By Carla Mozee, MarketWatch

Vivendi, Mediaset tussle continues; Volkswagen reaches U.S.

dealer agreement

European stocks swung higher Friday, with investors taking

remarks from Federal Reserve Chairwoman Janet Yellen as a sign of

confidence in economic growth world-wide.

The Stoxx Europe 600 closed up 0.5% at 343.72, but it had been

creeping up shortly before the text of Yellen's speech in Jackson

Hole, Wyo., was released. All but the consumer-services sector

ended higher.

Yellen, at the Fed's summer summit, signaled that the U.S.

central bank is preparing to increase interest rates as soon as

next month.

"In light of the continued solid performance of the labor market

and our outlook for economic activity and inflation, I believe the

case for an increase in the federal-funds rate has strengthened in

recent months," she said.

From the European markets perspective, "if the Fed starts to

hike interest rates, it shows that there is at least some sustained

and sustainable economic growth in what is the world's largest

economy," said Richard Hunter, head of research at Wilson King

Investment Management.

That "should have a positive effect on other economies because

the chase for economic growth is the big conundrum at the moment,"

he said.

Read:The head of Germany's Deutsche Bank says negative rates are

'fatal'

(http://www.marketwatch.com/story/the-head-of-germanys-largest-bank-says-negative-rates-are-fatal-2016-08-25)

Stocks in Germany, Europe's largest economy, closed higher,

leaving the DAX 30 up 0.6% at 10,587.77. France's CAC 40 closed up

0.8% at 4,441.87.

The euro fell against the dollar, exchanging hands at $1.1223,

down from $1.1281 late Thursday in New York.

The Stoxx 600 closed 1.1% higher for the week. That followed

last week's pullback of 1.7%.

Fund-tracker EPFR on Friday said more than $2 billion flowed out

of European equity funds in the week ended Wednesday. That marked

the 29th consecutive weekly outflow, extending the longest

redemption streak on record.

Vivendi tussle: In focus Friday was Vivendi SA (VIV.FR), whose

shares slumped 1.7%. The media company's second-quarter adjusted

earnings fell 3.1% to 187 million euros ($211 million), missing

analyst expectations. Vivendi said it's cutting EUR300 million in

costs from its pay-TV unit Canal Plus.

At the same time, shares of Mediaset SpA (MS.MI) fell 0.5% after

Vivendi, which has been seeking to amend an agreement with Mediaset

(http://www.marketwatch.com/story/vivendi-plans-costs-cuts-at-tv-unit-2016-08-26)

to buy its pay-TV business, said Thursday the contract could become

void Sept. 30. Mediaset reiterated that the contract is binding and

that it remains unwilling to change the terms of the deal.

Other movers: Gemalto NV (GTO.AE) shares surged 6.5% after the

SIM card maker's quarterly results came in above expectations.

Volkswagen AG (VOW.XE) picked up 2.2% after the German auto

maker reached an agreement with about 650 U.S. franchise dealers

(http://www.marketwatch.com/story/vw-strikes-deal-with-us-franchise-dealers-2016-08-26)

affected by the company's diesel-emissions scandal. A Sept. 30

deadline was set to complete the details.

Amec Foster Wheeler PLC (AMFW.LN) shares leapt 6.6% after Morgan

Stanley upgraded the energy engineering company to overweight from

equalweight.

BAE Systems PLC (BA.LN) rose 2.3% after the defense company's

rating was upgraded to buy from hold at Berenberg.

Indexes: Italy's FTSE MIB ended up 0.8% at 16,843.99, and

Spain's IBEX 30 picked up 0.7% at 8,659.50.

In London, the FTSE 100 closed up 0.3% at 6,838.05

(http://www.marketwatch.com/story/ftse-100-slips-but-miners-find-relief-after-selloff-2016-08-26),

but ended the week lower by 0.3%.

Data:Lending to eurozone firms increased

(http://www.marketwatch.com/story/ecb-data-show-rise-in-eurozone-lending-to-firms-2016-08-26)

at a faster yearly pace in July than in the previous month,

European Central Bank data showed, potentially reducing the need

for further monetary stimulus.

Consumer confidence in France rose to 97 in August from 96 in

July

(http://www.marketwatch.com/story/french-consumer-confidence-ticks-up-in-august-2016-08-26),

while economists had expected no improvement, Insee said Friday. In

addition, France's gross domestic product stalled in the second

quarter, according to a second print from the statistics agency.

The economy expanded by 0.7% in the first quarter.

GFK said German consumer sentiment is expected to improve

(http://www.marketwatch.com/story/german-consumer-confidence-set-to-rise-gfk-2016-08-26)

in September, and that could mark short-lived concerns about the

impact of Brexit on Europe's largest economy.

(END) Dow Jones Newswires

August 26, 2016 12:25 ET (16:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

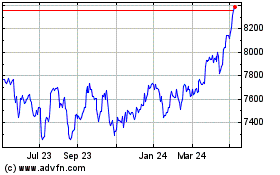

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

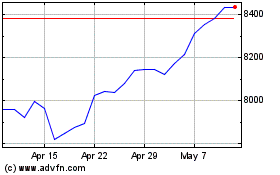

FTSE 100

Index Chart

From Apr 2023 to Apr 2024