of 1.5156 hit at 2:20

am ET. The pair was valued at 1.5123 when it ended Monday's

trading. The pound is seen finding support around the 1.50

level.

Pulling away from an early high of 1.5438 against the Swiss

franc, the pound slipped by 0.40 percent to a weekly low of 1.5377.

The next possible support for the pound may be found around the

1.527 region. The pound-franc pair ended Monday's trading at

1.5392.

The pound remained near a 3-week low of 185.14 against the

Japanese yen, after having advanced to 186.01 at 2:00 am ET. On the

downside, 184.00 is possibly seen as the next support level for the

pound. At Monday's close, the pair was valued at 185.71.

Japan's manufacturing activity expanded at the fastest pace in

twenty months in November, as output growth quickened, according to

flash survey from Markit Economics.

The Markit/ Nikkei Manufacturing Purchasing Managers' Index, or

PMI, rose to 52.8 in November from 52.4 in October. A score above

50 indicates expansion in the sector.

The pound was trading at 0.7044 against the euro, hovering

around an 8-day low of 0.7053 of hit at 4:00 am ET. The pound is

poised to challenge support around the 0.715 area. The euro-pound

pair was valued at 0.7031 at Monday's close.

Results of a survey by the Ifo Institute showed that German

business confidence strengthened unexpectedly in November.

The business climate index rose to 109 in November from 108.2 in

October. It was expected to remain unchanged at 108.2.

Looking ahead, preliminary third quarter U.S. GDP data, U.S.

S&P/Case-Shiller home price index for September, U.S. Richmond

Fed manufacturing index for November and U.S. consumer confidence

index for November are set to be announced in the New York

session.

At 3:30 pm ET, Bank of Canada Deputy Governor Lynn Patterson

will give a presentation as part of the bank's regional outreach

program at the University of Regina in Canada.

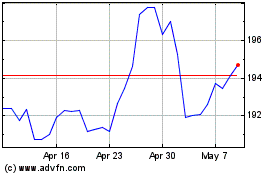

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

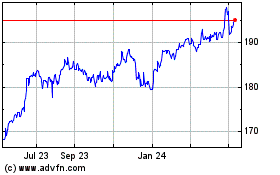

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024