LONDON MARKETS: FTSE 100 Closes Down As Dollar Strength Hobbles Miners

August 30 2016 - 12:46PM

Dow Jones News

By Carla Mozee, MarketWatch

Bunzl raises dividend payment; mortgage approvals hit 18-month

low

Stocks in the U.K. ended modestly lower in choppy trade Tuesday

as mining shares slumped as the dollar strengthened to multiweek

highs, dragging down commodities priced in the currency.

The FTSE 100 lost 0.3% to finish at 6,820.79. Trading was closed

Monday for a late-August bank holiday.

While a stronger U.S. economy should be supportive for global

growth, the FTSE 100 on Tuesday was "held back by a strong dollar,

with the fallers' board looking like a who's who of mining firms,"

said IG market analyst Joshua Mahony in a note.

In the mining group, shares of copper producer Antofagasta PLC

(ANTO.LN) dropped 5.4%, Randgold Resources PLC (RRS.LN) lost 4.1%

and iron-ore miner Rio Tinto PLC (RIO)(RIO) (RIO) ended the session

4.7% lower.

Offering an upbeat glimmer, shares of Associated British Foods

PLC (ABF.LN) rose 3.4% as RBC raised its rating on the company,

which runs sugar operations and the retailer Primark, to outperform

from sector perform.

Bunzl PLC (BZLFY) shares rose 1.4% after the maker of coffee

cups and mops raised its interim dividend payment

(http://www.marketwatch.com/story/bunzl-reports-rise-in-first-half-profit-2016-08-30)

and posted a 6% rise in first half pretax profit of GBP155.6

million ($203.88 million).

On Friday, the U.K. benchmarkrose 0.3%

(http://www.marketwatch.com/story/ftse-100-slips-but-miners-find-relief-after-selloff-2016-08-26)

after Federal Reserve Chairwoman Janet Yellen said the U.S. economy

looks ready to withstand higher interest rates, which elevated

expectations for rate increases in the U.S.

"The devaluation of gold, silver, copper and iron ore in the

wake of Friday's dollar rally is expected to provide a drag for

days to come, with only crude prices remaining surprisingly

resilient amid something of a bloodbath for commodity stocks," he

said.

A higher dollar makes dollar-denominated commodities like copper

more expensive for holders of other currencies to purchase.

Precious-metal producer Fresnillo PLC (FRES.LN) slumped 5.6% and

Glencore PLC (GLEN.LN) was off 4.3%, adding to last week's loss of

1.9% after the miner and commodities trader posted a $369 million

half-year net loss

(http://www.marketwatch.com/story/glencore-steps-up-debt-cuts-as-it-swings-to-loss-2016-08-24).

Oil prices

(http://www.marketwatch.com/story/oil-prices-nudged-higher-by-bargain-hunting-2016-08-30)

eventually turned lower . But shares of major oil companies were

mixed. BP PLC (BP.LN) was down 0.3% while Royal Dutch Shell PLC

(RDSB.LN) (RDSB.LN) rose 0.3%. Shell said Monday it reached a deal

to sell certain assets in the Gulf of Mexico for $425 million to

EnVen Energy Ventures LLC, an affiliate of Houston-based EnVen

Energy Corp.

As the dollar advanced, the pound was trading at $1.3090, down

from $1.3113 late Monday.

Housing: Meanwhile, shares of home builders retreated after the

Office for National Statistics said the number of new mortgages

approved in the U.K. fell in July to 60,912, the lowest level in

more than a year.

(http://www.marketwatch.com/story/uk-mortgage-approvals-at-lowest-in-18-months-2016-08-30)

Taylor Wimpey PLC's stock (TW.LN) fell 2.2%, Berkeley Group

Holdings PLC (BKG.LN) was off 2.4%, Persimmon PLC (PSN.LN) was

pushed 2.7% lower and Barratt Developments PLC (BDEV.LN) lost

1.4%.

Read:Berkeley Group set to leave FTSE 100; Polymetal to rejoin

(http://www.marketwatch.com/story/berkeley-to-leave-ftse-100-polymetal-to-rejoin-2016-08-30)

The British housing market has "not seized up by any means...but

there are signs the Brexit vote has exerted a severe shock," wrote

Neil Wilson, markets analyst at ETX Capital.

"Prices have so far held up pretty well but this decline in

approvals suggests this situation may not last, particularly as the

unemployment rate is expected to tick upwards and a weak pound hits

people in their pockets," he said.

(END) Dow Jones Newswires

August 30, 2016 12:31 ET (16:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

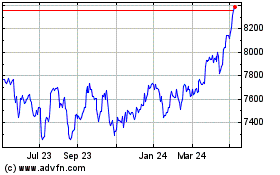

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

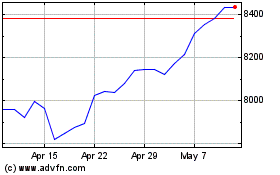

FTSE 100

Index Chart

From Apr 2023 to Apr 2024