Yen Slides Amid Risk Appetite

August 30 2016 - 12:25AM

RTTF2

The Japanese yen weakened against the other major currencies in

the early European session on Tuesday amid risk appetite, as oil

prices rebounded.

The U.K.'s FTSE 100 index is currently up 0.01 percent or 0.57

points at 6,838, France's CAC 40 index is up 0.99 percent or 43.77

points at 4,468 and Germany's DAX is up 0.83 percent or 87.84

points at 10,632.

Meanwhile, investors turned skeptical about the Federal

Reserve's plans for raising interest rates.

Investors look ahead to the all-important U.S. jobs report due

at the end of the week for clarity on the likely timing of the next

increase in the Fed funds rate.

It is believed that the non-farm payroll report could have a

significant impact on the interest rate outlook going into the next

Federal Reserve meeting in September.

Crude oil for October delivery are currently up $0.36 to $47.34

a barrel. The crude oil prices rose amid renewed concerns about an

oil glut.

In the Asian trading today, the yen traded higher against its

major rivals.

In the early European session, the yen fell to a 3-week low of

102.45 against the U.S. dollar, from an early 4-day high of 101.75.

The yen may test support near the 106.00 region.

Against the pound and the euro, the yen dropped to 134.03 and

114.36 from an early 4-day highs of 133.34 and 113.85,

respectively. If the yen extends its downtrend, it is likely to

find support around 129.00 against the pound and 118.00 against the

euro.

Against the Swiss franc and the Canadian dollar, the yen slipped

to 104.56 and 78.53 from an early 4-day highs of 104.03 and 78.19,

respectively. On the downside, 109.00 against the franc and 82.00

against the loonie are seen as the next support level for the

yen.

The yen edged down to 74.09 against the NZ dollar, from an early

high of 73.84. The yen is likely to find support around the 76.00

area. Looking ahead, Eurozone business climate index for August is

slated for release shortly.

In the New York session, flash German CPI data for August,

Canada industrial product and raw materials price indexes for July,

U.S. S&P/Case-Shiller home price index for June and U.S.

consumer confidence index for August, are set to be published.

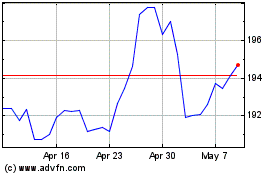

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

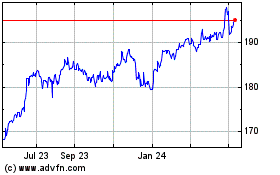

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024