LONDON MARKETS: FTSE 100 Ends At 2016 Closing High

July 27 2016 - 12:24PM

Dow Jones News

By Carla Mozee and Victor Reklaitis, MarketWatch

U.K. GDP expands in runup to Brexit vote

U.K. stocks scored a second straight day of gains Wednesday,

helped by upbeat earnings reports from companies such as ITV PLC

and home builder Taylor Wimpey PLC.

Investors also weighed the prospects for central-bank action, as

well as a reading on U.K. gross domestic product for the second

quarter that outstripped expectations. The preliminary reading was

in particular focus as it provided a snapshot of the economic

situation in the runup to and just after the Brexit

(https://brexit.efinancialnews.com/) referendum on June 23.

The FTSE 100 finished up 0.4% at 6,750.43, giving the blue-chip

index its highest close in 2016. The gauge -- which now stands at

levels last seen in August -- on Tuesday closed 0.2%

(http://www.marketwatch.com/story/ftse-100-edges-higher-as-sabmiller-gains-but-oil-major-bp-loses-ground-2016-07-26)

higher.

Trading got underway amid reports that Japanese Prime Minister

Shinzo Abe plans to introduce an economic stimulus plan worth more

than Yen28 trillion yen next week

(http://www.wsj.com/articles/japan-govt-mulling-issuance-of-50-year-debt-sources-1469589748).

And after the close of European trade, the U.S. Federal Reserve is

slated to release its policy decision. Expectations are for the Fed

to hold off on raising interest rates.

The "assessment of the Brexit risks to the U.S. and global

economy will be key to keeping the door open for any rate rise in

2016," said James Ruddiman, director of forex advisory at Audere

Solutions, in a note.

Read:Why the Fed may want to reach for the stock market's punch

bowl

(http://www.marketwatch.com/story/why-the-fed-may-want-to-lurch-for-the-punch-bowl-2016-07-26)

Movers: Earnings reports continued to roll in Wednesday.

ITV shares (ITV.LN) finished 6.8% higher after the company's

first-half net profit fell to GBP243 million ($319 million) on

costs, but revenue rose on the expansion of its production business

(http://www.marketwatch.com/story/itv-profit-falls-on-costs-as-revenue-jumps-2016-07-27).

ITV's programs include "Downton Abbey" and "The X Factor".

Taylor Wimpey (TW.LN) pushed up 6.7% after the company said it

remains committed to its dividend policy

(http://www.marketwatch.com/story/taylor-wimpey-profit-up-13-backs-dividend-policy-2016-07-27)

and posted a 13% rise in half-year pretax profit. The home builder

also said it's "encouraged" by business activity in the month since

the Brexit vote.

But decliners included GKN PLC (GKN.LN) as the car and plane

components maker posted flat half-year profit of GBP163 million

pounds

(http://www.marketwatch.com/story/gkn-profit-flattens-out-2016-07-26)($214

million). But revenue rose and GKN raised its dividend. The stock

closed down 1.7%.

GDP: The first reading of second-quarter U.K. GDP showed

quarter-over-quarter growth of 0.6%

(U.K.%20economic%20growth%20picked%20up%20pace%20ahead%20of%20Brexit%20referendum).

That was above expectations of 0.4% in a Wall Street Journal survey

of economists, and higher than growth of 0.4% in the first

quarter.

The report's headline figure "masks the contribution from a 2.1%

q/q surge in industrial production, which we see as unlikely to be

sustained," said Chris Hare, economist at Investec, in a note.

The GDP data follow last week's report from Markit showing

contraction in both the manufacturing and services sectors in July

(http://www.marketwatch.com/story/uk-economy-in-dramatic-downturn-after-brexit-vote-data-show-2016-07-22).

Since the Brexit vote, it appears there has been

"near-unanimity" in calls by Bank of England policy makers "for

more stimulus in response to a prospective weakening in the

economy," said Hare. "We see a 25 basis points rate cut at the next

Monetary Policy Meeting meeting ... alongside a package of other

measures."

The Bank of England will meet Aug. 4.

Brexwhat: The FTSE 250 finished 1.2% higher and briefly traded

above its close on June 23, the day of the Brexit vote. The midcap

index -- made up of companies with more U.K. revenue than FTSE 100

firms -- has bounced back after getting slammed right after the

referendum

(http://www.marketwatch.com/story/these-uk-stocks-are-getting-slammed-after-the-brexit-vote-2016-06-28).

But the pound was lower Wednesday, buying $1.3096 compared with

$1.3139 late Tuesday in New York.

For more on the impact of Brexit, see Financial News: Brexit

(https://brexit.efinancialnews.com/?gi=8c93e4d772d9), which covers

the fallout from the U.K.'s vote to leave the European Union.

(END) Dow Jones Newswires

July 27, 2016 12:09 ET (16:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

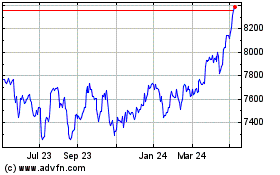

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

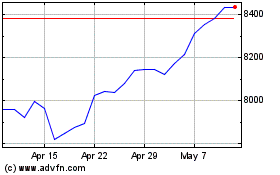

FTSE 100

Index Chart

From Apr 2023 to Apr 2024