Yen Strengthens As BoJ Stimulus Falls Short Of Expectations

July 28 2016 - 8:39PM

RTTF2

The Japanese yen climbed against its major opponents in Asian

trading on Friday, as the stimulus measures unveiled by the Bank of

Japan disappointed traders who had been expecting aggressive easing

to kick-start the economic growth.

The Bank of Japan raised the target for exchange-traded fund

purchases so that their outstanding amount will rise at an annual

pace of about JPY 6 trillion.

The board decided by an 8-1 majority vote to hold its target of

raising the monetary base at an annual pace of about JPY 80

trillion.

Also, the board voted 7-2 to continue applying a negative

interest rate of -0.1 percent to the policy rate balances in

current accounts held by financial institutions.

The yen climbed to more than a 2-week high of 102.71 against the

greenback, from a low of 105.61 hit at 11:30 pm ET.

The yen strengthened to more than 2-week highs of 105.05 against

the Swiss franc and 113.92 against the euro, off early 4-day low of

107.75 and a 2-day low of 116.87, respectively.

The yen hit more than a 2-week high of 135.52 against the pound,

coming off from its previous low of 139.23.

The yen advanced to a 3-week high of 73.16 against the kiwi,

more than 2-week highs of 77.52 against the aussie and 78.12

against the loonie, reversing from early 8-day low of 75.01, 2-day

lows of 79.45 and 80.25, respectively.

On the upside, the yen may locate resistance around 102.00

against the greenback, 112.50 against the euro, 104.00 against the

franc, 132.00 against the pound, 76.00 against the loonie, 75.00

against the aussie and 72.00 against the kiwi.

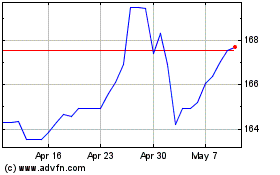

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

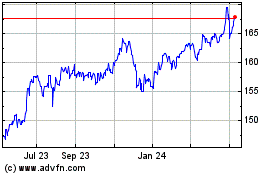

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024