By Jack Marshall

As the global advertising industry finishes up a week in the sun

at the Cannes Lions festival in France, executives awoke Friday

morning to news that Britain -- the largest advertising market in

Europe -- will be leaving the European Union.

The financial markets reacted quickly and negatively to the

development, with stock markets falling around the world and the

British pound plunging by more than 11%, on concerns about the

future of politics and economies across Europe.

The initial reaction from media and advertising executives was

one of uncertainty about what it could mean for their businesses

and indeed those of the clients that agencies are paid to

advise.

"Very disappointed, but the electorate has spoken," Martin

Sorrell, chief executive of London-based WPP said in a statement.

Mr. Sorrell had been a vocal proponent of remaining in the EU

leading up to the vote. "The resulting uncertainty, which will be

considerable, will obviously slow decision-making and deter

activity. This is not good news, to say the least."

Friday morning, British Prime Minister David Cameron said he

would step down within a few months, following an epic

miscalculation on his part.

"The PM's resignation clearly adds to the uncertainty," Mr.

Sorrell said. "However, we must deploy that stiff upper lip and

make the best of it."

Publicis Groupe SA Chief Executive Maurice Lévy was forced to

rip up a memo to staff Friday morning that praised the British

people for "making the right decision" in staying in the EU.

Instead, he drafted a second memo on his early morning flight with

a message for the U.K.: "We will stand by you."

Although he was hoping Britain would stay in, Mr. Lévy said that

the EU had botched issues ranging from the economy to what to do

with refugees.

"It's understandable that people are asking themselves what

Europe is for," he said. "It's not just to legislate on the

maturity of cheese and the size of eggs but that's what has

dominated the debate in recent years."

Before the vote, Mr. Lévy said he had done little to prepare for

a "Brexit" vote as he didn't want to give anyone the impression

that it was a genuine possibility. He also felt the two-year window

during which time the U.K. would renegotiate a new treaty to

replace EU membership would be ample time to make any adjustments

to its business.

Interpublic Group CEO Michael Roth sent an email to the

company's employees Friday morning predicting similar market

uncertainty as a result of the news.

"Yesterday's decision will undoubtedly lead to market volatility

in the short term, both in Europe, as well as globally. It's

important to remember that what does not change is the fact that

the U.K. is a vital cog in the world's economy, and that together

with our clients, we'll find footing in a post-Brexit world," Mr.

Roth wrote. "Longer-term, as long as open trade remains a priority,

markets should normalize, and that's the timeline we're focused

on."

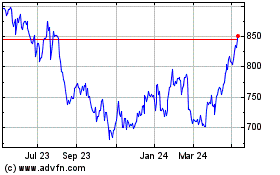

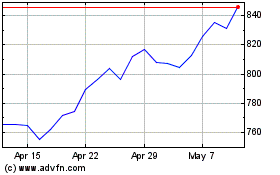

Stock prices for European advertising companies mirrored the

activity of the wider market Friday. U.K.-based WPP's share price

fell 4.1% Friday, while France-based Publicis Groupe and Havas

declined about 5% and 2.8%, respectively.

Following the U.K.'s decision, "it's unclear what will happen

with ad spend," Evercore analysts wrote in a research note,

highlighting that the U.K. represents 9% of revenue for Interpublic

and 10% for Omnicom. For WPP, it is about 15%, though Evercore

noted the company's reported revenue from other countries could

benefit from foreign-exchange weakness.

While they evaluate uncertainties about the structure and future

of their own businesses in Europe, agency executives say they are

also fielding questions from clients, who are also unsure of the

impact "Brexit" might have on their marketing activity there, if

any.

"This is completely uncharted territory we're in," said Johnny

Hornby, founder of agency group The & Partnership, speaking

Friday morning at a panel in Cannes hosted by The Wall Street

Journal.

"I've had clients emailing me worried about whether they will

invest in the U.K. if this happened," Mr. Hornby said.

Omnicom CEO John Wren said his company is focused on helping

clients navigate the changes and working closely with its U.K. and

European agencies.

"Over the course of time, we expect these uncertainties to be

resolved and our agencies, clients and consumers will adapt as

markets normalize, " he said in a prepared statement.

Media and advertising firms, like other corporations, have to

assess the impact of potential economic turmoil on their revenue as

well as the effect of currency fluctuations on that revenue.

For instance, Time Inc.'s U.K. arm generated 12% of the overall

company's $3.1 billion in revenue last year. Time Inc.'s shares

recently were down 4.3% in the U.S.

"What tends to happen during periods of market uncertainty and

shocks like this is that everybody assumes the worst, but the

reality is that the fundamentals usually aren't as bad as people

think," said Jaison Blair, a spokesman for Time Inc., which

publishes magazines such as Sports Illustrated and People. "A big

economy like the U.K.'s is far more resilient than people would

give credit."

Michael Bloomberg, founder of Bloomberg LP, also had a message

of resilience, saying the data and information company is committed

to maintaining operations in the U.K.

"We employ nearly 4,000 staff in the U.K., which is home to many

of our major clients. And our new London headquarters will open

next year. We will be in London for the long haul," he wrote in a

memo to clients. "Our priority is to continue to provide

outstanding client service as the U.K. and our clients begin a

transition period."

Many major U.S. media and entertainment companies have made a

concerted push in recent years to expand internationally,

particularly Discovery Communications Inc., which gets about half

of its revenue overseas.

Discovery, whose shares were down more than 6% Friday, said in a

memo that the U.K. has become one its biggest markets and "a

critical creative and business hub."

In reaction to the Brexit news, the company emphasized that its

currency-hedging program would "significantly minimize" the impact

of foreign exchange fluctuations on its financial results.

"We are accustomed to operating in an industry and a world where

change is constant," the company said in a prepared statement. "We

will work closely with U.K. and EU leaders to successfully navigate

this change and find new opportunities to shape our future."

--Nathalie Tadena, Nick Kostov, Jeffrey A. Trachtenberg, Lukas

I. Alpert and Joe Flint contributed to this article.

Write to Jack Marshall at Jack.Marshall@wsj.com

(END) Dow Jones Newswires

June 24, 2016 14:37 ET (18:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Wpp (LSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wpp (LSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024