EUROPE MARKETS: European Stocks End Higher As Weaker Euro Boosts Exporters

August 30 2016 - 12:31PM

Dow Jones News

By Carla Mozee, MarketWatch

K+S shares gain; parent of retailer Primark upgraded

European stocks ended higher Tuesday, with shares in exporters

rising in response to a weaker euro as investors prepared for the

possibility of a U.S. interest rate increase in September.

The Stoxx Europe 600 index rose 0.5% to settle at 344.75. The

index on Monday shed 0.2%

(http://www.marketwatch.com/story/european-stocks-slump-as-yellens-rate-hike-message-sinks-in-2016-08-29).

The German and French indexes outperformed the pan-European

benchmark on Tuesday. Frankfurt's DAX 30 index closed 1.1% higher

at 10,657.64, while the CAC 40 index in Paris rose 0.8% to

4,457.49.

Among individual stocks, German auto maker Volkswagen AG

(VOW.XE) (VOW.XE) rose 2% and French car maker Peugeot SA (UG.FR)

advanced 1.4%.

At the same time, the euro fell against the U.S. dollar.

European exporters such as auto makers tend to benefit when the

euro weakens, as it makes their products less expensive to buy for

holders of other currencies.

The greenback has advanced since Federal Reserve Chairwoman

Janet Yellen said late last week that the case for a U.S. rate

increase has strengthened.

At this point, sentiment "in the stock markets...remains

positive despite a slightly more hawkish Federal Reserve. This is

mainly because...central banks elsewhere are pretty much dovish,

most notably in Japan, the eurozone and now the U.K.," wrote Fawad

Razaqzada, market analyst at Forex.com.

"A small rate rise in the U.S. would not be the end of the world

anyway, though it may put further upward pressure on dollar. This

in turn should translate into stronger [dollar/yen] and weaker

[euro/U.S. dollar] exchange rates," he said.

"Consequently, the export-oriented stock markets in Japan and

Germany could start to outperform the U.S. going forward, provided

that Friday's U.S. jobs report does not put to bed talks of a 2016

rate rise once and for all," Razaqzada said.

The European Central Bank will hold its own policy meeting on

Sept. 8. Ahead of that, "there's been more narrative" about the

prospect of the ECB extending its corporate-bond purchasing

program, said Tony Cross, market analyst at Trustnet Direct.

"That could be driving sentiment," Cross said.

Movers: Shares of German potash and specialty fertilizer group

K+S AG (SDF.XE) climbed 4% following a Bloomberg report that Potash

Corp (POT) and Agrium Inc. (AGU.T) are preparing a merger

agreement. Potash last October dropped its pursuit of K+S.

Wirecard AG shares (WDI.XE) pushed up 3% after Barclays raised

its rating on the payment processing services company to overweight

from equalweight.

Associated British Foods PLC (ABF.LN), which runs sugar

operations and the retailer Primark, was upgraded to outperform

from sector perform at RBC. Shares rose 3.4%.

Other indexes: Italy's FTSE MIB rose 1.4% to 16,891.42. Bank

shares on the index advanced, with UniCredit SpA (UCG.MI) up 2.2%.

Spain's IBEX 35 gained 0.8% to 8,685.40.

In London, the FTSE 100 declined 0.3% to finish at 6,820.79

(http://www.marketwatch.com/story/ftse-100-seesaws-with-miners-under-pressure-after-holiday-2016-08-30).

Data: German inflation unexpectedly slowed to a rate of 0.3% in

August on the year, dragged mainly for a pullback in energy prices.

Analysts polled by FactSet had expected a rate of 0.5%.

A final reading of minus 8.5 of European consumer confidence in

August from the European Commission met market expectations.

(END) Dow Jones Newswires

August 30, 2016 12:16 ET (16:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

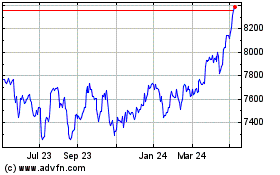

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

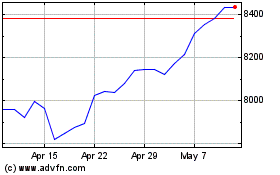

FTSE 100

Index Chart

From Apr 2023 to Apr 2024