LONDON MARKETS: FTSE 100 Stuck In Tight Range After Last Week's Selloff

February 08 2016 - 4:12AM

Dow Jones News

By Sara Sjolin, MarketWatch

Randgold lifts dividends

U.K. stocks on Monday struggled for direction after last week's

selloff, with oil and mining shares pushing higher on the back of

rising resource prices, while Rolls-Royce slumped ahead of

releasing earnings.

The FTSE 100 index slipped 0.2% to 5,838.08, but swung in and

out of losses. The index ended last week

(http://www.marketwatch.com/story/uk-stocks-wobble-as-miners-lose-hold-on-gains-2016-02-05)

down 3.9%, its largest week slide since early January, after a

mixed U.S. jobs report, jitters in the oil market and a dovish Bank

of England quarterly inflation report.

Shares of Randgold Resources Ltd. (RRS.LN) (RRS.LN) were among

biggest advancers in the London benchmark, up 3.1%, after the gold

miner said it's lifting its dividend

(http://www.marketwatch.com/story/randgold-lifts-dividend-after-record-output-2016-02-08).

The West African miner also reported record output and forecast

higher production for 2016.

Other mining companies were also on the rise, tracking solid

gains across most metals. Glencore PLC (GLEN.LN) (GLEN.LN) gained

3.7%, Rio Tinto PLC (RIO) (RIO) (RIO) added 3.1%, and BHP Billiton

PLC (BLT.LN) (BHP.AU) (BHP.AU) climbed 2.7%.

Oil prices jumped, pushing London-listed energy companies higher

too. Shares of Royal Dutch Shell PLC (RDSB.LN) (RDSB.LN) rose 0.8%,

BG Group PLC (BG.LN) gained 0.7%, and Tullow Oil PLC (TLW.LN)

picked up 0.5%.

On a more downbeat note, shares of Rolls-Royce Holdings PLC

(RR.LN) (RR.LN) dropped 2.1% ahead of its earnings release on

Friday. The aerospace and defense company is tipped to announce a

dividend cut, said Tony Cross, market analyst at Trustnet Direct,

in a note.

BT Group PLC (BT.A.LN) fell 0.7% after the telecom company said

its looking for a new finance director to succeed Tony

Chanmugam.

HSBC Holdings PLC (HSBA.LN) (HSBA.LN) (HSBA.LN) lost 1.2% after

British newspaper the Telegraph reported the bank is expected to

decide this week

(http://www.telegraph.co.uk/finance/newsbysector/epic/hsba/12145047/HSBC-to-stay-in-London-as-board-meets-for-final-decision-on-HQ.html)

whether to move its headquarters outside the U.K.

Investing Insights: A global markets survival guide

If you'll be in London on Tuesday, Feb. 23, you're invited to

join us for an evening of cocktails and conversation on the topics

of shifting monetary policy, growth, currencies, and the outlook

for investing opportunities and risks in European and global

markets.

Our panelists for the evening will include MarketWatch Personal

Finance and Investing Columnist Robert Powell; Mark Hulbert, Editor

of the Hulbert Financial Digest; and Virginie Maisonneuve, Founder

and Managing Director of Maisonneuve Global Advisors.

The event is free and open to the public, but reservations are

required. For more information or to RSVP for the event, please

email (MarketWatchevent@wsj.com).

(END) Dow Jones Newswires

February 08, 2016 03:57 ET (08:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

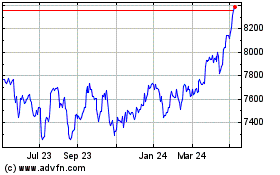

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

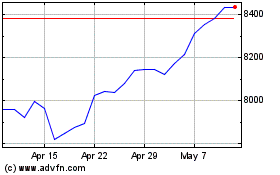

FTSE 100

Index Chart

From Apr 2023 to Apr 2024