EUROPE MARKETS: European Stocks Gain Ground As Euro Drifts Lower

August 30 2016 - 11:45AM

Dow Jones News

By Carla Mozee, MarketWatch

K+S shares gain; parent of retailer Primark upgraded

European stocks pushed higher Tuesday, with shares in exporters

rising in response to a weaker euro, as investors prepared for the

possibility of a U.S. interest rate hike in September.

The Stoxx Europe 600 index rose 0.6% to 345.12, gaining traction

after listless action at the open. All sectors were higher except

for the utilities and basic materials groups. The index on Monday

shed 0.2%

(http://www.marketwatch.com/story/european-stocks-slump-as-yellens-rate-hike-message-sinks-in-2016-08-29).

The German and French indexes were outperforming the

pan-European benchmark on Tuesday. Frankfurt's DAX 30 index was up

1.2% to 10,670.80, while the CAC 40 index in Paris rose 1% to

4,469.90.

Among individual stocks on those indexes, German auto maker

Volkswagen AG (VOW.XE) (VOW.XE) was up 2.1% and French car maker

Peugeot SA (UG.FR) tacked on 1.9%.

At the same time, the euro fell against the U.S. dollar, at

$1.11451 from $1.1186 late Monday. European exporters such as auto

makers tend to benefit when the euro weakens, as it makes their

products less expensive to buy for holders of other currencies.

The greenback has advanced since Federal Reserve Chairwoman

Janet Yellen said late last week that the case for a U.S. rate hike

has strengthened.

At this point, sentiment "in the stock markets...remains

positive despite a slightly more hawkish Federal Reserve. This is

mainly because...central banks elsewhere are pretty much dovish,

most notably in Japan, the eurozone and now the U.K.," wrote Fawad

Razaqzada, market analyst at Forex.com.

"A small rate rise in the U.S. would not be the end of the world

anyway, though it may put further upward pressure on dollar. This

in turn should translate into stronger USD/JPY and weaker EUR/USD

exchange rates," he said.

"Consequently, the export-oriented stock markets in Japan and

Germany could start to outperform the U.S. going forward, provided

that Friday's U.S. jobs report does not put to bed talks of a 2016

rate rise once and for all."

The European Central Bank will release its own policy

announcement on Thursday next week. Ahead of that, "there's been

more narrative" about the prospect of the ECB extending its

corporate-bond purchasing program, said Tony Cross, market analyst

at Trustnet Direct.

"That could be driving sentiment," Cross said.

Movers: Shares of German potash and specialty fertilizer group

K+S AG (SDF.XE) climbed 3.8% following a Bloomberg report that

Potash Corp (POT) and Agrium Inc. (AGU.T) are preparing a merger

agreement. Potash last October dropped its pursuit of K+S.

Wirecard AG shares (WDI.XE) pushed up 3.5% after Barclays raised

its rating on the payment processing services company to overweight

from equalweight.

Associated British Foods PLC (ABF.LN), which runs sugar

operations and the retailer Primark, was upgraded to outperform

from sector perform at RBC. Shares were up 3.4%.

Other indexes: Italy's FTSE MIB picked up 1.4% to 16,900.27.

Bank shares on the index were gaining, including at 2.4% rise in

UniCredit SpA (UCG.MI). Spain's IBEX 35 gained 1.1% to

8,706.80.

In London, the FTSE 100 was down 0.1% at 6,833.78

(http://www.marketwatch.com/story/ftse-100-seesaws-with-miners-under-pressure-after-holiday-2016-08-30).

Data: German inflation unexpectedly slowed to a rate of 0.3% in

August on the year, dragged mainly for a pullback in energy prices.

Analysts polled by FactSet had expected a rate of 0.5%.

A final reading of minus 8.5 of European consumer confidence in

August from the European Commission met market expectations.

(END) Dow Jones Newswires

August 30, 2016 11:30 ET (15:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

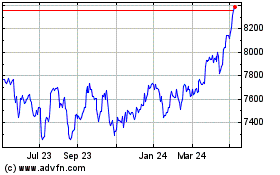

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

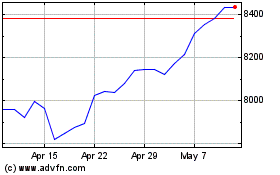

FTSE 100

Index Chart

From Apr 2023 to Apr 2024