LONDON MARKETS: FTSE 100 Heads For 3rd Straight Loss As Shares Of LSE, BHP Tumble

May 04 2016 - 8:56AM

Dow Jones News

By Carla Mozee, MarketWatch

U.K. construction PMI at lowest since 2013

U.K. stocks were hit hard Wednesday as shares of the London

Stock Exchange Group PLC and mining heavyweight BHP Billiton PLC

pushed the blue-chip benchmark toward a third consecutive

decline.

The FTSE 100 lost 1.2% to 6,112.91, with only the industrial

sector posting gains. The index on Tuesday dropped 0.9%

(http://www.marketwatch.com/story/ftse-100-drives-toward-lowest-in-nearly-a-month-as-miners-sink-2016-05-03)

and marked its lowest close since April 7.

Shares of London Stock Exchange (LSE.LN) descended to the bottom

of benchmark during afternoon trade, falling 9.8%. The stock was on

track for its sharpest drop since November 2008 after

Intercontinental Exchange Inc. (ICE), which runs the New York Stock

Exchange, decided against making a bid to acquire LSE.

LSE and Germany's Deutsche Boerse AG (DB1.XE) agreed in March to

merge, with the deal expected to establish Europe's largest

stock-exchange operator.

Also circling the bottom of the index was iron-ore heavyweight

BHP Billiton PLC (BLT.LN) (BHP.AU) (BHP.AU) as shares dropped 6.4%.

The move came after Brazilian federal prosecutors filed a civil

lawsuit Tuesday over a catastrophic dam failure in November.

Prosecutors are seeking up to 155 billion reais ($43.55 billion)

(http://www.marketwatch.com/story/mining-firms-bhp-vale-face-44b-lawsuit-in-brazil-2016-05-03)

for cleanup and remediation.

The dam was run by Samarco Mineração, a joint venture between

BHP and Brazilian miner Vale SA (VALE5.BR) (VALE5.BR).

Elsewhere in the mining space, Randgold Resources Ltd. (RRS.LN)

posted a 13% rise in first-quarter profit

(http://www.marketwatch.com/story/randgold-profit-rises-on-higher-gold-output-2016-05-04-24853252),

but the gold miner's shares slid 7.8%.

Meanwhile, shares of Royal Dutch Shell PLC (RDSB.LN) (RDSB.LN)

shed 2.2%. The oil major said quarterly adjusted earnings fell to

$1.6 billion

(http://www.marketwatch.com/story/shell-profit-falls-but-beats-forecasts-2016-05-04-34851723)

from $3.7 billion a year earlier, but that still beat analysts'

expectations.

Grocers: Also in the red were shares of J Sainsbury (SBRY.LN).

They fell 5% after the grocer cut its dividend payout

(http://www.marketwatch.com/story/sainsbury-cuts-dividend-payout-2016-05-04)

in a continued effort to manage costs. The U.K.'s second-largest

grocer by market share swung to a fiscal year pretax profit of

GBP548 million.

Separately, a survey from Kantar showed the top four U.K.

grocers lost market share

(http://www.marketwatch.com/story/top-four-uk-grocers-lose-market-share-2016-05-04)during

the 12 weeks ended April 24 to German discounters Aldi and Lidl.

Shares of Tesco PLC (TSCO.LN)(TSCO.LN) and Wm Morrison Supermarkets

PLC (MRW.LN) fell 3.4% and 2.3%, respectively.

But topping the FTSE 100 was Next PLC (NXT.LN), driving up 6.2%.

The apparel and household retailer cut its full-year forecast and

posted a quarterly decline in brand sales. But a more than 4% rise

in sales in its directory business helped lift Next's shares, said

Hargreaves Lansdown in a note.

Direct Line Insurance Group PLC (DLG.LN) gained 0.3% as the

company said quarterly gross premiums for ongoing operations rose

by 4.2%

(http://www.marketwatch.com/story/direct-line-quarterly-gross-premiums-rise-42-2016-05-04).

The pound switched slightly higher against the dollar, buying

$1.1502. Sterling had declined after a Markit/CIPS report said U.K.

construction activity slumped to the lowest since 2013 in April, to

a reading of 52.0. Analysts polled by FactSet had expected a

reading of 54.

(END) Dow Jones Newswires

May 04, 2016 08:41 ET (12:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

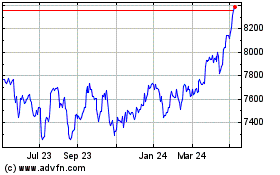

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

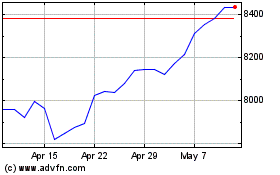

FTSE 100

Index Chart

From Apr 2023 to Apr 2024