Deutsche Börse, LSE to Push Ahead with Merger Despite 'Brexit' Vote--Update

June 24 2016 - 10:18PM

Dow Jones News

By Eyk Henning

FRANKFURT -- Deutsche Börse AG and London Stock Exchange Group

PLC Friday said they would push ahead with their planned $30

billion merger, after the U.K.'s vote to exit the European Union,

but people working on the deal fear that the companies could

struggle to win the backing of investors' and regulators.

A referendum committee consisting of six representatives of both

companies, including Deutsche Börse's Chairman Joachim Faber and

his LSE counterpart Donald Brydon, will in the coming days initiate

talks to assess the impact on the deal, the stock operators said in

a joint statement.

"We are convinced that the importance of the proposed

combination of Deutsche Börse and LSEG has increased even further

for our customers and will provide benefits for them as well as our

shareholders and other stakeholders," said Joachim Faber, Chairman

of the German company and head of both companies' referendum

committee.

Donald Brydon, chairman of the board of the LSE and designated

chairman of the combined group, added the merger represents a

compelling opportunity for both businesses despite the vote.

People familiar with the matter earlier Friday said those talks

will circle around a potential relocation of the planned

London-based holding company. Those people added they were

skeptical that both companies can agree on the issue without

delaying the transaction. The committee will likely take several

weeks if not months to make a recommendation over the deal.

Time is essential however, because LSE shareholders will vote on

the tie up at a meeting on July 4, and the tender offer for

Deutsche Börse shares is due to expire on July 12.

Uncertainty around the deal is weighing on both companies.

Deutsche Börse was down 4% at EUR74.77 ($85.13) while the LSE fell

13% to GBP23.80 (GBP35.4).

People familiar with the deal expect the steep plunge of LSE

shares may leave investors asking for a renegotiation of the merger

ratio. Shareholders in the German company were originally going to

receive 54.2% in the combined group, while LSE investors would have

been left with 45.8%. At least 75% of Deutsche Börse's shares need

to be tendered for the deal to go through.

The main impact [of a Brexit] would be the LSE/DB1 transaction

since it appears unlikely that the parties' shareholders are likely

to vote in favour of this transaction. We expect the spread to push

wider to 8-10% discount of LSE to DB1 as likelihood of the deal

ebbs," brokerage firm Market Securities said in a note to clients

Friday.

Additionally, German politicians and regulators have said that

they wouldn't give the deal their blessing should the U.K. leave

the EU because the combined entity would then be supervised by a

regulator located outside the EU. That appears to be a no-go for

German authorities.

The companies in their joint statement said they're in "ongoing

and constructive dialogue with the appropriate regulators and

authorities."

Industry observers said a possible solution was to let the deal

go ahead as planned and assure regulators that the company's base

would be moved to Frankfurt after closing of the transaction, which

was planned for the first quarter next year. But many observers

were skeptical about such a scenario because any relocation would

necessarily lead to a change in the planned management setup, a

time-consuming process that won't be resolved before LSE's July 4

shareholder meeting.

Under the current plan, Deutsche Börse's Chief Executive Carsten

Kengeter is poised to lead the combined group. An LSE

representative would likely have to lead the combined company,

however, to keep the powers of the so-called merger of equals in

balance.

In any case, both companies could attempt to strike a new deal

should the current one collapse. That could be complicated,

however, because the owner of the New York Stock Exchange,

Intercontinental Stock Exchange Inc., could come back with a bid

for LSE.

Write to Eyk Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

June 24, 2016 22:03 ET (02:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

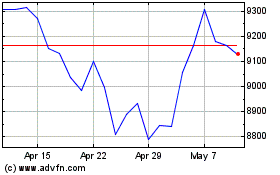

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024