Dollar Higher As Upbeat Data Underscores Fed Rate Hike Bets

May 26 2016 - 5:09AM

RTTF2

The U.S. dollar was trading higher against most major rivals in

European deals on Thursday, after data showed that durable goods

orders surged in April and weekly jobless claims declined more than

expected last week, heightening speculation that Fed will raise

rates as soon as June.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits decreased for the second straight week

in the week ended May 21st.

The report said initial jobless claims fell to 268,000, a

decrease of 10,000 from the previous week's unrevised level of

278,000. Economists had expected claims to edge down to

275,000.

Data from the Commerce Department showed that U.S. durable goods

orders surged up much more than expected in April, partly led by a

jump in orders for commercial aircraft and parts.

The durable goods orders spiked up by 3.4 percent in April,

beating forecasts for a 0.3 percent gain.

The U.S. pending home sales are due shortly, while Fed governor

Jerome Powell will speak on the economy and monetary policy in

Washington D.C. at 12:15 pm ET.

The Fed Chair Janet Yellen speaks at Harvard University on

Friday, with investors aiming to get more clues about a U.S. rate

hike in June.

The greenback was lower against most major rivals in Asian

deals, as investors booked some profits from the currency's recent

rally.

The greenback advanced to 0.9927 against the Swiss franc, after

having fallen to a 3-day low of 0.9884 at 1:15 am ET. Continuation

of the greenback's uptrend may see it finding resistance around the

1.02 zone.

Preliminary data from the Federal Statistical Office showed that

production in the Swiss industry and construction sectors rose for

the first time in more than a year during the first quarter even as

turnover declined.

The second sector output, which includes industry and

construction, grew 1 percent year-on-year following 1 4.2 percent

decline in the final three months of last year.

Reversing from an early 2-day low of 1.1192 against the euro,

the greenback bounced off to 1.1159. The greenback is seen finding

resistance around the 1.10 mark.

The greenback recouped its early losses against the yen with the

pair trading at 109.96, off early 2-day low of 109.42. On the

upside, 112.00 is likely seen as the next resistance level for the

greenback.

On the flip side, the greenback held steady against the pound,

after bouncing off from its early new 3-week low of 1.4739. The

pair was worth 1.4695 when it finished yesterday's trading.

The second estimates from the Office for National Statistics

showed that the U.K. economy expanded as initially estimated in the

first quarter.

Gross domestic product grew 0.4 percent in the first quarter

from previous three months, unrevised from the estimate published

on April 27. It was slower than the 0.6 percent expansion posted in

the fourth quarter of 2015.

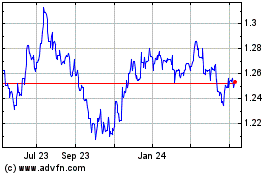

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024