Pound At Multi-day Versus Dollar As U.K. Services Growth Slows

May 05 2016 - 4:13AM

RTTF2

The pound fell to a multi-day low versus the U.S. dollar in

European trading on Thursday, after data showed that the U.K.

service sector activity expanded at the slowest pace in more than

three years in April.

The Chartered Institute of Procurement & Supply/Markit

services Purchasing Managers' Index fell to 52.3 in April from 53.7

in March. A reading above 50 indicates expansion.

The rate of expansion slowed for the third time in the past five

months and reached its lowest since February 2013. It also stayed

below the expected score of 53.5.

European markets are trading higher, amid a rebound in oil and

robust corporate earnings.

That said, the gains were tempered by lackluster data out of

China and the U.K. and the Ascension Day holiday in parts of

Europe.

Investors await all-important U.S. monthly jobs report on Friday

for more clues on the state of the economy.

The economy is expected to create 200,000 jobs in April, while

the unemployment index is expected to edge down to 4.9 percent.

The currency was moderately higher in Asian deals, buoyed by a

rebound in oil.

The pound dropped to a 10-day low of 1.4444 against the dollar,

after having advanced to 1.4529 at 2:30 am ET. If the pound-dollar

pair extends slide, 1.43 is likely seen as the next support

level.

The pound pared gains to 154.88 against the yen, from an early

high of 155.86. The pound is seen finding support around the 152.5

mark.

Although the pound eased from a 2-day high of 0.7883 against the

euro after the data, it changed course in a short while and was

trading higher at 0.7887. The pair finished Wednesday's trading at

0.7921.

The European Central Bank said the economic recovery is expected

to proceed on domestic demand and investment but cautioned that the

recovery is weighed down by the ongoing balance sheet

adjustments.

"Domestic demand, in particular, continues to be supported by

the ECB's monetary policy measures," the bank said in its economic

bulletin.

The pound resumed its early rally against the franc, approaching

a 2-day high of 1.3972. On the upside, it may challenge resistance

around the 1.42 mark. The pair was worth 1.3876 when it ended

yesterday's trading.

Looking ahead, Canada building permits for March and U.S. weekly

jobless claims for the week ended April 30 are slated for release

in the New York session.

At 9:15 am ET, ECB Vice President Vitor Constancio speaks on

"Re-Inventing the Role of Central Banks in Financial Stability", in

Ottawa.

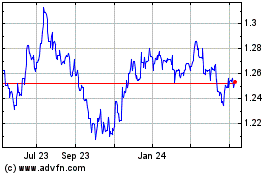

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024